Can You Imagine How Jubilant Where Food Comes From's (NASDAQ:WFCF) Shareholders Feel About Its 146% Share Price Gain?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Where Food Comes From, Inc. (NASDAQ:WFCF) share price had more than doubled in just one year - up 146%. It's also good to see the share price up 12% over the last quarter. It is also impressive that the stock is up 99% over three years, adding to the sense that it is a real winner.

See our latest analysis for Where Food Comes From

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

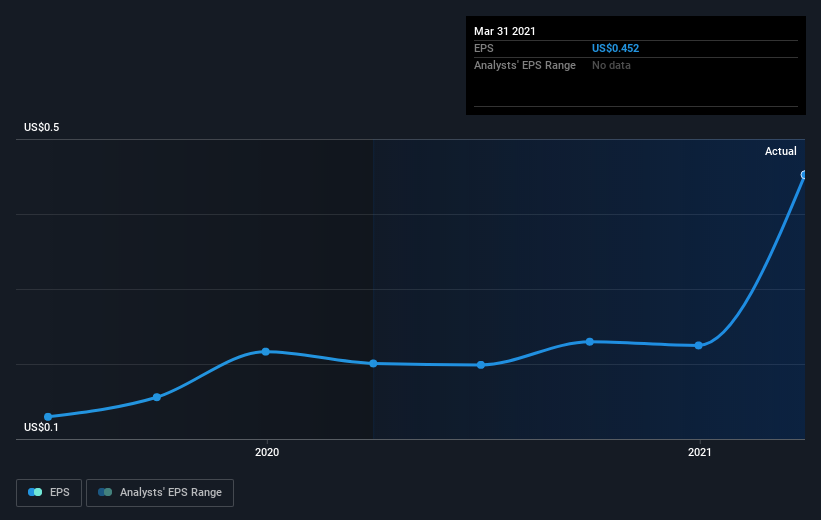

During the last year Where Food Comes From grew its earnings per share (EPS) by 125%. This EPS growth is reasonably close to the 146% increase in the share price. This makes us think the market hasn't really changed its sentiment around the company, in the last year. It looks like the share price is responding to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Where Food Comes From's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Where Food Comes From's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Where Food Comes From hasn't been paying dividends, but its TSR of 149% exceeds its share price return of 146%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Where Food Comes From has rewarded shareholders with a total shareholder return of 149% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Where Food Comes From better, we need to consider many other factors. Take risks, for example - Where Food Comes From has 2 warning signs we think you should be aware of.

But note: Where Food Comes From may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.