Howard Marks: Deep-Value Outperformance

- By Robert Abbott

Since the crash of 2008, many hedge fund managers have lost their edge, with average results that make passive indexing look good.

Howard Marks (Trades, Portfolio) of Oaktree Capital is not one of them, though. He has continued to deliver outperforming results.

Warning! GuruFocus has detected 5 Warning Signs with OAK. Click here to check it out.

The intrinsic value of OAK

That is due, in part, to his commitment to finding deep value in distressed debt and other situations where many managers fear to tread. It is also thanks to his enduring belief that success depends on what you pay, not what you buy.

Who is Marks?

Born in 1946, Marks graduated cum laude with a major in finance and a minor in Japanese studies from the Wharton School at the University of Pennsylvania, and then received an MBA in accounting and marketing from the University of Chicago in 1969.

His work history began with a stint at Citicorp, where he advanced from equity research analyst to director of research. In 1978, he was promoted to vice president and also functioned as a senior portfolio manager, supervising convertible and high-yield securities. In 1985, he moved to Trust Company of the West (TCW) and headed groups investing in high-yield bonds and convertible securities. He and colleague Bruce Karsh organized a distressed debt fund from a major financial institution.

Along with Karsh and four other TCW partners, Marks founded Oaktree Capital Management in 1995.

In addition to investing, Marks is also a prolific writer, the author of at least 10 books and many memos to his clients. His writing style has been described as folksy, sharply pointed and astute. He has won the praise of Warren Buffett (Trades, Portfolio), who said, "When I see memos from Howard Marks in my mail, they"re the first thing I open and read. I always learn something, and that goes double for his book." ("The Most Important Thing: Uncommon Sense for the Thoughtful Investor," published in 2011).

Apparently, that is a case of mutual appreciation, with Marks speaking highly of Buffett and his mentor, Benjamin Graham.

All of Marks" memos are free and available--right back to 1990--at the firm"s website.

Marks went out on his own after some 25 years of varied experience with different aspects of turning lower-rated debt into money-making assets. He also brought to his firm a solid background in value investing theory and practice.

What is Oaktree Capital?

Oaktree is a Los Angeles-based investment advisory firm, according to its Form ADV Part 2A filed on April 24. It is publicly traded on the New York Stock Exchange under the name Oaktree Capital Group LLC (OAK).

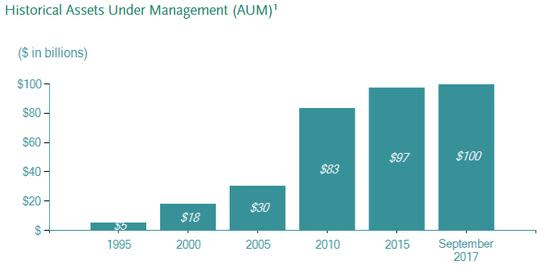

It has $109,255,720,251 in assets under management, according to its Form ADV. This chart from the firm"s website shows the journey to more than $100 billion of assets under management:

Founded in 1995, it operates as a hedge fund and charges an annual management fee of 0.5% to 2.0%, depending on the type of fund, and a performance fee of 20% on realized profits (based on several criteria, and may include after an 8% return to investors).

The Form ADV Part 2A reports the firm"s clients are U.S. and non-U.S. mutual funds, along with a variety of corporations and pooled investment entities. This chart shows the distribution of clients:

It segments its offerings along asset classes, with six specific areas of interest: distressed debt, corporate debt, control investing, convertible securities, real estate and listed equities.

After seeing dismal, post-2008 results from numerous hedge fund gurus, it is a pleasant surprise to find one who has been successful, at least judging by assets under management. Not only have the assets grown, but their growth has been robust, particularly between 2005 and 2010.

Strategies and tactics

On the Oaktree Capital website, Marks and his colleagues lay out six guiding principles, which together comprise their philosophy:

Risk control: They say simple investment performance is not their top priority; instead, they refer to superior performance with less-than-commensurate risk.

Consistency: They reject the idea of floating between the top and bottom quartiles; in their words, "It is our belief that a superior record is best built on a high batting average rather than a mix of brilliant successes and dismal failures."

Market inefficiency: They look toward less-efficient markets where their skill and effort should pay off for clients.

Specialization: Each portfolio should practice a single investment specialty; i.e., be a master of one thing rather than a jack of all trades. Each portfolio gets a charter, mandating its boundaries.

No macro-forecasting: They believe in superior knowledge of companies and their securities, rather than trying to predict the future of the economy, interest rates or the securities markets.

No market-timing: Saying, "Clients hire us to invest in specific market niches...", they stay fully invested. If the market climate causes concern, they will bias portfolios toward more defensive investments.

Strategically, Oaktree uses fundamental analysis to identify opportunities in several areas, including option writing. All seek to generate capital appreciation without "undue" risk. In its Form ADV Part 2A, the firm spells out the details involved with the six areas of focus groups:

Distressed debt involves troubled situations, value opportunities and emerging market opportunities. These may come from financial distress, restructured debt obligations and newly issued securities arising out of reorganizations or restructuring.

