Imagine Owning Axalta Coating Systems (NYSE:AXTA) And Wondering If The 17% Share Price Slide Is Justified

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Axalta Coating Systems Ltd. (NYSE:AXTA) shareholders over the last year, as the share price declined 17%. That's well bellow the market return of 8.7%. At least the damage isn't so bad if you look at the last three years, since the stock is down 13% in that time. It's down 2.1% in the last seven days.

Check out our latest analysis for Axalta Coating Systems

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Axalta Coating Systems saw its earnings per share increase strongly. The rate of growth may not be sustainable, but it is still really positive. As a result, we're surprised to see the weak share price. Some different data might shed some more light on the situation.

Axalta Coating Systems's revenue is actually up 7.3% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

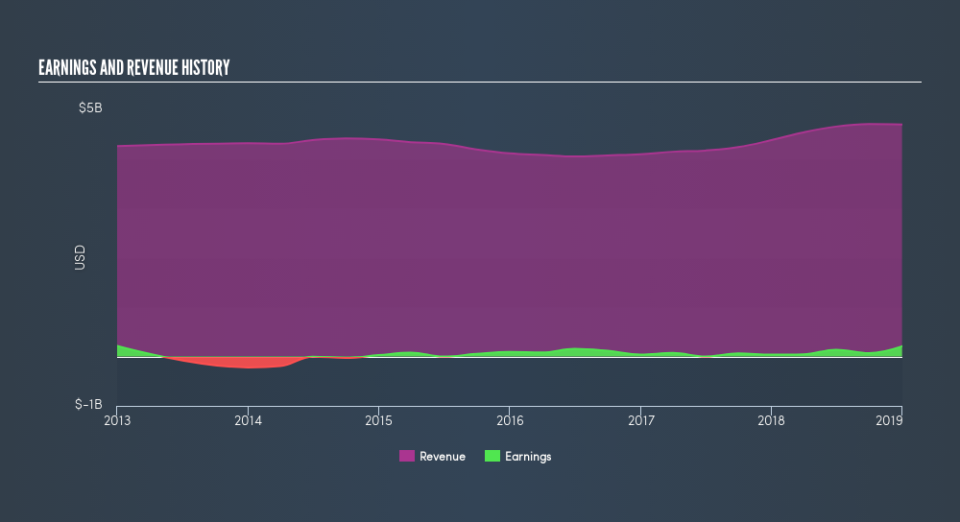

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Axalta Coating Systems in this interactive graph of future profit estimates.

A Different Perspective

Axalta Coating Systems shareholders are down 17% for the year, but the broader market is up 8.7%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 4.6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. If you would like to research Axalta Coating Systems in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.