IBM Exits Its Facial Recognition Business Amid Protests

International Business Machines Corporation IBM will reportedly no longer sell or develop facial-recognition software in an effort to curb racial discrimination. Moreover, the company will oppose the use of such technology for mass surveillance and racial profiling.

The decision comes amid nationwide protests in the United States over the death of George Floyd in police custody.

Per a Reuters Report, CEO Arvind Krishna has called for key policy changes in the United States through police reform, responsible use of technology, and broadening skills and educational opportunities to achieve racial equality in the country.

The decision to move away from the controversial technology is likely to free up resources for IBM, which can be reinvested in other profitable businesses. It is also expected to boost the company’s brand reputation and instill investors’ optimism in the stock.

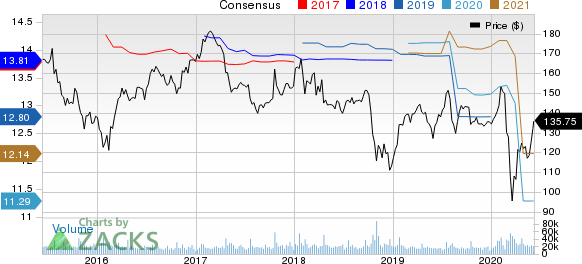

Notably, shares of the company have returned 1.3% in the year-to-date period against the industry’s decline of 3.1%.

International Business Machines Corporation Price and Consensus

Facial Recognition under Fire for Privacy Concerns

The facial recognition technology is increasingly being leveraged by various government and law enforcement agencies as well as private entities to fulfill their respective requirements. The use of the tech is almost infinite, for instance, unlocking screens, identifying and uniting family members, and receiving suggestions for tagging a person on a picture, to mention a few.

The improvements in sensors and cameras, and strengthened machine learning (ML) capabilities are paving the way for organizations to increasingly leverage the facial recognition technology.

However, the technology has been accused of being biased, which leads to disproportionate targeting of people along the lines of race or ethnicity. Notably, per a study published by the National Institute of Standards and Technology (NIST), facial recognition systems have a higher rate of false positives for Asian and African-American faces as compared to Caucasian faces.

As a result, the companies providing facial recognition technology have come under increased pressure to regulate their services.

Markedly, Facebook FB came under scrutiny over its use of facial recognition technology. In January, the company paid $550 million to settle a class-action lawsuit regarding the use of this technology to identify people’s faces without consent.

Further, in March, Microsoft MSFT divested its stake in Israel-based startup AnyVision and stopped making minority investments in other companies that offer facial recognition technology due to privacy concerns.

Thus, IBM is expected to benefit from its decision to exit from its facial recognition business as the technology is not fool-proof and requires significant modifications, at the moment.

Zacks Rank & A Key Pick

IBM currently carries a Zacks Rank #3 (Hold).

A better-ranked stock worth considering in the broader sector is Nice Ltd. NICE, which flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Nice is currently pegged at 10%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Click to get this free report Microsoft Corporation (MSFT) : Free Stock Analysis Report International Business Machines Corporation (IBM) : Free Stock Analysis Report Facebook, Inc. (FB) : Free Stock Analysis Report Nice Ltd. (NICE) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research