HubSpot (HUBS) Surpasses Q2 Earnings and Revenue Estimates

HubSpot, Inc HUBS reported relatively healthy second-quarter 2022 results, with both the bottom line and the top line surpassing the respective Zacks Consensus Estimate, driven by strong product innovation and a deep understanding of its customers’ requirements. The company’s strategic priority is to deliver a world-class front-office platform by investing in anchor hubs and innovating new emerging hubs. The company continues to expand its app ecosystem, with its integration catalog growing nearly 40% year over year. HubSpot also remains focused on becoming a leading CRM platform provider in the near future. The solid quarterly performance was reflected in share price appreciation post earnings release.

Quarter Details

GAAP net loss in the quarter was $56.4 million or a loss of $1.18 per share compared with a net loss of $24.6 million or a loss of 53 cents per share in the prior-year quarter.

Non-GAAP net income in the second quarter was $22.4 million or 44 cents per share compared with $21.6 million or 43 cents per share in the prior-year quarter. It beat the Zacks Consensus Estimate by a penny.

Revenues during the reported quarter were $421.8 million compared with $310.8 million in the prior-year quarter, reflecting growth of 35.7% and beating the Zacks Consensus Estimate of $410 million. The strengthening of the U.S. dollar throughout the second quarter contributed majorly to the earnings growth. Growing customer base, which surged 25% year over year to 150,865, also contributed to the results.

Subscription revenues in the quarter were $421.4 million compared with $300.4 million in the year-ago quarter, reflecting growth of 40.3%. Professional services and other revenues were $9.4 million compared with $10.4 million in the prior-year quarter, reflecting a decline of 9.8%. Average subscription revenue per customer was up 10% from the prior-year quarter to $11,198.

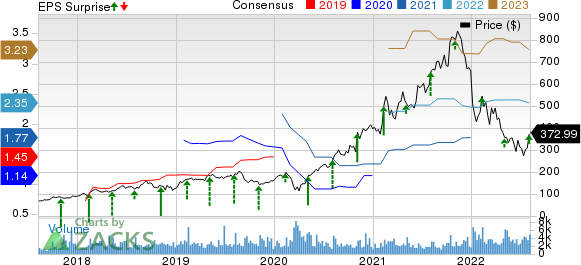

HubSpot, Inc. Price, Consensus and EPS Surprise

HubSpot, Inc. price-consensus-eps-surprise-chart | HubSpot, Inc. Quote

Operating Details

Gross profit reported during the quarter was $342.8 million compared with $247.9 million in the prior-year quarter. GAAP operating loss during the quarter was reported at $52.3 million compared with a loss of $16.6 million in the prior-year quarter. Non-GAAP operating income during the quarter was $29.4 million compared with $27.5 million in the prior-year quarter.

Cash Flow & Liquidity

During the quarter, HubSpot generated $40.9 million from operating activities compared with $38.2 million in the prior-year period. As of Jun 30, 2022, the company had $305.7 million in cash and cash equivalents with $264.2 million of operating lease liabilities, net of current portion.

Guidance

For third-quarter 2022, HubSpot forecasts revenues to be in the range of $425 million to $426 million. The company expects non-GAAP net income per share to be in the band of 50 cents to 52 cents.

For 2022, the company has lowered the revenue guidance from $1.722 billion-$1.728 billion to $1.69 billion to $1.695 billion owing to challenging macroeconomic conditions. Non-GAAP operating income is expected to be within $143 million-$144 million compared with an earlier expectation of $152 million to $154 million. Non-GAAP net income per share is likely to be in the range of $2.28-$2.30, down from $2.40-$2.42 projected earlier.

Zacks Rank & Stocks to Consider

HubSpot currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Bancorp. FBP, sporting a Zacks Rank #1, delivered an earnings surprise of 17.1%, on average, in the trailing four quarters. Over the past year, the stock has risen 18.2%.

Earnings estimates for the current year have moved up 16.8% since August 2021. First Bancorp operates in six segments – Commercial and Corporate Banking, Mortgage Banking, Consumer Banking, Treasury and Investments, United States Operations and Virgin Islands Operations.

Home Bancorp, Inc. HBCP, sporting a Zacks Rank #1, is another key pick for investors. It delivered an earnings surprise of 15.5% in the previous quarter and a stellar earnings surprise of 26.9%, on average, in the trailing four quarters. The company specializes in providing one-to-four family first mortgage loans, home equity loans and lines, commercial real estate loans, construction and land loans, multi-family residential loans, commercial and industrial loans and consumer loans.

Earnings estimates for the current year have moved up 27.2% since August 2021.

Liberty Energy Inc. LBRT has a Zacks Rank #1. The Zacks Consensus Estimate for Liberty Energy’s current-year earnings has been revised 307.7% upward since August 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First BanCorp. (FBP) : Free Stock Analysis Report

HubSpot, Inc. (HUBS) : Free Stock Analysis Report

Home Bancorp, Inc. (HBCP) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research