HubSpot (HUBS) Up 14.6% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for HubSpot, Inc. HUBS. Shares have added about 14.6% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is HUBS due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Hubspot delivered fourth-quarter 2017 non-GAAP earnings of 12 cents per share against a loss of 13 cents per share in the year-ago quarter. The figure also beat the Zacks Consensus Estimate of 7 cents per share.

Revenues of $106.5 million surged 39% year over year in fourth-quarter 2017. The figure surpassed the Zacks Consensus Estimate of $101 million as well as the guided range of $101-$102 million.

Year-over-year growth in revenues can be primarily attributed to its growing customer base, which increased 48%.

Quarter Details

Subscription revenues increased 40% from the year-ago quarter to $101.7 million, representing 95% of the total revenues. Professional services and other revenues were up 20% year over year to $4.8 million.

Average subscription revenue per customer decreased 4% year over year to $10,255. The decline can primarily be attributed to increased adoption of the company’s marketing starter product and sales starter product called Sales Pro.

Deferred revenues grew 44% year over year to $139 million, while calculated billings, defined as revenue plus the change in deferred revenues, came in at $126 million, up 41% year over year. Management noted that growth in billings was primarily driven by a forex benefit.

International revenues grew 65% year over year, representing 35% of total revenues in the quarter, which also benefited from positive forex impact.

Management is positive about the performance of Hubspot One and Hubspot CRM tools. Additionally, the acquisitions of Motion AI and Kemvi reflect the company’s focus on integrating artificial intelligence (AI) in its offerings, as well as expanding solutions portfolio.

Management noted that the company successfully hosted the INBOUND event in September, bringing together thousands of marketing and sales professionals and eminent speakers from around the world including Michelle Obama.

Lastly, management is also optimistic about the launch of Customer Hub scheduled in 2018.

Margin and Balance Sheet

The company reported non-GAAP operating income of $4.3 million against a loss of $4.5 million in the year-ago quarter.

Hubspot had cash, cash equivalents and investments balance of $535.7 million as of Dec 31, 2017. During the quarter, free cash flow came in at $7 million.

Guidance

HubSpot forecasts revenues in the range of $109.2-$110.2 million for first-quarter 2018.

Management expects non-GAAP operating income in the range of $4-$5 million for the first quarter. Moreover, HubSpot expects non-GAAP earnings to be in the range of 10-12 cents per share.

For full-year 2018, HubSpot anticipates revenues in the range of $481-$485 million. Non-GAAP operating income is expected in the range of $20-$24 million. Non-GAAP earnings is anticipated to be in the range of 51-59 cents per share.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter.

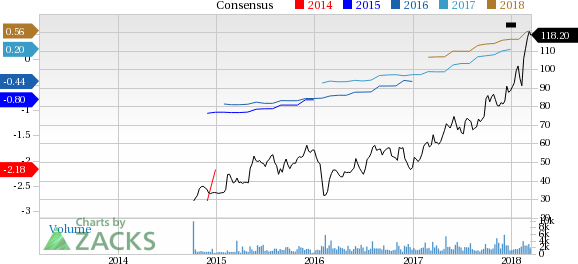

HubSpot, Inc. Price and Consensus

HubSpot, Inc. Price and Consensus | HubSpot, Inc. Quote

VGM Scores

At this time, HUBS has a strong Growth Score of A, though it is lagging a bit on the momentum front with a B. The stock was allocated a grade of F on the value side, putting it in the fifth quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. Notably, HUBS has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HubSpot, Inc. (HUBS) : Free Stock Analysis Report

To read this article on Zacks.com click here.