Imagine Owning Range Resources (NYSE:RRC) And Trying To Stomach The 88% Share Price Drop

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held Range Resources Corporation (NYSE:RRC) for five years would be nursing their metaphorical wounds since the share price dropped 88% in that time. And it's not just long term holders hurting, because the stock is down 24% in the last year. The last week also saw the share price slip down another 6.1%.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Range Resources

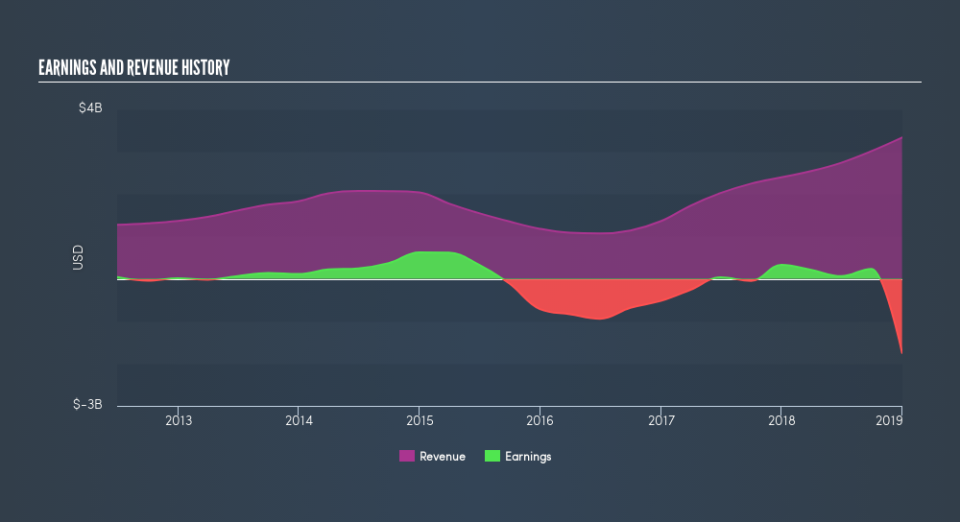

Because Range Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Range Resources grew its revenue at 11% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 35% per year in the last five years. The market can be a harsh master when your company is losing money and revenue growth disappoints.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 11% in the last year, Range Resources shareholders lost 24% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 34% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Range Resources by clicking this link.

Range Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.