Huntington (HBAN) Q2 Earnings Beat Estimates, Revenues Up

Huntington Bancshares Incorporated HBAN reported a positive earnings surprise of 13.0% in second-quarter 2017. Adjusted earnings per share of 26 cents outpaced the Zacks Consensus Estimate by 3 cents. Moreover, the figure was higher than the prior-year quarter adjusted earnings of 21 cents. The reported earnings figure excludes FirstMerit acquisition-related expenses of 3 cents per share.

Shares of Huntington Bancshares gained more than 2% in the beginning of the trading session today, reflecting investors’ optimism. However, the price reaction during full-trading session will give a better idea.

Better-than-expected results witnessed higher revenues. Continual growth in both loan and deposit balances was also recorded. Notably, the reported results highlight the benefit of the FirstMerit acquisition. However, elevated expenses and higher net charge-offs were the primary headwinds.

Net income jumped nearly 55.4% year over year to $272 million during the quarter.

Revenues, Loans & Deposits Escalate, Expenses Flare Up

Huntington Bancshares’ total revenue on a fully taxable-equivalent (FTE) basis was $1.08 billion in the quarter, surpassing the Zacks Consensus Estimate of $1.07 billion. Moreover, total revenue was up 37% year over year.

Net interest income (NII) came in at $757 million on a FTE basis, up 47% from the prior-year quarter. The rise was driven by an increase in average earnings assets, along with an expansion of 25 basis points (bps) in net interest margin (NIM), to 3.31%.

Non-interest income climbed 20% year over year to $325 million. The upsurge was due to growth in almost all components of income.

Non-interest expense surged 33% year over year to $694 million. The increase was stemmed by rise in mostly all components of expenses. Excluding the impact of certain non-recurring items, non-interest expense increased 28% year over year.

As of Jun 30, 2017, average loans and leases at Huntington jumped nearly 29.7% year over year to $67.3 billion. Also, average total deposits surged 38% year over year to $76.5 billion.

Credit Quality: A Mixed Bag

Net charge-offs were $36 million or an annualized 0.21% of average total loans in the reported quarter, up from $17 million or an annualized 0.13% in the year-ago quarter.

Provision for credit losses was stable on a year-over year basis at $25 million. In addition, total non-performing assets totaled $415 million as of Jun 30, 2017, down from $490 million as of Jun 30, 2016.

The quarter-end allowance for credit losses, as a percentage of total loans and leases, dropped to 1.11% from 1.33% in the prior-year quarter.

Strong Capital Ratios

Huntington Bancshares capital ratios were strong.

Common equity tier 1 risk-based capital ratio and regulatory Tier 1 risk-based capital ratio were 9.88% and 11.24%, respectively, as compared with 9.80% and 11.37% in the year-ago quarter.

Tangible common equity to tangible assets ratio was 7.41%, down from 7.96% as of Jun 30, 2016.

Outlook for 2017

Including the synergies of FirstMerit acquisition, total revenue for full-year 2017 is expected to be over 20%. Management projects to implement all FirstMerit-related cost savings by third-quarter 2017.

Average balance sheet growth is estimated over 20%, driven mainly by the FirstMerit acquisition. On a period-end basis, loan growth is anticipated in the range of 4–6%.

Overall, asset quality metrics are likely to remain stable with moderate quarterly volatility, given the current low level of problem assets and credit costs.

Management anticipates NCOs to remain below the long-term normalized range of 35–55 basis points, while provision expense is expected to continue to normalize.

Excluding certain items, the effective tax rate for 2017 is estimated in the range of 24–27%.

Our Viewpoint

Huntington reported an encouraging quarter. The company has a solid franchise in the Midwest and is focused on capitalizing on growth opportunities. Further, it exhibits consistent efforts in increasing loan and deposit balances, aiding revenue growth. Additionally, we remain optimistic about the company’s several strategic actions, including acquisitions and consolidation of branches.

However, escalating costs and unstable credit metrics pose challenges to the company’s financials.

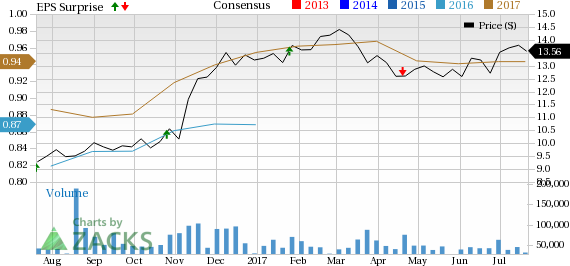

Huntington Bancshares Incorporated Price, Consensus and EPS Surprise

Huntington Bancshares Incorporated Price, Consensus and EPS Surprise | Huntington Bancshares Incorporated Quote

Currently, Huntington carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of other Banks

Impacted by low non-interest income and high expenses, Northern Trust Corporation NTRS reported a negative earnings surprise of 4.8% in second-quarter 2017. Adjusted earnings per share came in at $1.18, missing the Zacks Consensus Estimate of $1.24. However, the reported figure compared favorably with $1.07 recorded in the year-ago quarter.

Higher interest income drove Wells Fargo & Company’s WFC second-quarter 2017 earnings which recorded a positive surprise of about 4.9%. Earnings of $1.07 per share outpaced the Zacks Consensus Estimate of $1.02. Moreover, the figure compared favorably with the prior-year quarter’s earnings of $1.01 per share.

Citigroup Inc. C delivered a positive earnings surprise of 5.0% in second-quarter 2017, riding on higher revenues. The company’s income from continuing operations per share of $1.27 for the quarter outpaced the Zacks Consensus Estimate of $1.21. Also, earnings compared favorably with the year-ago figure of $1.25 per share.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research