Hyatt (H) Benefits From Hotel Openings and Robust Demand

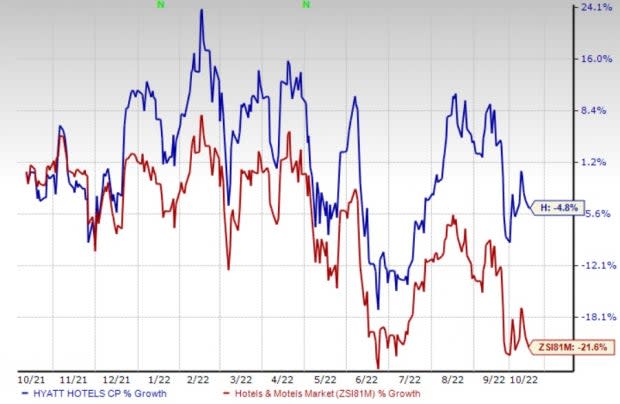

Shares of Hyatt Hotels Corporation H have declined 4.8% in the past year compared with the industry’s decline of 21.6%. However, in the past three months, the stock has gained 10.3%. The company continues to benefit from new hotel openings, robust demand and a loyalty program.

This Zacks Rank #1 (Strong Buy) company’s earnings in 2022 and 2023 are likely to witness growth of 113% and 178.6%, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

Growth Drivers

The company continues to expand its presence to drive growth. During the second quarter of 2022, 28 new hotels (or 5,510 rooms) joined Hyatt's system. As of Jun 30, 2022, the company had executed management or franchise contracts for approximately 550 hotels (or 113,000 rooms).

Unit growth in 2022 is expected to increase approximately 6% on a net-room basis. In 2018, 2019 and 2020, Hyatt registered net room growth of 13.6%, 7.4% and 5.2% on a year-over-year basis, respectively.

Given easing travel restrictions in the Asia Pacific region along with a rebound of leisure travel, the company unveiled a robust pipeline of landmark luxury and lifestyle hotels, with anticipated openings in late 2022 and 2023. These include the strategic entry of several brands into new markets, such as the arrival of The Unbound Collection by Hyatt brand (in Japan), the Andaz brand (Thailand), the Hyatt Centric brand (Southeast Asia) and a new hotel in Malaysia. Some of the additional luxury and lifestyle hotel openings planned for 2022 and 2023 are Grand Hyatt Shenzhou Peninsula, Park Hyatt Kuala Lumpur (debut of the Park Hyatt brand in Malaysia), Andaz Macau, Grand Hyatt Kunming, Andaz Nanjing Hexi and Alila Donghu Wuhan.

The company is gaining from the improvement in demand from the Europe, Africa, Middle East and Southwest Asia segments. During the second quarter of 2022, leisure transient revenues were 19% more than the 2019 levels on a comparable system-wide basis. The company is optimistic that demand will remain high in 2022.

Image Source: Zacks Investment Research

During second-quarter 2022, the company witnessed a rise in group bookings at its Americas full-service managed hotels on a year-over-year basis. As people return to the office, travel restrictions are eased and more cross-border travel resumes, the company remains optimistic about the recovery of business transient and its continued momentum over the back half of the year. This and strength in short-term bookings coupled with strong food and beverage spending are likely to support the recovery process in the upcoming periods.

To survive in a tough economic environment, Hyatt is continuously devising newer ways to enhance guest experience and raise occupancy. Successful innovation has been a trademark of Hyatt, with a commitment to the impactful architectural design of hotels in both large-scale conventions and smaller leisure markets. The company also has a creative approach to food and beverage at its hotels worldwide and has created profitable and popular venues that build and enhance demand for its hotel properties.

Other Key Picks

Some other top-ranked stocks in the Zacks Consumer Discretionary sector are Marriott Vacations Worldwide Corporation VAC, Live Nation Entertainment, Inc. LYV and InterContinental Hotels Group PLC IHG.

Marriott Vacations currently sports a Zacks Rank #1. VAC has a trailing four-quarter earnings surprise of 13.9%, on average. The stock has declined 18% in the past year.

The Zacks Consensus Estimate for VAC’s current financial year sales and earnings per share (EPS) indicates an increase of 19.7% and 131.4%, respectively, from the year-ago period’s reported levels.

Live Nation Entertainment carries a Zacks Rank #1. LYV has a trailing four-quarter earnings surprise of 70.7%, on average. The stock has declined 22% in the past year.

The Zacks Consensus Estimate for LYV’s current financial year EPS indicates growth of 117.2% from the year-ago period’s reported levels.

InterContinental Hotels carries a Zacks Rank #1. IHG has a long-term earnings growth of 32.7%. The stock has declined 26.6% in the past year.

The Zacks Consensus Estimate for IHG’s current financial year sales and EPS indicates growth of 21.7% and 88.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research