House Passes Bill to Redesign IRS

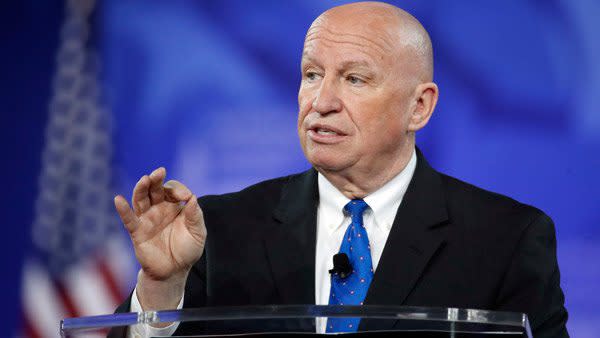

Rep. Kevin Brady, R-Texas. (Photo: AP)

The Taxpayer First Act of 2019, which would redesign the Internal Revenue Service, passed the full House on Tuesday.

The legislation, H.R. 1957, which passed the House Ways & Means Committee on April 2, has bipartisan support in both chambers of Congress.

Rep. Kevin Brady, R-Texas, the top Republican on the House Ways and Means Committee, stated after the vote that “with a new tax code, it is time for a new tax administrator. I applaud the House for passing the Taxpayer First Act — a bold step to redesign the IRS to be an agency with one singular mission: putting taxpayers first.”

The bill refocuses the “agency to live up to its mission of serving taxpayers, overhauling the IRS’ tools of enforcement, and strengthening the IRS’ ability to proactively combat identity theft and fraud,” Brady said.

Brady encouraged “swift action” in the Senate in order to send this legislation to the president’s desk this year.

“Provisions in this bill protect low- and moderate-income taxpayers, create sensible enforcement reforms, and ensure the IRS provides taxpayers and small businesses the assistance they deserve,” House Ways & Means Committee Chairman Richard Neal, D-Mass., said upon committee passage. “The commonsense, much-needed reforms in this legislation will modernize the IRS and rightfully prioritize taxpayers.”

Among the bill’s 45 changes to the IRS includes creating an independent appeals process, strengthening the IRS’ ability to proactively combat identity theft tax refund fraud, and improving the taxpayer experience across the IRS’ suite of taxpayer services.

“The House Ways and Means Committee and the Senate Finance Committee have carefully and thoughtfully developed this legislation over several years, after numerous hearings and roundtables, in a bipartisan, bicameral manner,” said Neal and Brady, in a joint statement when introducing the bill.

The legislation would also make it illegal for the IRS to create free tax preparation software.

Sen. Ron Wyden, D-Ore., ranking member on the Senate Finance Committee, said in a statement after the vote that “again and again in my service in the Senate I have battled the tax-preparation software industry to simplify filing taxes for the typical American. In fact, the industry spent millions to fight my proposals in two tax-reform bills to allow a ‘simple return,’ which would require the IRS to send any American a pre-filed tax return on request using the agency’s tax information.”

Added Wyden: “During the debate on the tax administration bill, my staff pushed back on a prohibition on the agency competing with private tax preparation services, and I will continue to push for my proposal for the pre-filed ‘simple’ return and the principle that a taxpayer should not have to use a private company to pay their taxes online.”

The final package, Wyden said, “reduced the role of private debt collection on the most vulnerable Americans and made a permanent a highly successful program for low-income taxpayers.”

--- Check out Key Democrat Revives Plan to Make Capital Gains Tax Due Annually on ThinkAdvisor.