IDEXX (IDXX) Earnings Beat Estimates in Q2, Margins Rise

IDEXX Laboratories, Inc. IDXX posted second-quarter 2020 earnings per share (EPS) of $1.72, reflecting a 20.3% year-over-year rise. The figure surpassed the Zacks Consensus Estimate by 43.3%. Comparable-constant-currency EPS growth was 23%, which excludes the impact of changes in foreign exchange rates and tax benefits of share-based compensation activity.

Revenues in Detail

Second-quarter revenues grew 2.8% year over year to $637.6 million. Organically, growth was 3.6%. The metric exceeded the Zacks Consensus Estimate by 9.9%.

The year-over-year upside was primarily driven by strong global gains in Companion Animal Group (“CAG”) Diagnostics’ recurring revenue growth of 7% on both reported and organic basis. High single-digit organic gains in the United States and international markets also drove the top line. OPTI Medical Systems COVID-19 human Polymerase Chain Reaction (PCR) testing contributed about 1% to the second-quarter top line. However, second-quarter results were impacted by a fall in new CAG instrument placement levels and Water business revenues, including pressure in non-compliance water testing, impacted by factors related to the COVID-19 pandemic.

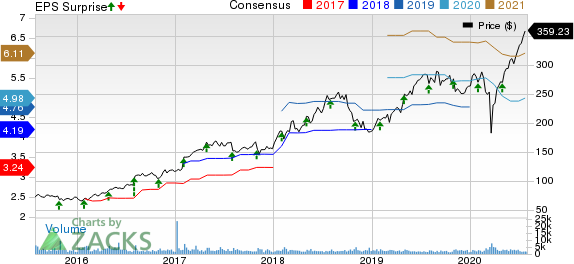

IDEXX Laboratories, Inc. Price, Consensus and EPS Surprise

IDEXX Laboratories, Inc. price-consensus-eps-surprise-chart | IDEXX Laboratories, Inc. Quote

Segmental Analysis

IDEXX derives revenues from four operating segments — CAG; Water; Livestock, Poultry and Dairy (LPD); and Other.

In the second quarter, CAG revenues rose 3.4% (up 3.8% organically) year over year to $566.1 million. The Water segment’s revenues were down 19.1% (down 16.2% organically) year over year to $28.1 million. LPD revenues fell 2.6% (up 1.7% organically) to $32.2 million. Revenues at the Other segment grew 127.8% both on reported and organic basis to $11.1 million.

Margins

Gross profit in the second quarter rose 6% to $379.3 million. Gross margin expanded 179 basis points (bps) to 59.5% despite a 1.5% fall in cost of revenues to $258.3 million.

Sales and marketing expenses fell 7.1% to $94.2 million, while general and administrative expenses moved up 0.5% to $60.3 million. Additionally, research and development expenses declined 1.9% to $31.6 million. Operating profit in the reported quarter was $193.2 million compared with $164.3 million in the year-ago period. Operating margin in the quarter expanded 382 bps to 30.3%.

Financial Position

IDEXX exited the second quarter with cash and cash equivalents of $105.3 million compared with $81.4 million at the end of the first quarter. Long-term debt for the company at the end of the second quarter was $899.6 million compared with $697.4 million at the end of the first quarter.

Cumulative net cash provided by operating activities at the end of the second quarter was $260.9 million compared with $228.4 million in the year-ago period.

2020 Outlook

Uncertainties regarding the duration and impact of the coronavirus pandemic on veterinary service providers have compelled IDEXX Laboratories to refrain from providing any guidance for the year. It did not even provide any guidance for the third quarter.

Our Take

IDEXX exited the second quarter with better-than-expected results. Solid organic revenue growth is encouraging. The top line in the quarter was driven by strong sales at the CAG business. The company witnessed sturdy gains in Diagnostics recurring revenues, supported by high single-digit organic gains in both U.S. and International markets in the quarter under review.

Further, the company’s human health business, OPTI Medical Systems’ OPTI SARS-CoV-2 RNA RT-PCR (which received the CE Mark in June and FDA’s Emergency Use Authorization in May) buoys optimism. Margin expansion looks encouraging.

However, the pandemic-led business impacts dragged down revenues along with dismal performances by three of the four reporting segments. The company’s inability to provide any financial outlook is concerning.

Zacks Rank & Other Key Picks

IDEXX has a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are West Pharmaceutical Services, Inc. WST, Thermo Fisher Scientific Inc. TMO and PerkinElmer, Inc. PKI. All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

West Pharmaceutical reported second-quarter 2020 adjusted EPS of $1.25, beating the Zacks Consensus Estimate by 37.4%. Net revenues of $527.2 million outpaced the consensus estimate by 6.9%.

Thermo Fisher reported second-quarter 2020 adjusted EPS of $3.89, beating the Zacks Consensus Estimate by 45.7%. Revenues of $6.92 billion outpaced the consensus mark by 0.1%.

PerkinElmer reported second-quarter 2020 adjusted EPS of $1.57, surpassing the Zacks Consensus Estimate by 68.8%. Revenues of $811.7 million outpaced the consensus mark by 1.3%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research