Imagine Owning Zicom Group (ASX:ZGL) While The Price Tanked 52%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Zicom Group Limited (ASX:ZGL) shareholders for doubting their decision to hold, with the stock down 52% over a half decade.

Check out our latest analysis for Zicom Group

Because Zicom Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

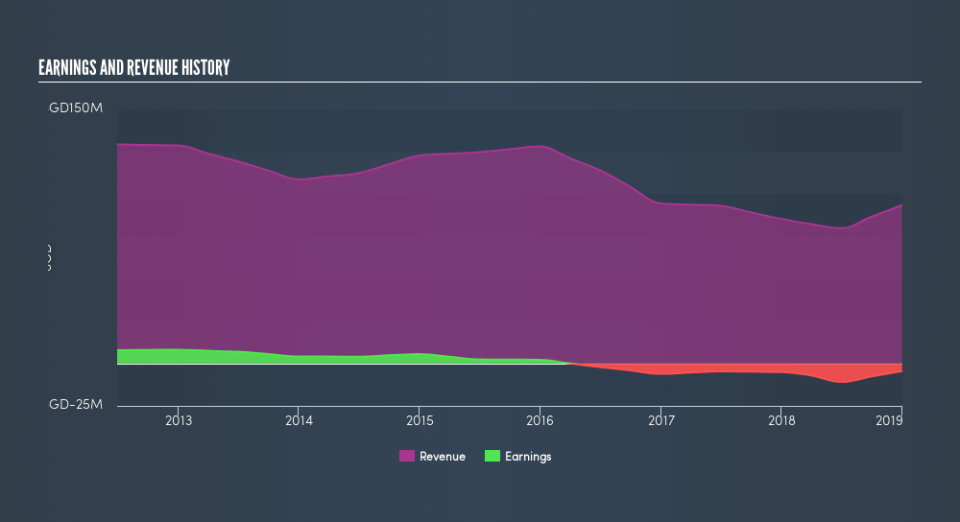

Over half a decade Zicom Group reduced its trailing twelve month revenue by 7.8% for each year. While far from catastrophic that is not good. The share price decline of 14% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Zicom Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, Zicom Group generated a TSR of -48%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Investors in Zicom Group had a tough year, with a total loss of 8.7%, against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before spending more time on Zicom Group it might be wise to click here to see if insiders have been buying or selling shares.

We will like Zicom Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.