This Is Increasingly Looking Like An Emerging Market Bond Meltdown

The massive sell-off across emerging markets continues in force today.

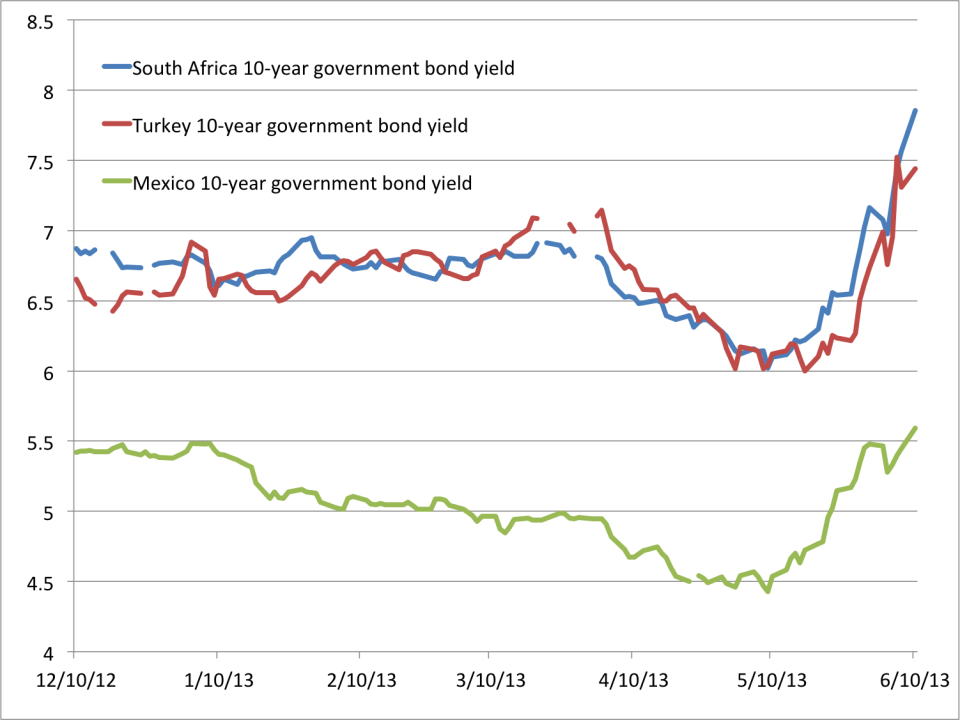

One of the big themes in global markets over the past month has been the rise in U.S. Treasury yields and the attendant strength in the U.S. dollar. This has caused a big unwind in emerging markets, as EM currencies depreciate against the dollar and higher-yielding EM government bonds look less attractive relative to Treasuries.

The 10-year Turkish government bond yield rose 22 basis points today to 4.22%. In South Africa, 10-year yields rose 28 basis points to 7.84%. And in Mexico, 10-year government bond yields widened 5 basis points to 3.33%.

Business Insider/Matthew Boesler, data from Bloomberg

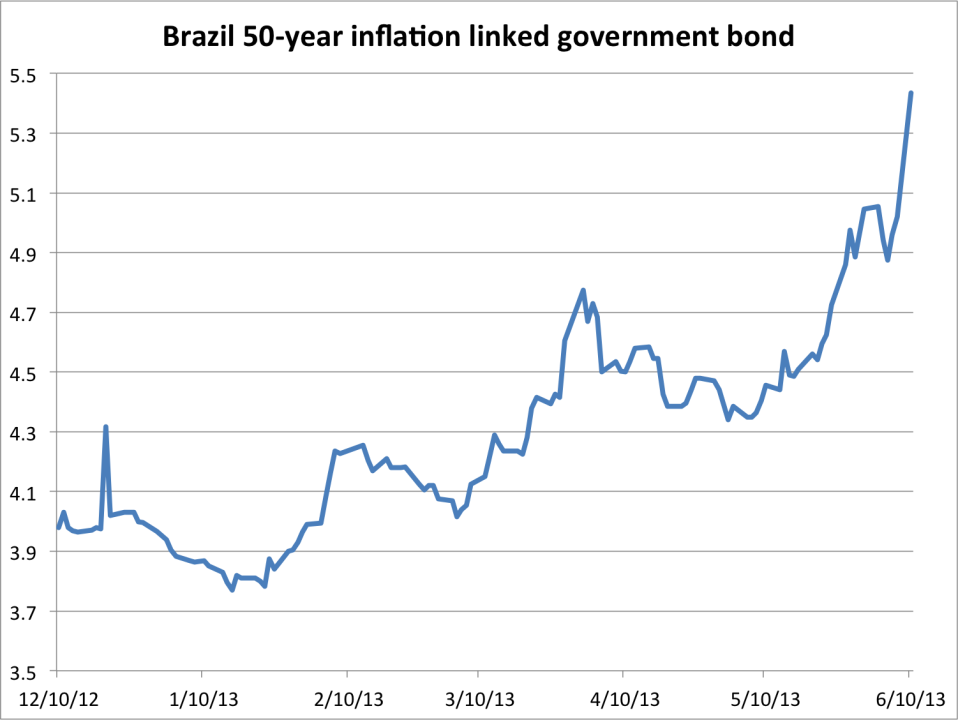

And if you're looking for a really ugly chart, inflation linkers in Brazil are getting absolutely massacred. (Inflation linkers are just bonds linked to inflation, like TIPS in the U.S.)

Business Insider/Matthew Boesler, data from Bloomberg

More From Business Insider