Imagine Owning Vita Group (ASX:VTG) And Trying To Stomach The 80% Share Price Drop

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Vita Group Limited (ASX:VTG); the share price is down a whopping 80% in the last three years. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 56% in a year. More recently, the share price has dropped a further 57% in a month. But this could be related to poor market conditions -- stocks are down 30% in the same time.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Vita Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

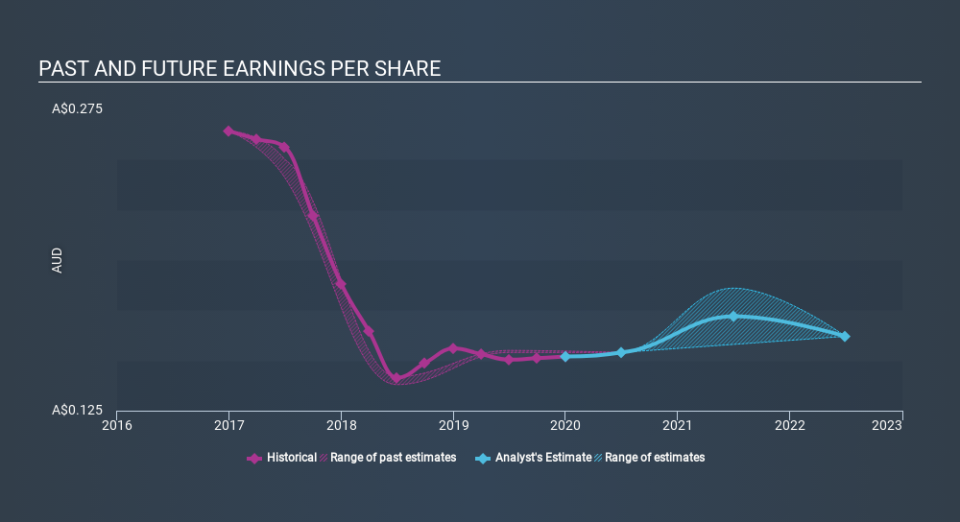

Vita Group saw its EPS decline at a compound rate of 17% per year, over the last three years. The share price decline of 42% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 4.21.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Vita Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Vita Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Vita Group's TSR, which was a 77% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 17% in the twelve months, Vita Group shareholders did even worse, losing 55%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Vita Group better, we need to consider many other factors. Even so, be aware that Vita Group is showing 3 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.