IBM Beats on Q2 Earnings, Stock Down on Top-Line Decline

International Business Machines Corp IBM reported third-quarter 2018 non-GAAP earnings of $3.42 per share, which beat the Zacks Consensus Estimate by couple of cents. Earnings per share (EPS) increased 4.9% from the year-ago quarter.

The year-over-year growth in EPS can be attributed to solid pre-tax margin operating leverage (28 cents contribution) and aggressive share buybacks (19 cents contribution). This was partially offset by lower revenues (seven cents negative impact) and higher tax rate (17 cents negative impact).

Revenues of $18.76 billion lagged the Zacks Consensus Estimate of $19.10 billion and declined 2.1% on a year-over-year basis. At constant currency (cc), revenues remained flat.

IBM stated that signings plunged 21% to $8 billion. Services backlog declined 3% from the year-ago quarter to $113 billion.

Shares decreased more than 4.7% in after-hour trading, following third-quarter announcement. IBM has lost 10.1% year to date, underperforming the industry’s decline of 4.4%.

Geographic Revenue Details

Revenues from Americas inched up 1%, driven by continued growth in Canada and Latin America and modest growth in the United States.

Europe, Middle-East and Africa decreased 2% from the year-ago quarter, driven by decline in Germany and France, partially offset by growth in Spain and the United Kingdom.

Asia-Pacific revenues declined 1% on a year-over-year basis with modest growth in Japan.

Strategic Imperatives Growth Continues

Strategic Imperatives (cloud, analytics, mobility and security) grew 7% at cc from the year-ago quarter to $9.3 billion. Security revenues surged 34%. On a trailing 12-month basis, Strategic Imperatives revenues were $39.5 billion, up 13% (11% at cc).

Cloud revenues surged 13% from the year-ago quarter to $4.6 billion. The annual run rate for cloud as-a-service revenues increased 24% at cc on a year-over-year basis to $11.4 billion.

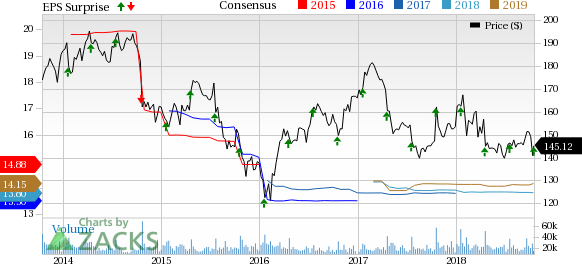

International Business Machines Corporation Price, Consensus and EPS Surprise

International Business Machines Corporation Price, Consensus and EPS Surprise | International Business Machines Corporation Quote

Cloud revenues of $19 billion on a trailing 12-month basis increased 20% (18% at cc) and now accounts for 24% of IBM’s total revenues.

Cognitive Revenues Decline

Cognitive Solutions’ revenues-external decreased 5.7% year over year (down 5% at cc) to $4.15 billion. Segmental revenues pertaining to Strategic Imperatives and Cloud declined 4% and 2%, respectively. Cloud as-a-service revenue annual run rate was $2 billion.

Solutions Software includes offerings in strategic verticals like health, domain-specific capabilities like analytics and security, and IBM’s emerging technologies of AI and blockchain. The segment also includes offerings that address horizontal domains like collaboration, commerce and talent. Solutions Software revenues decreased 3% year over year in the quarter.

IBM stated that in commerce domain the infusion of AI into offerings like customer experience analytics helped SaaS signings to grow double digit in the quarter. The recent launch of Notes Domino version 10, which is optimized for mobile, and supports JavaScript and node.js will boost growth collaboration in 2019.

Transaction Processing Software includes software that runs mission-critical workloads, leveraging IBM’s hardware platforms. Revenues fell 8% on a year-over-year basis.

IBM witnessed growth in industry verticals like health, key areas of analytics and security in the quarter. Watson Health witnessed broad-based growth in Payer, Provider, Imaging and Life Sciences domains.

During the quarter, the Sugar.IQ application, developed by Medtronic MDT in partnership with IBM, hit the market. The application is designed to simplify and improve daily diabetes management.

IBM stated that analytics performed well in the quarter, driven by data science offerings and IBM Cloud Private for Data offering.

During the quarter, the company announced bias detection services and launched new Watson services on the IBM Cloud Private platform.

Security growth was driven by offerings in orchestration, data security and endpoint management.

In blockchain, IBM Food Trust network for food safety went live in the quarter. Reatiler Carrefour joined IBM’s blockchain network. The company also jointly announced TradeLens with Maersk that addresses inefficiencies in the global supply chain. IBM currently supports 75 active blockchain networks.

