Can You Imagine How Associated Capital Group's (NYSE:AC) Shareholders Feel About The 34% Share Price Increase?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Low-cost index funds make it easy to achieve average market returns. But in any diversified portfolio of stocks, you'll see some that fall short of the average. Unfortunately for shareholders, while the Associated Capital Group, Inc. (NYSE:AC) share price is up 34% in the last three years, that falls short of the market return. Looking at more recent returns, the stock is up 9.5% in a year.

Check out our latest analysis for Associated Capital Group

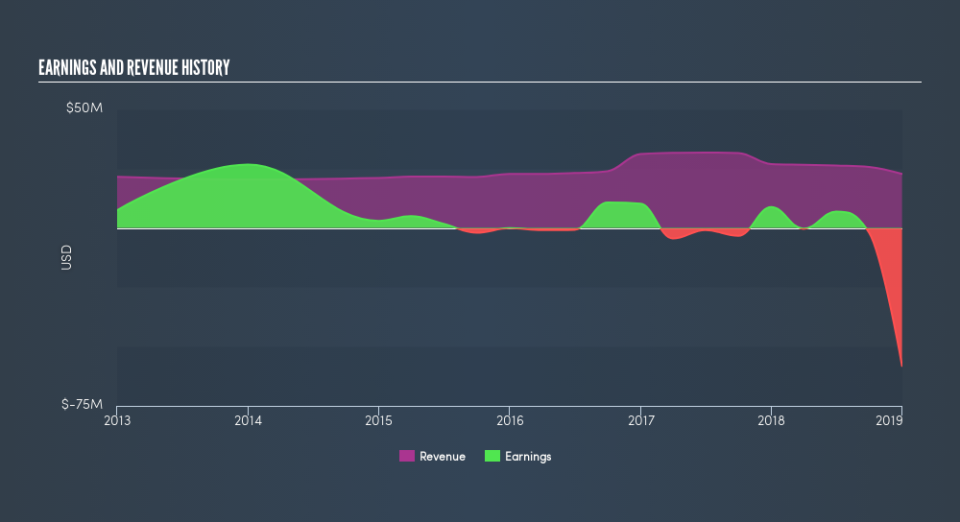

Because Associated Capital Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Associated Capital Group saw its revenue grow at 2.2% per year. That's not a very high growth rate considering it doesn't make profits. It's probably fair to say that the modest growth is reflected in the modest share price gain of 10% per year. It seems likely that we'll have to zoom in on the data more closely to understand if there is an opportunity here.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Associated Capital Group, it has a TSR of 37% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Associated Capital Group shareholders have gained 10% (in total) over the last year. That's including the dividend. But the three year TSR of 11% per year is even better. You could get a better understanding of Associated Capital Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.