Imagine Owning GOME Retail Holdings (HKG:493) And Wondering If The 32% Share Price Slide Is Justified

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in GOME Retail Holdings Limited (HKG:493), since the last five years saw the share price fall 32%. It's up 2.7% in the last seven days.

Check out our latest analysis for GOME Retail Holdings

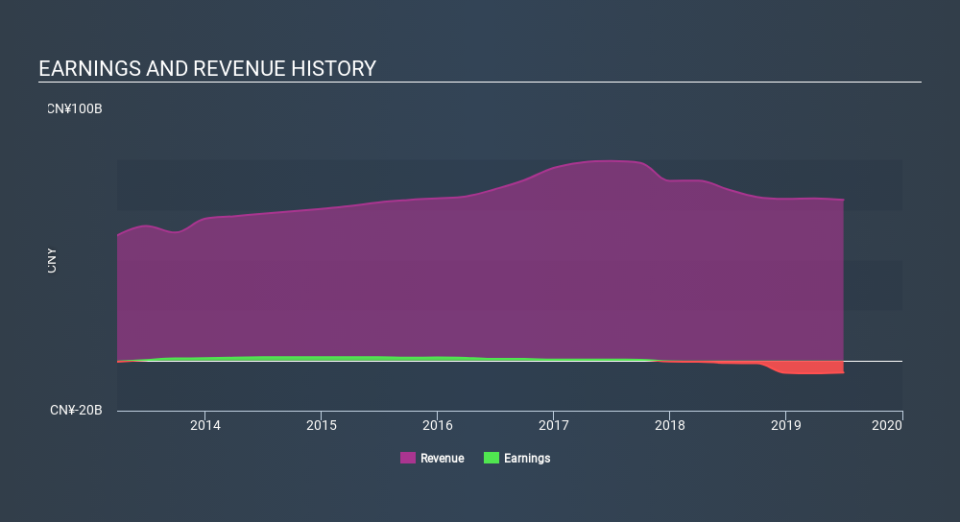

Given that GOME Retail Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, GOME Retail Holdings saw its revenue increase by 2.5% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 7.4% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on GOME Retail Holdings

What about the Total Shareholder Return (TSR)?

We've already covered GOME Retail Holdings's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. GOME Retail Holdings's TSR of was a loss of 28% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that GOME Retail Holdings shareholders have received a total shareholder return of 12% over the last year. Notably the five-year annualised TSR loss of 6.4% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand GOME Retail Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for GOME Retail Holdings you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.