Humana's (HUM) Earnings and Revenues Beat Estimates in Q2

Humana Inc.’s HUM second-quarter 2019 operating earnings per share of $6.05 beat the Zacks Consensus Estimate by 15.5%. The bottom line also improved 52.8% year over year. This upside can primarily be attributed to Medicare Advantage membership growth and higher revenues.

Operational Update

Further, revenues of $16.2 billion were up nearly 14% in the second quarter. Moreover, the top line surpassed the Zacks Consensus Estimate by 2.3% year over year.

Adjusted consolidated pre-tax income of $1073 million surged 32% year over year, backed by the company’s consistent execution of its strategy and solid performances by its Medicare Advantage business and Healthcare Services segment.

Benefit ratio expanded 10 basis points to 84.4%.

Operating cost ratio deteriorated 190 basis points to 10.6%.

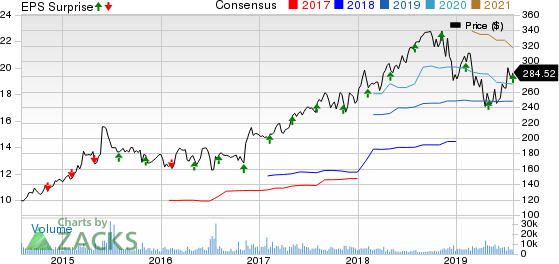

Humana Inc. Price, Consensus and EPS Surprise

Humana Inc. price-consensus-eps-surprise-chart | Humana Inc. Quote

Segmental Results

Retail

Revenues from the Retail segment were $14.16 billion, up 18% year over year. This can primarily be attributed to higher revenues from the company’s individual and group Medicare Advantage membership strength and improved per-member premiums plus higher state-based contracts membership.

Benefit ratio of 85.2% contracted 30 bps year over year by engaging the Medicare Advantage members in clinical programs and documenting them under the CMS risk-adjustment model and lower-than-estimated medical costs.

The segment’s 8.5% operating cost ratio contracted 160 bps year over year owing to the suspension of health insurance industry fee (HIF) in 2019 and operational cost efficiencies.

Group and Specialty

Revenues from the Group and Specialty segment were $1.87 billion, down 2% from the prior-year quarter due to a reduction in fully-insured group commercial and specialty membership, the impact of a few contractual incentives and also adjustments related to the TRICARE contract of 2018.

Benefit ratio expanded 590 bps year over year to 86.3% due to the impact of unfavorable Prior Period Development, suspension of the HIF and membership mix.

Operating cost ratio contracted 180 bps year over year to 21.8%.

Healthcare Services

Revenues of $6.39 billion increased 7% year over year, primarily owing to Medicare Advantage membership growth and improved revenues related to the company’s provider services business.

Operating cost ratio contracted 10 bps year over year to 96.1%.

Individual Commercial

Humana exited this business effective Jan 1, 2018 and consequently, the result reflects its run-out.

Financial Update

As of Jun 30, 2019, the company had cash, cash equivalents and investment securities of $4.7 billion, up 104% from year-end 2018.

Debt-to-total capitalization as of Jun 30, 2019 was 32.5%, down 490 bps from Dec 31, 2018.

Operating cash inflow totaled $1434 million in the second quarter against cash outflow of $99 million in the year-earlier quarter.

Capital Deployment

The company paid out cash dividends worth $74 million in the quarter under review.

During the second quarter, the company did not buy back shares.

In July 2019, the company’s board of directors approved a new $3-billion share repurchase plan, replacing its previous buyback authorization.

2019 Guidance

For 2019, Humana expects adjusted EPS to be around $17.60 per share.

Zacks Rank

Humana carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Releases From the Medical Sector

Among other players from the medical sector having reported second-quarter earnings so far, the bottom-line results of UnitedHealth Group Incorporated UNH, Anthem Inc. ANTM and Centene Corporation CNC outpaced the respective Zacks Consensus Estimate.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Centene Corporation (CNC) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research