Hormel Foods (HRL) Q4 Earnings Top Estimates, Revenues Dip Y/Y

Hormel Foods Corporation HRL posted fourth-quarter fiscal 2022 results, wherein the bottom line beat the Zacks Consensus Estimate while remaining flat year over year. However, the top line fell year over year and missed the Zacks Consensus Estimate.

In fiscal 2022, the company delivered record sales and a double-digit profit increase. Management concluded the integration of the Planters business, progressed with its six strategic priorities, navigated through a tough operating landscape and laid the foundation for the next step of its Go Forward (GoFWD) initiative.

Hormel Foods recently unveiled a new operating model to better align its business structure and make it more easygoing, market-driven and consumer and customer-focused. As part of its GoFWD initiative, Hormel Foods transitioned to three operating units — Retail, Foodservice and International — and started operating under its new model on Oct 31, 2022.

For the abovementioned transition, management expects to undertake actions in the first quarter. These include adopting a new organizational structure, continuing to fully integrate Jennie-O Turkey Store into its One Supply Chain and new operating segments and setting up the Brand Fuel Center of Excellence (for brand management, innovation and e-commerce enhancements).

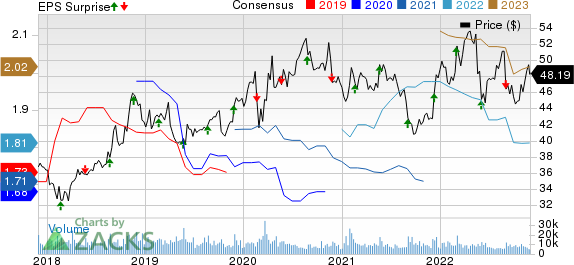

Hormel Foods Corporation Price, Consensus and EPS Surprise

Hormel Foods Corporation price-consensus-eps-surprise-chart | Hormel Foods Corporation Quote

Quarter in Detail

Hormel Foods’ earnings of 51 cents per share came a penny ahead of the Zacks Consensus Estimate. The metric remained in line with the year-ago quarter level.

Net sales in the quarter were $3,283.5 million compared to the Zacks Consensus Estimate of $3,295 million. The top line decreased 5% year over year, while organic net sales were up 2%.

Channel-wise, net sales across U.S. Retail and U.S. Foodservice moved down 6% and 1% year over year, respectively, while International sales fell 10% in the quarter. Demand remained high in U.S. channels, and the company gained from its pricing efforts to counter inflation, along with gains from the Planters snacks nut business.

However, international sales were down due to soft export sales. The fourth quarter and the full year of 2022 included a week lesser compared with the year-ago period.

Segment Details

Net sales in the Grocery Products unit increased 3%, while organic net sales were up 11% year over year. Volumes were down 4%, though the organic volume was up 4%. Net sales were driven by the sturdy demand for SKIPPY peanut butter, as well as pricing actions in Mexican and simple meals.

Organic sales and volumes were backed by strength in brands like SPAM, SKIPPY, WHOLLY, Herdez and Dinty Moore. The segmental profit declined 8% due to cost inflation.

Net sales in the Jennie-O Turkey Store segment tumbled 15%, while volumes slumped 32%. Organic net sales and volumes were down 8% and 27%, respectively.

Sales and volumes were hurt by the adverse supply impacts of highly pathogenic avian influenza on the company’s vertically integrated supply chain. However, the segmental profit surged a whopping 149% on elevated commodity prices and a better value-added mix.

Net sales in the Refrigerated Foods unit fell 7% year over year. Organic net sales in the segment remained flat year over year. Volumes decreased 19%, and organic volumes tumbled 13%. Net sales decreased due to the effect of an additional week in the fourth quarter of fiscal 2021, along with reduced commodity sales.

Volumes were hurt by reduced commodity sales stemming from the company's new pork supply deal. The segmental profit moved down 15% due to elevated operational, logistics and raw material costs and reduced commodity profitability.

International & Other net sales slid 2%, while organic net sales advanced 6%. Volumes were flat, and organic volumes rose 8% year over year. Net sales and volume increases for the SPAM and SKIPPY brands and multinational businesses were countered by reduced fresh pork and refrigerated export sales. The segmental profit fell 4%.

Financial Details

Hormel Foods ended fiscal 2022 with cash on hand of $982 million and total long-term debt of $3.3 billion. In fiscal 2022, cash flow from operations was $1.1 billion, and capital expenditures totaled $279 million. This Zacks Rank #3 (Hold) player expects to incur capital expenditures of $350 million in fiscal 2023.

The company paid out dividends of $558 million in fiscal 2022 while not making any share repurchases. Hormel Foods has the capacity to buy back nearly four million shares under its existing authorization. Last week, HRL announced its 57th straight yearly dividend hike, taking it to $1.10 per share.

Guidance

Hormel Foods remains well-placed in the retail, foodservice and international channels as it enters fiscal 2023 and expects to fuel top-line growth. Increased brand investments, higher production capacity and HRL’s initial GoFWD actions are likely to support top-line growth. Management anticipates earnings growth to be backed by its Foodservice and International segments, together with supply-chain enhancements.

That said, Hormel Foods anticipates operating in a difficult, volatile and inflated-cost environment in fiscal 2023.

HRL projects fiscal 2023 net sales in the range of $12.6-$12.9 billion, indicating 1-3% growth from the fiscal 2022 level. Earnings per share are envisioned in the range of $1.83-$1.93, suggesting growth of 1-6% growth from the fiscal 2022 level.

Shares of Hormel Foods have slipped 4.1% in the past three months compared with the industry’s drop of 7.9%.

Looking for Consumer Staple Stocks? Check These

Some better-ranked stocks from the sector are Lamb Weston LW, Conagra Brands CAG and The J. M. Smucker Company SJM.

Lamb Weston, a frozen potato product company, currently has a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 47.3%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings suggests growth of 14.6% and 45.7%, respectively, from the comparable year-ago reported numbers.

Conagra Brands, which operates as a consumer-packaged goods food company, carries a Zacks Rank #2 at present. CAG has a trailing four-quarter earnings surprise of 1.8%, on average.

The Zacks Consensus Estimate for Conagra Brands’ current financial-year sales and earnings suggests growth of 5.2% and 3.4%, respectively, from the corresponding year-ago reported numbers.

The J. M. Smucker, which manufactures and markets branded food and beverage products, currently carries a Zacks Rank of 2. SJM has a trailing four-quarter earnings surprise of 18.5%, on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year sales suggests growth of 5.6% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report