Can You Imagine How Chuffed United Rentals’s (NYSE:URI) Shareholders Feel About Its 103% Share Price Gain?

The most you can lose on any stock (assuming you don’t use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. To wit, the United Rentals, Inc. (NYSE:URI) share price has flown 103% in the last three years. Most would be happy with that. It’s also good to see the share price up 15% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 6.4% in 90 days).

See our latest analysis for United Rentals

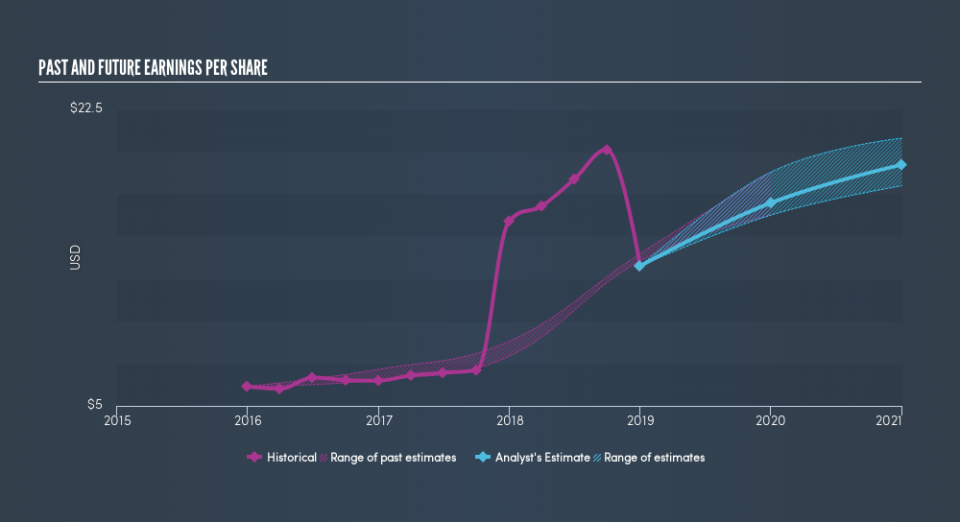

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

United Rentals was able to grow its EPS at 29% per year over three years, sending the share price higher. We note that the 27% yearly (average) share price gain isn’t too far from the EPS growth rate. Coincidence? Probably not. This suggests that sentiment and expectations have not changed drastically. Au contraire, the share price change has arguably mimicked the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in United Rentals had a tough year, with a total loss of 32%, against a market gain of about 2.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn’t be so upset, since they would have made 6.2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares – and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.