Imagine Owning iFabric (TSE:IFA) While The Price Tanked 66%

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the iFabric Corp. (TSE:IFA) share price dropped 66% in the last half decade. That’s an unpleasant experience for long term holders. And we doubt long term believers are the only worried holders, since the stock price has declined 54% over the last twelve months. The falls have accelerated recently, with the share price down 20% in the last three months.

View our latest analysis for iFabric

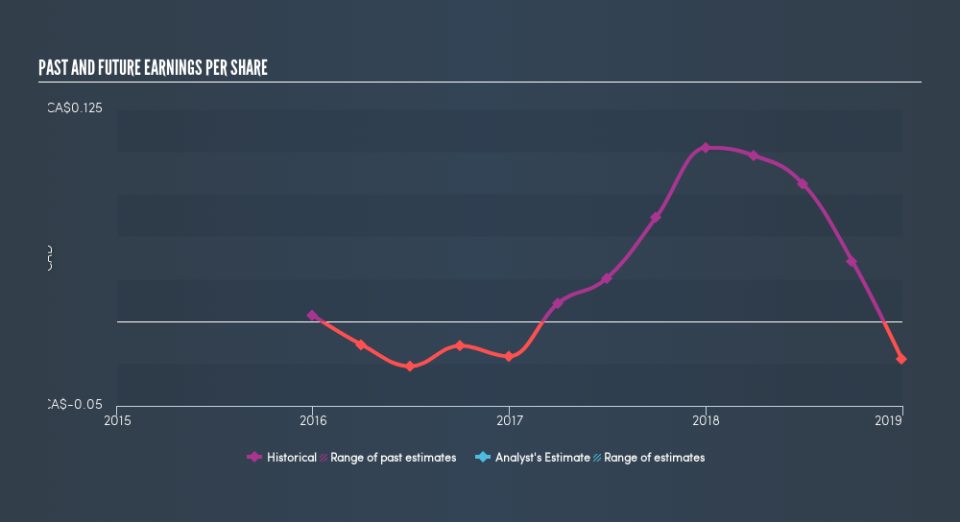

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

In the last half decade iFabric saw its share price fall as its EPS declined below zero. At present it’s hard to make valid comparisons between EPS and the share price. However, we can say we’d expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

iFabric shareholders are down 54% for the year, but the market itself is up 3.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the annualised loss of 19% over the last half decade. We realise that Buffett has said investors should ‘buy when there is blood on the streets’, but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on iFabric it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.