Imagine Holding Fox Factory Holding (NASDAQ:FOXF) Shares While The Price Zoomed 735% Higher

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Fox Factory Holding Corp. (NASDAQ:FOXF) share price is up a whopping 735% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 19% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 8.8% in 90 days).

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Fox Factory Holding

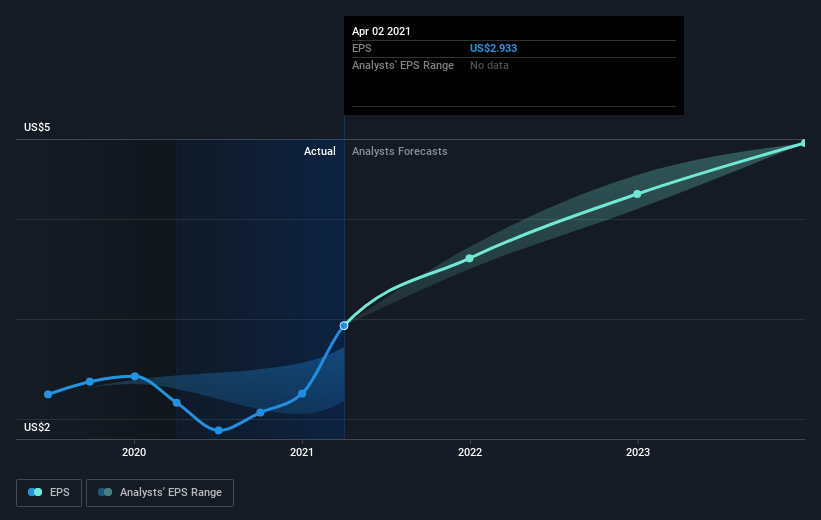

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Fox Factory Holding managed to grow its earnings per share at 32% a year. This EPS growth is lower than the 53% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 51.25.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Fox Factory Holding's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Fox Factory Holding shareholders have received a total shareholder return of 70% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 53% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Fox Factory Holding , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.