IBM Puts On a Red Hat

- By James Li

International Business Machines Corp. (IBM) and Red Hat Inc. (RHT), two major application software companies, announced on Monday they entered a definitive agreement in which IBM will acquire Red Hat in an all-cash transaction valued at approximately $34 billion.

Transaction details

Per the merger agreement, IBM will acquire all outstanding shares of Red Hat for $190 per share, representing a total enterprise value of approximately $34 billion. IBM expects to finance the transaction with a combination of cash and long-term debt.

Warning! GuruFocus has detected 6 Warning Signs with IBM. Click here to check it out.

The intrinsic value of IBM

The merger, which has been approved by the boards of both companies, is expected to close in the second half of 2019 subject to shareholder approval from Red Hat and other customary closing conditions.

CEOs of both companies highlight 'game-changing' merger

IBM CEO Ginni Rometty said on the conference call that the acquisition of Red Hat "changes everything about the cloud market." While competitors are still just 20% along their cloud journey, the Armonk, New York-based company is already expanding to the "second chapter of the cloud," which focuses on hybrid cloud, multicloud and open source.

Rometty praised the Red Hat team for transforming the company from an open source pioneer to a "driving force in hybrid cloud computing." The CEO said IBM championed the Linux platform for over two decades, investing $1 billion to support it and collaborating with the company to help "develop and grow" the platform and bring hybrid cloud solutions to customers. Such initiatives allowed Linux to become "the fastest-growing platform" and the top platform in the cloud in 2018.

Red Hat CEO Jim Whitehurst said the merger "opens up additional opportunities" across the Raleigh, North Carolina-based company by "leveraging IBM's scale and resources" to accelerate the expansion of Linux to a wider audience and "operate as a distinct unit" within the IBM Hybrid Cloud.

Red Hat boasts strong fundamental data

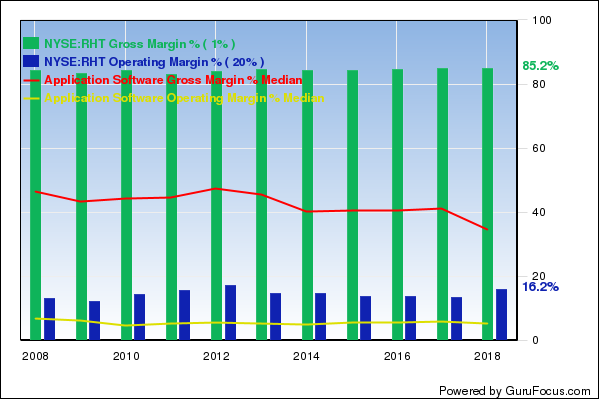

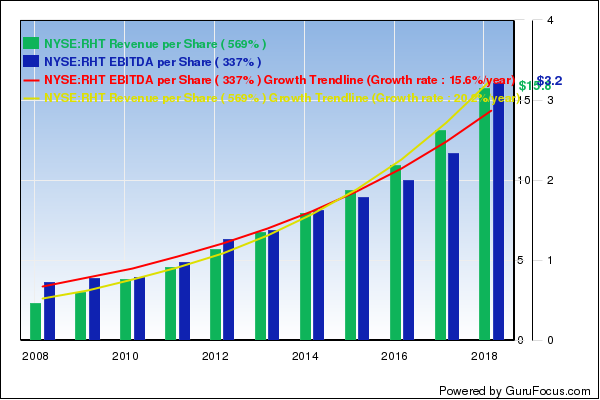

Merger arbitrage hedge fund manager John Paulson (Trades, Portfolio) listed several key criteria of successful mergers, including strategic rationale and a solidly performing target. IBM Chief Financial Officer Jim Kavanaugh said Red Hat is a "high-growth, high-value" company with a strong margin profile: Red Hat's gross margin of 85.54% is near a 10-year high and outperforms 88% of global competitors according to GuruFocus.

Red Hat's profit margins have expanded over the past 10 years, a sign of strong profitability and growth. Additionally, the website ranks the company's business predictability 4.5 stars out of five, suggesting strong and consistent revenue and earnings growth. Red Hat's three-year revenue growth rate of 18.70% is outperforming 78% of global competitors.

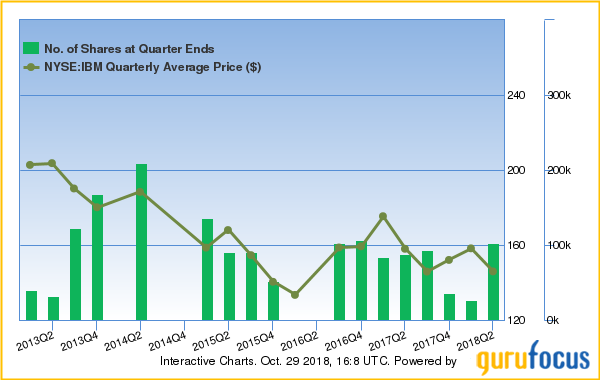

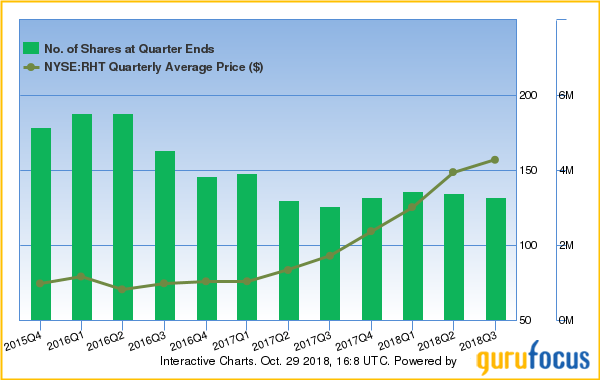

While shares of IBM traded a modest 1% lower, shares of Red Hat increased over 45% in morning trading on the merger news. Gurus with holdings in IBM include Arnold Van Den Berg (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates, while gurus with holdings in Red Hat include Spiros Segalas (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

Disclosure: No positions.

Read more here:

52-Week Company Lows

US Market Indexes Close Lower Wednesday

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Signs with IBM. Click here to check it out.

The intrinsic value of IBM