Global Business Services Revenues Increase

Revenues from Global Business Services-external segment were $4.13 billion, up 0.9% from the year-ago quarter (up 3% at cc). Segmental revenues pertaining to Strategic Imperatives grew 9%. Cloud practice surged 18%. Cloud as-a-service revenue annual run rate was $1.9 billion.

Application Management revenues declined 1% from the year-ago quarter. However, Global Process Services revenues climbed 2%. Moreover, Consulting revenues increased 7% year over year, driven by strong performance from IBM’s digital business.

Technology Services & Cloud Platforms: Revenues Dip

Revenues from Technology Services & Cloud Platforms-external decreased 2% from the year-ago quarter (flat at cc) to $8.29 billion. Segmental revenues pertaining to Strategic Imperatives advanced 16%, driven by hybrid cloud services. Cloud surged 22% from the year-ago quarter. Cloud as-a-service revenue annual run rate was $7.5 billion.

Integration Software increased 1% from the year-ago quarter. During the quarter, 95 companies around the world selected IBM Cloud Private offering. Infrastructure Services revenues also increased 1% on a year-over-year basis.

However, Technical Support Services revenues decreased 3% from the year-ago quarter.

Power & z14 Drive Systems Revenues

Systems revenues increased 0.9% on a year-over-year basis (up 2% at cc) to $1.74 billion. Segmental revenues pertaining to Strategic Imperatives surged 5%, while Cloud revenues declined 8%.

IBM Z revenues increased 6% year over year on more than 20% MIPS growth, driven by broad-based adoption of the z14 mainframe.

Power revenues increased 17% from the year-ago quarter. During the quarter, IBM launched its next generation POWER9 processors for midrange and high-end systems that are designed for handling advanced analytics, cloud environments and data-intensive workloads in AI, HANA, and UNIX markets.

IBM also introduced new offerings optimizing both hardware and software for AI. Management believes that products like PowerAI Vision and PowerAI Enterprise will help drive new customer adoption.

However, storage hardware revenues declined 6% due to weak performance in the midrange and high end, partially offset by strong growth in All Flash Arrays. IBM stated that pricing pressure in the immensely competitive storage market is hurting revenues. The company announced its new FlashSystems with next generation NVMe technology during the quarter.

Operating Systems Software revenues declined 4%, while Systems Hardware advanced 4% from the year-ago quarter.

Finally, Global Financing (includes financing and used equipment sales) revenues decreased 9.1% at cc to $388 million.

Operating Details

Non-GAAP gross margin remained unchanged from the year-ago quarter at 47.4%. This was IBM’s best gross margin performance in years and was primarily driven by 160 basis points (bps) expansion in services margin. However, unfavorable mix in z14 mainframe and software fully offset this expansion.

Operating expense declined 4% year over year, due to realization of acquisition synergies and improving operational efficiencies. IBM continues to invest in fast growing fields like hybrid cloud, artificial intelligence (AI), security and blockchain.

Pre-tax margin from continuing operations expanded 50 bps on a year-over-year basis to 19.2%.

Cognitive Solutions and Global Business Services segment pre-tax margins expanded 190 bps and 320 bps, respectively, on a year-over-year basis. However, Technology Services & Cloud Platforms segment pre-tax margin contracted 100 bps.

Systems pre-tax income was $209 million down 38% year over year. Global Financing segment pre-tax income jumped 26.7% to $308 million.

Balance Sheet & Cash Flow Details

IBM ended third-quarter 2018 with $14.70 billion in total cash and marketable securities compared with $11.93 billion at the end of second-quarter 2018. Total debt (including global financing) was $46.9 billion, up $1.4 million from the previous quarter.

IBM reported cash flow from operations (excluding Global Financing receivables) of $3.1 billion and generated free cash flow of $2.2 billion in the quarter.

In the reported quarter, the company returned $2.1 billion to shareholders through dividends and share repurchases. At the end of the quarter, the company had $1.4 billion remaining under current buyback authorization.

Guidance

IBM reiterated EPS forecast for 2018. Non-GAAP EPS is expected to be at least $13.80. The Zacks Consensus Estimate is currently pegged at $13.84.

IBM still anticipates 2018 free cash flow of $12 billion.

Zacks Rank & Stocks to Consider

IBM currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader computer & technology sector are Hewlett Packard Enterprise HPE and Microsoft MSFT. Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term EPS growth rate for Hewlett Packard Enterprise and Microsoft is currently pegged at 9.8% and 12.3%, respectively.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Medtronic PLC (MDT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research