Housing Industry Continues to Plummet: 3 Value Picks

Keeping this popular adage — slow and steady wins the race — in mind, we bring to you three homebuilding stocks that are currently trading at a discount and have ample room to run.

Though myriad problems have been decelerating the homebuilding industry of late, as is evident from the 17.5% year-to-date decline against a 1.7% rise of the S&P 500 index, the larger picture is convincingly strong.

Meanwhile, builders are spooked by higher aluminum and steel costs, thanks to the newly-imposed tariffs. This, coupled with increased lumber prices owing to an import tariff, is denting builders’ margins. Further, troubles like limited land availability, labor shortage, increasing mortgage rates continue to make things difficult.

But these deterrents shouldn’t make investors steer clear of the housing industry altogether.

Potential Solid

Consumer demand is robust as is evident from the new home sales data that point at an 11.6% increase year over year in April despite the month-to-month irregularity. Housing starts were up 10.5% from April 2017 buoyed by a 7.2% increase in single-family homes and a 19.1% rise in apartments. Again, permits were 7.7% above the April 2017 level prompted by a 7.9% rise in single-family homes and 6.4% growth in buildings with five units or more. Also, builder confidence remained above 50 in the first five months of 2018, indicative of a favorable outlook.

The solid momentum is expected to continue in the rest of 2018, courtesy of an improving economy, modest wage growth, low unemployment levels, positive consumer confidence and escalating rent costs. The U.S. economy is expected to grow at a 4% annualized rate in the second quarter, per the latest Atlanta Federal Reserve’s GDPNow forecast. This is up from 2.3% registered in the first quarter of 2018. Meanwhile, unemployment rate in April was 3.9%, the lowest since 2000.

The industry ranks among the top 18% (46 out of 265 industries). Despite the somber past performance, a solid rank signals that the industry is likely to benefit from favorable broader factors in the immediate future.

Industry Valuation

Currently, valuation of the sector is not on par with the index. Owing to the asset-driven nature of homebuilders, it makes sense to determine their value on the basis of the price-to-book ratio. The Zacks Homebuilding industry is undervalued compared to the broader S&P 500 index. The industry currently has a trailing 12-month P/B ratio of 1.4, less than the market’s current P/B of 3.9. Its lower-than-market position hints at an upside in the quarters ahead.

Looking at the more commonly used Price to Earnings Ratio, the company has a trailing 12-month P/E of 12.4 which compares pretty favorably with the market’s 19.9. We should also point out that the industry has a forward P/E ratio (price relative to this year’s earnings) of just 9.5. Thus, it is fair to say that a slightly more value-oriented path may be ahead for the industry in the near term.

Therefore, it makes sense to add some undervalued stocks with solid growth potential from the industry to your portfolio right now.

Picking the Right Stocks

Investors need to be cautious while picking value stocks. It is important to note that some of the stocks are deemed to be undervalued with no upside potential. Or, they may appear undervalued as per one metric, but not when judged by another. Our Value Style Score separates the wheat from the chaff by using multiple criteria to truly find the most attractive value stocks.

The Growth Style Score, in the meanwhile, analyzes the prospects of a company and also evaluates its corporate financial statements.

We have shortlisted homebuilding stocks with a Value Score of A or B as well as an impressive Growth Score of A or B. The stocks also have a solid Zacks Rank #1 (Strong Buy) or 2 (Buy). Back-tested results have shown that stocks with a Style Score of A or B coupled with a bullish Zacks Rank are the best investment options.

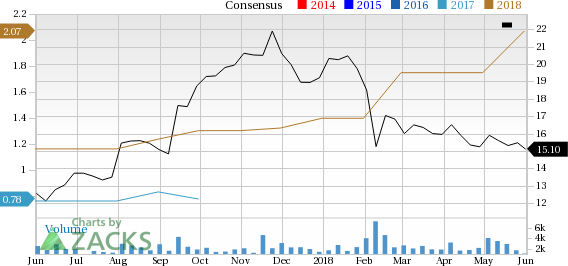

Beazer Homes USA, Inc. BZH, a Zacks Rank #2 stock, has a Value and Growth Score of A. Earnings estimates for the current quarter and 2019 have moved north by 7.9% and 5.6%, respectively, over the past 60 days. The Zacks Consensus Estimate calls for EPS growth of 78.3% for the current quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Beazer Homes USA, Inc. Price and Consensus

Beazer Homes USA, Inc. Price and Consensus | Beazer Homes USA, Inc. Quote

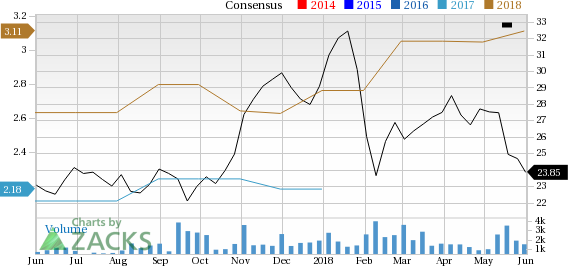

William Lyon Homes WLH carries a Zacks Rank #2 and has a Value and Growth Score of B. Estimated earnings growth is 40.7% for the current year and 22.2% for 2019. Although earnings estimates for the current year have declined by 6 cents, the same for the next year have risen 5.6% over the past 60 days.

Lyon William Homes Price and Consensus

Lyon William Homes Price and Consensus | Lyon William Homes Quote

M.D.C. Holdings, Inc. MDC carries a Zacks Rank #1 and has a Value Score of A. The stock has seen the Zacks Consensus Estimate for current-year earnings being revised 12.3% upward for 2018 and 11% for 2019 over the last 60 days. The Zacks Consensus Estimate projects EPS growth of 30.6% for the current year and 13.2% for next. The stock has a Zacks Rank #2.

M.D.C. Holdings, Inc. Price and Consensus

M.D.C. Holdings, Inc. Price and Consensus | M.D.C. Holdings, Inc. Quote

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Lyon William Homes (WLH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research