Can You Imagine How Jubilant SS&C Technologies Holdings' (NASDAQ:SSNC) Shareholders Feel About Its 119% Share Price Gain?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) share price has soared 119% in the last half decade. Most would be very happy with that. We note the stock price is up 3.8% in the last seven days.

See our latest analysis for SS&C Technologies Holdings

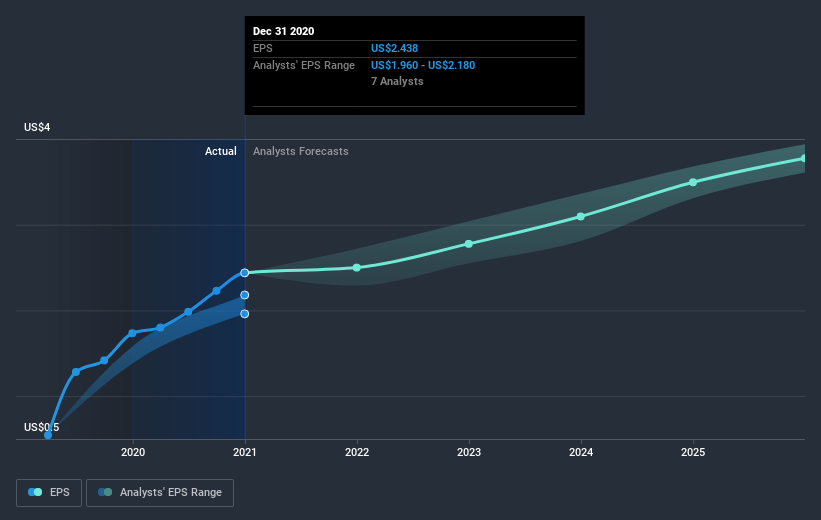

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, SS&C Technologies Holdings managed to grow its earnings per share at 60% a year. This EPS growth is higher than the 17% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of SS&C Technologies Holdings, it has a TSR of 128% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

SS&C Technologies Holdings shareholders gained a total return of 53% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 18% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for SS&C Technologies Holdings you should be aware of.

SS&C Technologies Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.