Improving Demand & Cost Cuts Fuel Caterpillar's (CAT) Growth

On May 9, we issued an updated research report on the mining and construction equipment behemoth, Caterpillar Inc. CAT. Backed by its cost-saving efforts and its end markets — construction, mining and energy —showing positive momentum lately, the company seems poised for an improved 2018.

Stellar Q1 Performance

Caterpillar delivered another upbeat quarter, with adjusted earnings per share soaring 120% in the first quarter of 2018, while revenues surged 32%, driven by higher sales volume on the back of improved end-user demand across all regions and most end markets. This marked the company’s fifth consecutive quarter of both top and bottom-line growth, after a string of dismal performances for four years.

Retail Sales on Growth Path

Caterpillar reported a rise of 26% in global retail sales for the three months ended March 2018, with improvement noted across all regions. Within Machines, Resource Industries and Construction Industries reported positive gains for the ninth and 14th consecutive months, respectively. Energy & Transportation’s retail sales improved for the seventh consecutive month. The company’s overall retail sales growth graph has remained in the positive territory since March 2017. In March, the company witnessed a 1% rise in machine retail sales, which put an end to its unprecedented 51-month long stretch of declining sales. Retail sales averaged 10.3% in 2017 and 31% in the first three months of 2018.

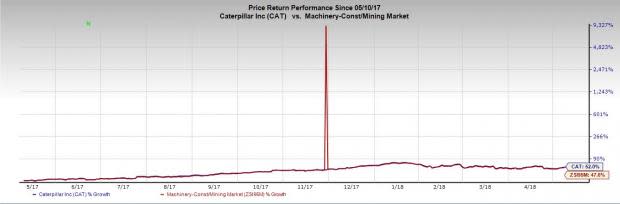

Given its back-to-back upbeat performances, the company has outperformed the industry in the past year. Shares have surged 52% while the industry registered growth of 48%.

2018 View Upbeat

The company did not provide any revenue guidance but stated that it anticipates an increase in sales volume, with volume increase forecasted across the three primary segments. Strong sales momentum resulting from strong order rates, lean dealer inventories and an increasing backlog bode well for an improved 2018 performance. Backed by these factors, along with positive economic indicators globally, the company now anticipates adjusted earnings per share between $10.25 and $11.25 for fiscal 2018. The company had earlier provided adjusted earnings per share guidance of $8.25-$9.25 for the fiscal. The mid-point of $10.80 reflects year-over-year rise of 56%.

The Zacks Consensus Estimate for 2018 for revenues and earnings is at $52.3 billion and $10.39, respectively. Estimates for Caterpillar have moved up in the past 30 days, reflecting the optimistic outlook of analysts. The earnings estimates have gone up 13% for fiscal 2018 and 12% for fiscal 2019.

The stock has an estimated long-term earnings growth rate of 13.2%.

Segments Poised for Growth

Caterpillar expects broad-based growth in Construction Industries in 2018. In North America, continued improvement in residential and non-residential construction as well as revival in infrastructure demand after many years of underinvestment will drive revenues. Infrastructure development in China will also be a catalyst. EAME is anticipated to continue to grow amid high business confidence and stability in oil-producing countries. Further, Latin America will continue on its growth path.

Global economic momentum and increasing commodity prices is restoring miners’ profitability and resuming capital spending. This bodes well for the Resource Industries segment.

Coming to the Energy & Transportation segment, sales into Oil and Gas applications are expected to increase in 2018, aided by reciprocating engines for gas compression and well servicing activity in North America. The current turbines backlog remains robust in support of the midstream pipeline business. The company projects an increase in Transportation primarily from recent acquisitions in rail services. Rail traffic in North America has improved, with number of idled locomotives and railcars going down. Power Generation sales are forecast to improve after a multi-year downturn. Sales into Industrial applications are anticipated to rise in 2018 driven by projected demand in EAME.

Restructuring, Expanded Offerings to Aid Performance

In September 2015, Caterpillar set out with significant restructuring and cost reduction initiative, with actions expected through 2018. Once fully implemented, the plan would lower annual operating costs by about $1.5 billion. This includes the consolidation or closure of more than 30 facilities and reduction of workforce by more than 16,000.

Caterpillar continues to focus on customers and on the future by continuing to invest in digital capabilities, connecting assets and jobsites along with developing the next generation of more productive and efficient products. The company is readying factories and suppliers to meet increased demand, while remaining focused on developing a more competitive and flexible cost structure. This should enable it to respond quickly if economic fundamentals change.

The company is in the early stages of implementing its strategy for profitable growth. During 2018, the company will continue to make additional investments in expanded offerings and services important for long-term success. It will use Operating & Execution Model to divert resources to areas that represent the greatest opportunity for return on investments.

Zacks Rank & Other Stocks to Consider

Caterpillar currently sports a Zacks Rank #1 (Strong Buy).

Other top-ranked companies in the industrial product space include Terex Corporation TEX, H&E Equipment Services, Inc. HEES and IDEX Corporation IEX. Terex flaunts a Zacks Rank #1 while H&E Equipment Services and IDEX carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Terex has expected long-term growth of 20%. Over the past year, its shares have gone up 23%.

H&E Equipment Services has expected long-term growth of 17.4%. It shares have soared 71% over the past year.

IDEX Corporation has an expected long-term growth of 11%. Its shares have gained 31% in the past year.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research