HP (HPQ) Gains 8% as Q4 Earnings and Revenues Beat Estimates

Shares of HP Inc. HPQ soared 7.5% in Tuesday’s extended trading session after the company delivered overwhelming fourth-quarter fiscal 2021 results. The personal computer and printer maker’s fourth-quarter earnings and revenues surpassed the respective Zacks Consensus Estimates and marked a significant year-over-year improvement.

HP reported a solid bottom line for the fourth quarter, wherein its non-GAAP earnings jumped 52% year over year to 94 cents per share from the 62 cents reported in the year-ago quarter. Also, quarterly earnings surpassed the Zacks Consensus Estimate of 88 cents per share and management’s guided range of 84-90 cents.

The significant year-over-year increase in earnings reflects benefits from higher revenues and favorable pricing, product mix currency exchange rates, partially offset by higher commodity costs and increased investments in innovation and the go-to-market strategy.

HP’s net revenues increased 9.3% year over year to $16.7 billion and beat the Zacks Consensus Estimate of $15.4 billion. In constant currency (cc), revenues grew 6.9%.

The robust top-line performance reflects strong demand for HP’s personal systems and printers. However, the revenue growth was negatively impacted by the continued component supply-chain constraints. Also, COVID-related factory shutdowns across several parts of the world, along with the transportation disruptions and congested ports have been negatively impacting HP’s overall sales.

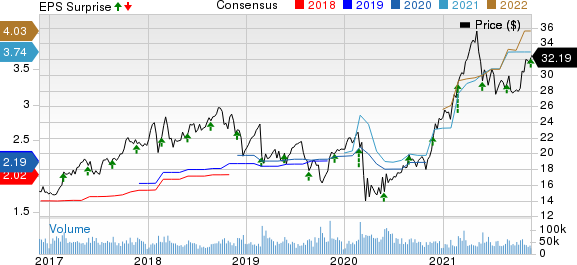

HP Inc. Price, Consensus and EPS Surprise

HP Inc. price-consensus-eps-surprise-chart | HP Inc. Quote

Quarter in Detail

Personal Systems revenues (71% of net revenues) came in at $11.8 billion, 13% higher than the year-ago quarter (up 10% in cc). The year-over-year growth reflected strong demand for PCs and the positive impact of the big shift toward mainstream and premium commercials. Further, consumer revenues decreased 3%, while commercial revenues increased 25%.

HP’s total PC units sold were down 9% on a year-over-year basis due to the expected supply chain challenges and lower chrome mix. Notebooks registered a year-over-year decline of 12%, while desktop units dropped 2%. Notebook revenues increased 13% year over year to $8.3 billion, while desktop sales grew 11% to $2.5 billion. Workstation sales jumped 39% to $492 million.

HP noted that demand for its products under the Personal Systems segment remained strong during the reported quarter with the backlog increasing again on a quarter-over-quarter basis. However, continued supply-chain constraints hurt this segment’s overall sales growth.

HP is witnessing a strong rebound in its Printing business, which was affected by the office closures during the pandemic. However, due to the continued manufacturing and component supply constraints, the company failed to meet demand.

Printing business revenues (29% of net revenues) increased 1% year over year (flat in cc) to $4.9 billion. HP’s total hardware units sold decreased 26%. Consumer Hardware units declined 28%, while revenues plunged 6%. Further, Commercial Hardware units and revenues decreased 12% and 19%, respectively. Supplies revenues declined 2%.

Region wise, at cc, revenues from the EMEA (36% of 4Q21 revenues) and APJ (24%) climbed 15% and 18%, respectively. However, sales in America (40%) fell 4%.

Operating Results

Segment wise, Personal Systems’ operating margin expanded 140 basis points (bps) to 6.5%, primarily driven by favorable pricing, product mix and currency exchange rates, partially offset by higher commodity costs and increased investments in the go-to-market strategy and innovations.

The printing division’s operating margin expanded 200 bps to 17% on favorable pricing, product mix and currency exchange rates.

HP’s overall non-GAAP operating margin from the continuing operations of 9.5% advanced 150 bps year over year.

Fiscal 2021 Highlights

HP’s fiscal 2021 net revenue increased 12.1% year over year to $63.5 billion and surpassed the Zacks Consensus Estimate of $62.16 billion. The company’s fiscal 2021 non-GAAP earnings surged 66% year over year to $3.79 per share. Moreover, quarterly earnings surpassed the Zacks Consensus Estimate of $3.74 per share and management’s guided range of 3.56-$3.62.

Balance Sheet and Cash Flow

HP ended the fiscal fourth quarter with cash and cash equivalents of $4.3 billion, up from $3.4 billion at the end of the third quarter of fiscal 2021.

During the reported quarter, the company generated operating cash flows of $2.8 billion and a free cash flow of $0.9 billion. HP returned $2 billion to its shareholders in the form of stock repurchases ($1.8 billion) and cash dividends ($219 million) during the fiscal fourth quarter. Also, HP returned 210% of its free cash flows.

During fiscal 2021, the company generated operating and free cash flows of $6.4 billion and $4.2 billion, respectively. It bought back $6.2 billion worth of its common stocks and paid $938 million in cash dividends. Also, HP returned 170% of its free cash flows.

First-Quarter and Fiscal 2022 Guidance

For fiscal 2022, management expects non-GAAP earnings in the range of $4.07-$4.27 per share. Also, the company estimates to generate at least $4.5 billion of free cash flow during the fiscal year. On the earnings conference call, HP said that it expects to buy back at least $4 billion worth of its common stock during fiscal 2022.

For the first quarter of fiscal 2022, HP estimates non-GAAP earnings per share between 99 cents and $1.05. For the printing segment, HP projects robust demand for consumer printers and continued improvement in the commercial segment as offices reopen. HP anticipates solid demand for personal systems during the current quarter.

HP expects that the industry-wide component supply constraints might affect its ability to meet demand. Moreover, the ongoing pandemic is expected to cause some manufacturing, port and logistics disruptions at least through the first half of 2022. These factors are expected to curb the company’s revenue growth in the ongoing quarter.

Zacks Rank & Key Picks

Currently, HP carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector include Google-parent Alphabet GOOGL, Diodes DIOD and Cirrus Logic CRUS, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alphabet’s fourth-quarter 2021 earnings has been revised upward by $1.87 to $26.72 per share over the past 30 days. For 2021, earnings estimates have been moved upward by $5.99 to $107.86 per share in the last 30 days.

Alphabet’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 41.5%. The GOOGL stock has rallied 66.3% in the year-to-date (YTD) period.

The Zacks Consensus Estimate for Diodes’ fourth-quarter 2021 earnings has been revised upward by 23.9% to $1.45 per share over the past 30 days. For 2021, earnings estimates have moved upward by 6.3% to $5.06 per share over the last 30 days.

Diodes’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 10%. Shares of DIOD have rallied 52.8% YTD.

The consensus mark for Cirrus Logic’s third-quarter fiscal 2022 earnings has been raised to $2.15 per share from $2.10 per share 30 days ago. For fiscal 2022, earnings estimates have revised upward by 38 cents to $5.37 per share in the last 30 days.

Cirrus Logic’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missed the same on one occasion, the average surprise being 14.9%. Shares of CRUS have declined 2.2% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.