Illumina (ILMN) Beats Q1 Earnings Estimates, Withdraws View

Illumina, Inc.’s ILMN first-quarter 2020 adjusted earnings per share (EPS) of $1.64 surpassed the Zacks Consensus Estimate by 30.2%. Moreover, the bottom line improved 2.5% from the year-ago quarter.

Notably, adjusted net income excludes expenses related to the Reverse Termination Fee and Continuation Advances paid to Pacific Biosciences in the quarter.

Including one-time items, the company’s GAAP EPS was $1.17, down 25.5% year over year.

Revenues

In the quarter under review, Illumina’s revenues rose 1.5% year over year to $859 million. The top line also surpassed the Zacks Consensus Estimate by 1.2%. The year-over-year improvement can be attributed to the company’s strength in sequencing consumables, and sequencing services and other. However, this was dented by lower-than-expected sequencing system revenue.

Segment Details

Sequencing Consumable revenues totaled $553 million in the reported quarter, up 14.9% year over year. Sequencing Instrument revenues were $79 million, down 24.8% from the year-ago figure. Sequencing revenues, a subsegment of the Service & Other segment, were $128 million, up 13.3% from the year-ago quarter.

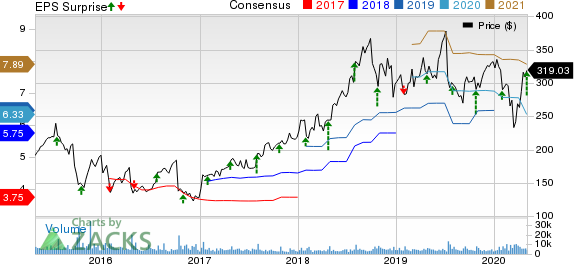

Illumina, Inc. Price, Consensus and EPS Surprise

Illumina, Inc. price-consensus-eps-surprise-chart | Illumina, Inc. Quote

In the first quarter of 2020, the NovaSeq pull-through per system witnessed year-over-year growth within the company’s expectations. Pull-through for both MiSeq and, NextSeq 500 and 550s were flat compared with the sequentially previous quarter. NextSeq shipments, except NextSeq 2000, were lower than expected due to COVID-related disruptions toward the end of the quarter. Further, MiniSeq was below its expected pull through range.

Margins

Gross margin (excluding amortization of acquired intangible assets) was 72.9% in the reported quarter, highlighting an expansion of 278 basis points (bps) year over year.

Research and development expenses declined 7.7% year over year to $156 million, and selling, general & administrative expenses rose 29.9% to $274 million. These expenses pushed up the operating cost by 13.2% to $430 million.

Adjusted operating margin came in at 22.8%, reflecting a contraction of 236 bps year over year.

Financial Update

Illumina exited the first quarter of 2020 with cash and cash equivalents plus short-term investments of $3.33 billion compared with $3.41 million at the end of 2019. The company authorized a share repurchase program to buy back $750 million of outstanding common stock and repurchased approximately $187 million of common stock in the first quarter.

At the end of the fiscal first quarter, net cash provided by operating activities was $281 million compared with $198 million a year ago.

2020 Guidance

Illumina noted that it is not in a position to estimate the extent of severity and duration of the outbreak as well as quantify the actual impact. Accordingly, it has withdrawn its financial guidance for full-year 2020 revenue and EPS guidance.

Our Take

Illumina’s first-quarter performance was mixed amid the global economic condition due to the coronavirus pandemic. The company’s top line was driven by the Sequencing Consumables subsegment, which registered robust growth in the reported quarter. However, sequential instruments put up a dull show.

A year-over-year decline in research and development costs, lower sequencing system revenues in the low throughput category, and weak performance by MiniSeq were headwinds. Decline in total array revenues is also concerning. Lower pull-through for NextSeq shipments, except NextSeq 2000, is another headwind. The company withdrawing its full year guidance is a cause of concern as well.

Meanwhile, the company’s efforts to combat the coronavirus pandemic buoy optimism. It launched the SARS-CoV-2 Data Toolkit, which is a new suite of data analysis tools and workflow functionality for researchers working on the virus using next-generation sequencing. The toolkit will make it easier to detect and identify the virus. Currently, the company is providing the toolkit free of charge to the global research community to support the efforts of combatting the pandemic. Illumina also donated sequencing systems and related consumables to support the expansion of SARS-CoV-2 sequencing capabilities and capacity in up to 10 African countries.

Zacks Rank & Key Picks

Illumina currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria reported third-quarter fiscal 2020 adjusted EPS of 2 cents, comparing favorably with the Zacks Consensus Estimate of a loss of 4 cents. Its net revenues of $64.4 million outpaced the consensus estimate by 14.6%. The company carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, surpassing the Zacks Consensus Estimate by 18.1%. Its revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly delivered first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Its first-quarter revenues of $145.3 million surpassed the consensus estimate by 6.3%. The company currently sports a Zacks Rank #1.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.