Horace Mann (HMN) Okays Share Buyback Authorization of $50M

The board of directors of Horace Mann Educators Corporation HMN approved a $50 million increase in its share buyback program to return more value to investors. HMN has already bought back shares worth $95.5 million from 2011 through May 24, 2022.

Horace Mann is the largest multi-line financial services company serving the U.S. educator market and is well poised to capitalize on the solid opportunity in the K-12 educator market. An 8% increase in K-12 teachers is anticipated between 2015 and 2027. A demographic shift is expected as baby boomers retire and millennials make up a higher percentage of the workforce. Thus, HMN is well poised to capitalize on the opportunity, given its strategic focus on designing products. Strategic endeavors have more than doubled its capital generating capacity.

The insurer targets 10% average annual EPS growth and sustained double-digit ROEs, driven by growth from next year. HMN estimates generating about $50 million in excess capital annually in 2022 and beyond to support growth initiatives, buy back shares and hike dividends.

Apart from the recent share buyback approval, Horace Mann has increased its dividend for 14 straight years at a CAGR of 14%. Its current dividend yield of 3.1% is higher than the industry average of 2.2%. HMN pays more than $50 million in cash dividends annually and targets a 50% dividend payout over the medium term.

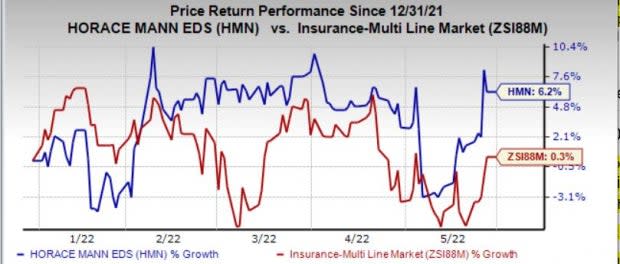

Shares of HMN have gained 6.2% year to date, outperforming the industry’s growth of 0.3%. Strategic initiatives to fuel profitability, its niche market focus, and solid capital position should help shares move even higher.

Image Source: Zacks Investment Research

Horace Mann presently carries a Zacks Rank #5 (Strong Sell).

Given the solid capital level of the insurance industry and improving operating backdrop favoring strong operational performance, insurers like Unum Group UNM, Everest Re Group, Ltd. RE and Chubb Limited CB have resorted to effective capital deployment to enhance shareholder value.

The board of directors of Unum Group approved a 10% increase in its dividend to 33 cents per share. This recent dividend hike marked the 13th increase in the last 12 years. Over the last 11 years, Unum Group has prudently shifted its business mix by increasing the proportion of voluntary products, adding Dental and Vision and divesting Closed Disability Block. Management remains focused on moving to a mix of businesses with higher growth and stable margins. This should help the leading disability income writer and second-largest writer of the voluntary business in the United States retain the momentum.

Everest Re Group’s board of directors has approved a 6.4% hike in its quarterly dividend to $1.65 per share. RE boasts a consistent increase in dividends, with the metric witnessing a nine-year CAGR (2014-2022) of 9.2%. Everest Re’s consistent share buyback is also driving the bottom line. Everest Re is likely to benefit from its capital adequacy, financial flexibility, long-term operating performance and traditional risk management capabilities. Everest Re boasts a strong capital position with sufficient cash generation capabilities.

Chubb’s board of directors approved a 3.75% hike in its dividend to $3.32 per share and a $2.5 billion share buyback program. This insurer boasts one of the largest product portfolios in the global insurance industry. CB is focusing on cyber insurance that has immense room for growth, putting in efforts to capitalize on the potential of middle-market businesses, both domestic and international, with a traditional core package as well as a specialty product. Improvement in the pricing environment, new business growth and high renewal rates along with other positives, should help it continue with effective capital deployment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research