Corporate debt includes domestic and international high-yield bonds, U.S. senior loans, European senior loans, U.S. private debt and strategic credit.

Control investing refers to investments in special situations, European principal, power opportunities and infrastructure investments.

Convertible securities takes in investments in U.S. convertibles, non-U.S. convertibles and high-income convertibles. On the high-income side, Marks and Oaktree look at total return from a combination of current income and capital appreciation.

Real estate involves investments in real property, real estate companies and companies that have major real estate assets. This strategy looks to income and long-term capital growth. Modest leverage may be used in this asset class.

Liquid equities takes in emerging market absolute returns, emerging market equities and value equities. On absolute returns, they invest in equity as well as derivative securities, particularly in Asia and the Pacific region. It uses long and short positions without "significant leverage." For value equities, they like to put together an unleveraged and concentrated portfolio made up of stressed, post-reorganization and equities with asymmetric return profiles.

Finally, Marks has become famous by insisting that price matters more than what you buy. In the late 1960s and early 1970s, Marks worked for Citibank, where the emphasis was on "Nifty 50" investing, which meant buying the very best American stocks. Marks says Citibank invested in the best companies and lost a lot of money. It then invested in America"s worst companies and made a lot of money. That cemented his belief that success is a function of what you pay, not what you buy.

Marks has created a firm which brings together six strategic teams under a broader umbrella. All teams have individual mandates, but share a common set of philosophical principles. With his emphasis on price, it makes sense for to him have focused on corporate and distressed debt.

Holdings

This GuruFocus chart shows Marks" sectoral preferences in equity holdings as of Sept. 30:

Also from GuruFocus, this list shows Oaktree Capital"s top 10 equity holdings at the end of the third quarter of 2017:

Vistra Energy Corp. (VST): 22.14%

Tribune Media Co. (TRCO): 13.65%

Star Bulk Carriers Corp. (SBLK): 7.45%

Ally Financial Inc. (ALLY): 5.65%

Altaba Inc. (AABA): 4.86%

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM): 3.58%

Itau Unibanco Holding SA (ITUB): 2.98%

Alibaba Group Holding Ltd. (BABA): 2.78%

Vale SA (VALE): 2.14

Dynegy Inc. (DYN): 1.94%

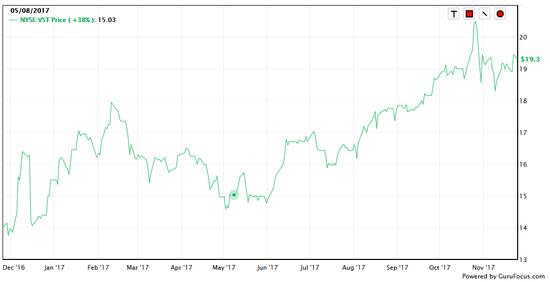

Vistra Energy is a vertically integrated electricity utility in Texas, and part of the reason utilities are such a big sector for Marks. It does not fare well in the GuruFocus ratings, with just a 4 for financial strength and a 2 for profitability and growth. However, it has rewarded investors who bought and held for the past year with a 38% gain:

Probably the first time I have seen utilities dominate a hedge fund or actively-managed portfolio. Of course, the equities component is a relatively small part (roughly 4%) of Oaktree"s $100 billion pool of capital. No doubt individual equities positions have been selected to perform a specific function within the portfolio.

Performance

In a May 2014 article, Marks is quoted as saying, ""Our return over the past 25 years has been 23% a year. And 95% of our outcomes are positive," he noted, adding Oaktree has raised about 50 funds over the same period and never had one that lost money."

As a publicly traded company, Oaktree reports on its overall progress, even though it does not report specifics on the individual funds under its umbrella. This GuruFocus chart shows the share price action since the company went public in 2012, five and a half years ago:

The stock is currently down some 30% from the high in January 2014. One of the results of that slide has been to push the dividend up to 7.59% on a 76% payout.

GuruFocus provides this summary of Oaktree"s key metrics:

While not debt-free, there are several factors to like in this picture, including rising revenue over the past three years, strong margins and a robust ROE. Given Oaktree Capital"s current pricing, it may be worth further investigation.

Conclusion

Most of us will not be able to invest directly in hedge funds, but Oaktree does provide a backdoor through its public listing. Whether that would or would not be a good investment is a subject for another day.

Marks is somewhat unique in that he is a veteran of the hedge fund business who has kept making money for his clients. That starts by making risk management or risk control the top priority, not simple investment returns. It also includes focusing on less-efficient markets, where mispricing is found more often, and working in distressed debt and corporate debt markets, where opportunities are overvalued. And distressed debt is a good place to look when deep-value investments are sought.

This profile has only skimmed the surface of Marks" thinking and activity; value investors will find much more by digging into his easily accessible writing.

Disclosure: I do not own shares in any of the companies listed in this article, and do not expect to buy any in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with OAK. Click here to check it out.

The intrinsic value of OAK