Host Hotels (HST) Buys Baker's Cay Resort for $200 Million

Host Hotels & Resorts Inc. HST has acquired a fee simple interest in the 200-room Baker’s Cay Resort Key Largo, Curio Collection for roughly $200 million in cash in an off-market transaction. This transaction brings the REIT’s total hotel acquisitions to nearly $1 billion in the year so far.

The acquisition was executed at an attractive pricing, with the price representing an estimated 6.2% capitalization rate and a 14.5X EBITDA multiple based on 2021 property forecasts. The company expects this resort to deliver more than $300 of revenue per available room (RevPAR) and $69,000 of EBITDA per key in 2021, ranking eighth on both metrics in Host’s 2019 pro forma portfolio.

The property is situated on 13 acres of beachfront land on Key Largo’s Gulf Coast. It offers a variety of amenities like swimmable private beach, spa, salon, dock and fitness center. Located just 65 miles away from the Miami International Airport, the company is likely to witness a healthy demand.

Markedly, with the relaxation of regulations related to the pandemic and resumption of travel, the lodging industry is enjoying a recovery in leisure demand in markets like Miami, Phoenix and Hawaii, and in the Sunbelt regions. In addition to these, due to strict development ordinances, the Florida Keys market is seeing a favorable supply-demand dynamics, making the acquisition a strategic fit for the company.

Also, the hotel offers 26,000 square feet of total meeting space, including ballrooms spanning 4,000 and 6,900 square foot event lawn, four food and beverage outlets and two outdoor pools. This enables the property to attract in-house demand as well as opens up scope for higher group and business bookings.

Further, with a complete $63-million renovation and repositioning in 2019, Baker’s Cay looks like a new resort. The renovated property will likely capture additional revenues during the economic recovery.

Given a strong balance sheet position, the company has made significant acquisition of high-quality properties over the past years, which have scope for long-term growth. In fact this May, Host Hotels announced the acquisition of a fee-simple interest in the 444-room Four Seasons Resort Orlando at Walt Disney World Resort for around $610 million in cash.

While Host Hotels is poised to see an improvement in RevPAR on hotel reopening, any significant improvements will remain challenged in the near term amid a slower recovery of corporate and group demand. Also, recovery in the demand for core business transient is likely to be tepid in the ongoing year due to delayed return to offices.

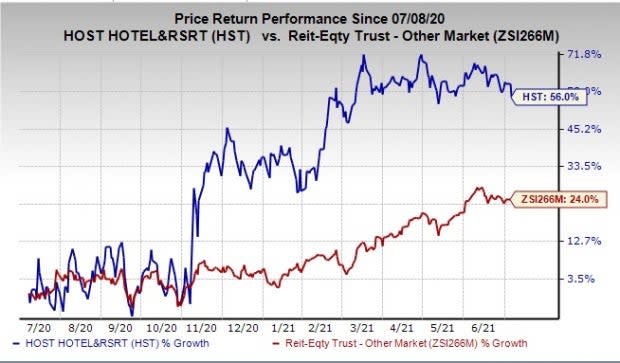

Shares of this Zacks Rank #3 (Hold) company have appreciated 56% over the past year, outperforming the industry’s rally of 24%.

Image Source: Zacks Investment Research

Stocks to Consider

Geo Group Inc The GEO sports a Zacks Rank of 1 (Strong Buy), at present. The Zacks Consensus Estimate for the ongoing year’s FFO per share has been revised marginally upward to 29 cents over the past month. You can see thecomplete list of today’s Zacks #1 Rank stocks here.

Mack-Cali Realty Corporation’s CLI Zacks Consensus Estimate for 2021 FFO per share has moved 1.8% north to 57 cents over the past month. The company currently carries a Zacks Rank of 2 (Buy).

Industrial Logistics Properties Trust’s ILPT Zacks Consensus Estimate for 2021 FFO per share has moved up marginally to $1.88 over the past two months. The company currently carries a Zacks Rank of 2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

MackCali Realty Corporation (CLI) : Free Stock Analysis Report

Geo Group Inc The (GEO) : Free Stock Analysis Report

Industrial Logistics Properties Trust (ILPT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research