Imagine Owning Vantage International (Holdings) (HKG:15) While The Price Tanked 59%

Investing in stocks inevitably means buying into some companies that perform poorly. Long term Vantage International (Holdings) Limited (HKG:15) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 59% in that time. And more recent buyers are having a tough time too, with a drop of 44% in the last year. Shareholders have had an even rougher run lately, with the share price down 29% in the last 90 days. Of course, this share price action may well have been influenced by the 16% decline in the broader market, throughout the period.

Check out our latest analysis for Vantage International (Holdings)

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Vantage International (Holdings) actually managed to grow EPS by 4.2% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It looks to us like the market was probably too optimistic around growth three years ago. But it's possible a look at other metrics will be enlightening.

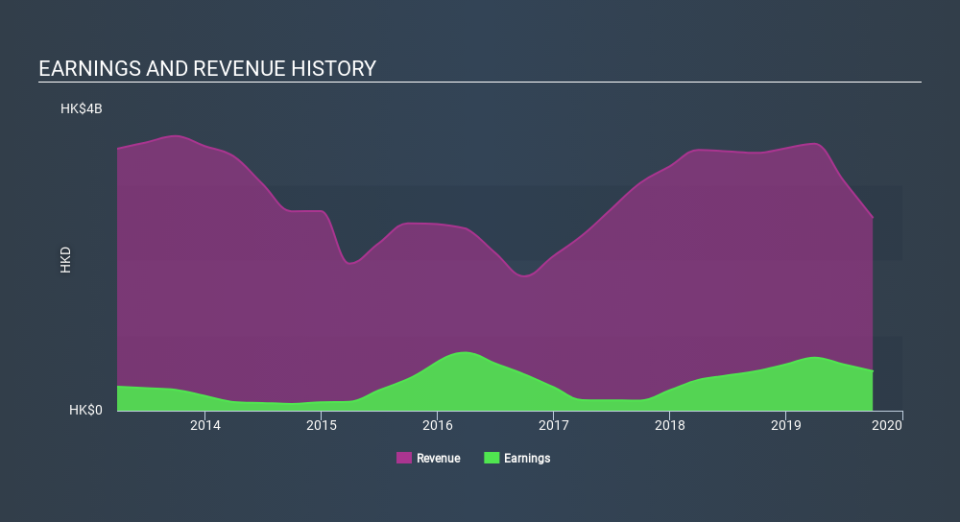

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Vantage International (Holdings) has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Vantage International (Holdings) the TSR over the last 3 years was -56%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Vantage International (Holdings) shareholders are down 43% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 17%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Vantage International (Holdings) you should be aware of.

Of course Vantage International (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.