HubSpot (HUBS) Q1 Earnings Beat, Coronavirus Dims '20 View

HubSpot, Inc.’s HUBS first-quarter 2020 non-GAAP earnings of 35 cents per share beat the Zacks Consensus Estimate by 52.2%. The figure also exceeded management’s guided range of 22-24 cents. However, the bottom line declined 2.8% from the year-ago quarter.

Revenues of $199 million surpassed the Zacks Consensus Estimate of $190 million and improved 31% (33% on a constant currency basis) year over year. The top line was also higher than management’s guided range of $192.5-$193.5 million.

The top line was driven by accelerating Subscription revenues. Further, growing customer base, which surged 30% year over year to 78,776, contributed to the results.

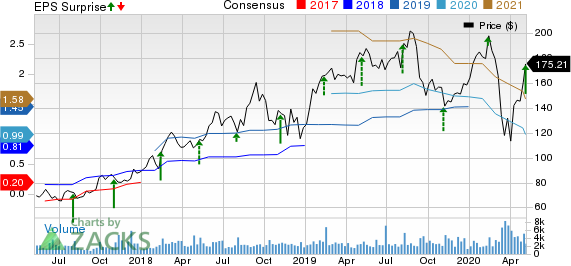

HubSpot Inc Price, Consensus and EPS Surprise

HubSpot Inc price-consensus-eps-surprise-chart | HubSpot Inc Quote

Quarter Details

Subscription revenues (96.1% of the total revenues) improved 33% from the year-ago quarter to $191.2 million. Professional services and other revenues (3.9%) were up 2% year over year to $7.7 million.

Total average subscription revenue per customer was up 2% year over year to $10,018.

Deferred revenues (including current portion) improved 25% year over year to $242 million. Meanwhile, calculated billings, defined as revenues plus the change in deferred revenues came in at $207 million, surging 30% year over year (up 32% at cc).

International revenues advanced 41% from the year-ago quarter (up 45% at cc), representing 42% of total revenues in the reported quarter.

Margins in Detail

Per management, non-GAAP gross margin during the reported quarter remained flat year over year at 82%. Further, non-GAAP subscription margin of 85.4% contracted 80 basis points (bps) on a year-over-year basis.

Non-GAAP Research and development (R&D) expenses as a percentage of revenues expanded 200 bps year over year to 19%. Non-GAAP General and administrative (G&A) expenses contracted 100 bps to 10% on a year-over-year basis. Meanwhile, non-GAAP Sales and marketing (S&M) expenses expanded 200 bps to 46% from the year-ago quarter.

The company reported non-GAAP operating income of $14.6 million, up 12.3% from the year-ago figure. Management had projected non-GAAP operating income in the band of $9.5-$10.5 million for the first quarter.

Non-GAAP operating margin contracted 130 bps on a year-over-year basis to 7.3%.

Balance Sheet & Cash Flow

As of Mar 31, 2020, HubSpot reported cash and cash equivalents and short-term investments of $968.6 million, up from $961.5 million as of Dec 31, 2019.

Cash flow from operations during the reported quarter came in at $23 million compared with $47.9 million reported in the prior quarter.

Free cash flow came in at $7.1 million compared with the prior-quarter figure of $24.4 million.

Guidance

For second-quarter 2020, HubSpot forecast revenues in the range of $195-$196 million. The mid-point of the range — $195.5 million — is lower than the current Zacks Consensus Estimate for the first quarter of $195.8 million.

Management expects non-GAAP operating income in the band of $10.5-$11.5 million.

Moreover, HubSpot anticipates non-GAAP net income per share to be in the range of 23-25 cents. The Zacks Consensus Estimate is currently pegged at 21 cents per share.

For 2020, the company has trimmed guidance citing challenging business environment and macroeconomic headwinds pertaining to COVID-19 induced global crisis. The company now anticipates revenues in the range of $800-$810 million compared with the prior range of $840.5 million to $844.5 million. The mid-point of the range — $805 million — is lower than the current Zacks Consensus Estimate for the second quarter of $806.7 million.

Management expects non-GAAP operating income in the band of $40-$42 million compared with the earlier guided range of $54-$58 million.

HubSpot anticipates non-GAAP net income per share to be in the range of 88-92 cents compared with the previous range of $1.24-$1.32. The Zacks Consensus Estimate is currently pegged at 99 cents per share.

Zacks Rank & Key Picks

HubSpot currently has a Zacks Rank #3 (Hold).

ASE Technology Holding Co., Ltd. ASX, Twilio Inc. TWLO and InterDigital, Inc. IDCC are some better-ranked stocks worth considering in the broader computer and technology sector, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for ASE Technology, Twilio and InterDigital is pegged at 26.63%, 26.61% and 15%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital Inc (IDCC) : Free Stock Analysis Report

Advanced Semiconductor Engineering Inc (ASX) : Free Stock Analysis Report

HubSpot Inc (HUBS) : Free Stock Analysis Report

Twilio Inc (TWLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research