IBM vs. Alphabet: Which Is the Better Buy?

Over the last 20 years, the growth of the internet and the subsequent emergence of mobile and cloud computing have disrupted IBM (NYSE: IBM). As IT spending at companies has shifted to the cloud, Big Blue has scrambled to shed old assets and invest in new technologies to pave the way for growth. But the damage has been done: Over the last five years, shares of IBM have badly trailed the broader market, down 24% compared to the S&P 500 return of 51%.

On the other side, Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL) has emerged as one of the most dominant companies in the world. The stock has doubled in the last five years, beating the broader market.

Let's compare both companies' financial fortitude, valuation, and competitive advantage to determine which stock is the best investment going forward.

IMAGE SOURCE: GETTY IMAGES.

Financial fortitude

The financial fortitude test tells us which company is better able to handle adversity during tough economic times. It's not always a deal breaker, but it is a useful comparison that can separate the wheat from the chaff when you're deciding between two stocks to buy.

Check out the table below, which shows how each company stacks up on key financial metrics. Note that market capitalization (total shares outstanding times the current stock price), revenue, and free cash flow are provided to give you an idea of the difference in size between the two companies.

Metric | IBM | Alphabet |

|---|---|---|

Cash | $12 billion | $109.14 billion |

Debt | $45.81 billion | $3.95 billion |

Market capitalization | $124 billion | $782 billion |

Revenue (TTM) | $79.59 billion | $136.82 billion |

Free cash flow (TTM) | $11.53 billion | $21.34 billion |

Data source: YCharts and Yahoo! Finance. TTM = trailing 12 months.

Alphabet is obviously the stronger of the two, financially, even after accounting for the difference in annual revenue the two companies generate. IBM has $45 billion in debt and only $12 billion in cash and short-term investments. Alphabet has very little debt, a massive cash hoard, and generates twice as much free cash flow.

Winner: Alphabet.

Valuation and dividends

Comparing the two stocks on valuation is a crucial test. It can help guard against paying too much for a company's earnings, although buying the stock with the lower price-to-earnings ratio is not always the better buy. It's always a good idea to compare the P/E ratio with the expected growth rate of the company's earnings, because sometimes stocks are cheap for a reason. This is where the price/earnings-to-growth (PEG) ratio can be a useful comparison tool. The lower the PEG ratio, the more the stock may be undervalued given its earnings performance.

Here's how both IBM and Alphabet compare on a range of popular valuation metrics:

Metric | IBM | Alphabet |

|---|---|---|

Trailing P/E | 14.08 | 25.06 |

Forward P/E | 9.47 | 23.27 |

PEG ratio | 10.06 | 1.63 |

Dividend yield | 4.65% | NA |

Cash payout as a percentage of free cash flow | 49.14% | NA |

Data source: YCharts and Yahoo! Finance.

IBM has a lower P/E, but it's also expected to grow earnings per share only about 1% per year over the next five years. The company hasn't grown much over the last several years, and analysts clearly don't see any catalyst to change that anytime soon. That's why IBM has a high PEG ratio of 10.

On the other side, analysts expect Alphabet to grow earnings 16.4% per year over the next five years -- consistent with its double-digit growth rate in the past -- which gives the stock a lower PEG ratio of 1.63.

However, notice that IBM pays out a generous dividend yield of 4.65%. What's more, it only pays out 49% of its free cash flow in dividends, which makes its high dividend yield sustainable.

Overall, I would give the edge to Alphabet on valuation because of its lower PEG ratio, but IBM clearly has something to offer investors with its high dividend yield. I'm going to call this one a draw.

Winner: Tie.

Competitive advantage

I invest for the long term. So, for me, weighing each company's competitive strength is the most crucial test. I like to invest in companies that have something going for them. That gives me confidence that they can keep growing over the long haul.

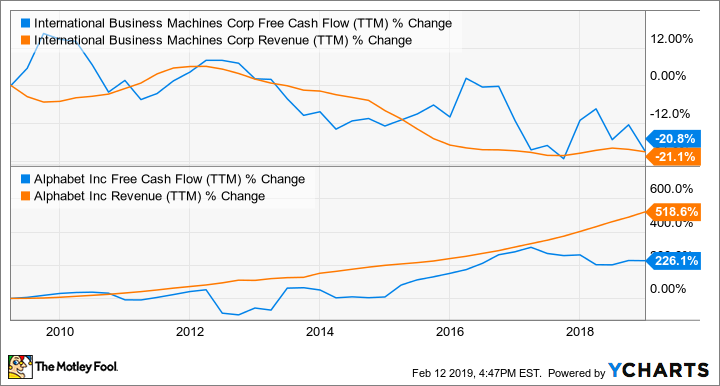

For several years, IBM has been shuffling its assets around as it invests in faster-growing areas like cloud computing, artificial intelligence, data analytics, and mobile solutions while ditching slower-growing businesses like IT services and hardware. Acquiring new businesses and selling old ones is why revenue and free cash flow haven't grown in 10 years, as you can see in this chart.

IBM free cash flow (TTM) data by YCharts.

IBM has a moat, but it's narrowing. It derives a competitive advantage from years of serving corporate clients across many industries. These deep corporate relationships have made its services sticky. A company that has depended on IBM for years is not likely to switch to another solutions provider.

But IBM's main weakness is that it's falling behind more nimble technology companies -- like Alphabet, Microsoft, and Amazon.com -- that are way ahead of IBM in the cloud space and other cutting-edge technologies like artificial intelligence. For example, IT spending on cloud-based offerings is expected to grow faster over the next three years than traditional (non-cloud) IT offerings, according to research firm Gartner. Gartner calls this shift to cloud computing "one of the most disruptive forces in IT markets since the early days of the digital age."

The clock is ticking on IBM, but the company knows this, which is why it is scrambling to catch up in a fast-growing cloud space, where it only controls about 2% of the market. Toward the end of 2018, IBM acquired cloud services provider Red Hat for $34 billion, one of the largest tech deals in history. However, it remains uncertain whether it will catch leaders like Amazon and Microsoft, which together control about 65% of the cloud market and have been growing their cloud businesses much faster than IBM lately.

Now, let's consider Alphabet. Alphabet's Google is ranked the third most valuable brand in the world, according to Brand Finance. The company generates more than 80% of annual revenue from advertising,, but what drives that revenue is machine learning. Google collects enormous amounts of data from its users across search, Gmail, Maps, Android, Chrome, Google Play, and YouTube. It then applies machine learning technology to make sense of that data, which helps advertisers squeeze higher returns out of ad spending. Of course, machine learning also helps Google deliver better products to users, which then attract more users, more data, and more spending from advertisers. It's a virtuous cycle that continues to deliver robust growth for shareholders.

While IBM is using its cash to catch up to other tech rivals, Alphabet is so dominant and profitable that it can use its excess cash to invest in moonshot opportunities beyond its core products, such as self-driving cars (Waymo), life sciences (Verily), and other high-reward, high-risk investments that could turn into sizable, stand-alone businesses down the road.

Winner: Alphabet.

Alphabet is the better buy

It's sometimes tempting to want to buy the low P/E stock, but I think investors will be much better off over the long term going with companies that prove they can sustain growth, like Alphabet. Additionally, Alphabet is in a stronger financial position and possesses a competitive advantage that gets stronger with every bit of data it collects. These characteristics should deliver solid returns for shareholders over the long haul.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. John Ballard owns shares of Amazon. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Amazon. The Motley Fool owns shares of Microsoft. The Motley Fool is short shares of IBM. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.