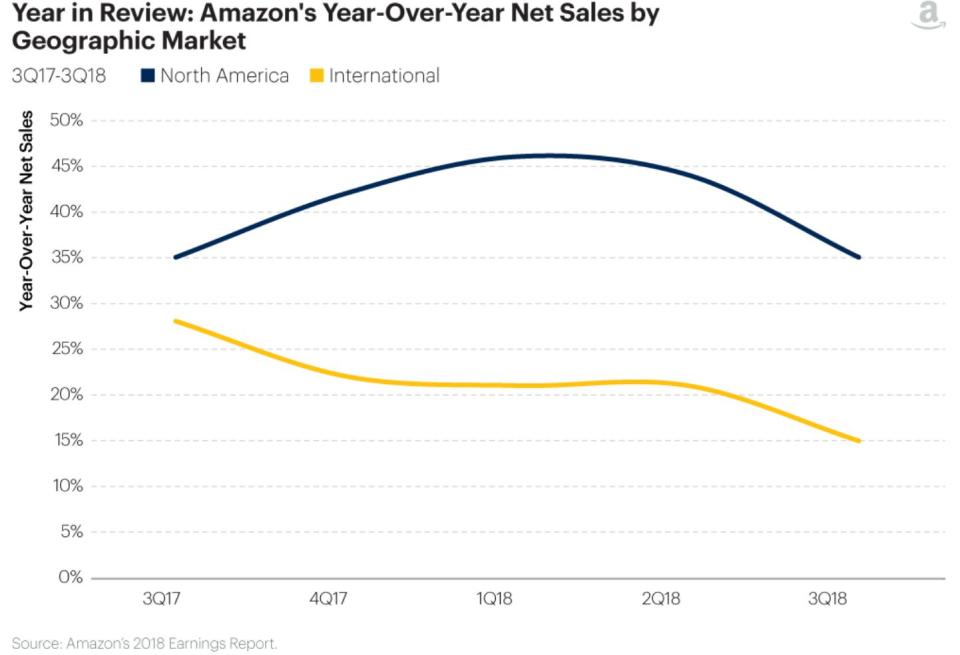

One of Amazon’s biggest risks is outside the U.S.

As Amazon reported in-line earnings results on Thursday, the e-commerce giant is also scrambling to comply with new e-commerce regulations in India, effective Feb 1.

Some products began to disappear from Amazon India, including Echo speakers, Presto home cleaning goods, and other AmazonBasics products. The new rules prohibit online retailers from selling items through vendors in which they have an equity stake, and also from having sellers sell exclusively on their platforms. This could be a big disruption for Amazon, which has been pushing its private-label products on its everything store.

Echo Dot, the best-selling item on Amazon this past holiday season, returned to the site through other sellers within 24 hours. But now customers need to wait until March 7, when it will be in stock.

Amazon owns nearly half of the units sold on its platform. When asked about the impact of the new regulation on its business Thursday, Amazon CFO Brian Olsavsky said the company is still evaluating the situation in India. Taking that into account, Amazon has offered first quarter 2019 revenue guidance of $56 billion-$60 billion, the mid-point of which is 5% below Wall Street expectations.

“There's much uncertainty as to what the impact of the government role changes is going to have on the e-commerce sector there,” Olsavsky told analysts on Thursday. “Our main issue and our main concern is trying to minimize the impact to our customers and sellers in India. We've built our business around price selection and convenience. We don't think the changes help in those dimensions for both the customers in India and also the sellers.”

In its 10-K filings on Thursday, the Seattle-based company also warned “substantial uncertainties” regarding the interpretation laws and regulations in India and China, and “it is possible that these governments will ultimately take a view contrary to ours.”

India is a major growth market for Amazon

Olsavsky said the company is still committed to the India market and hopeful about the long-term prospects. The e-commerce market in India has more than tripled since 2015, powered by smartphone penetration and favorable demographics with a median age of 28.

Last year, Amazon lost an expensive bidding war for Flipkart. Walmart spent $16 billion on the domestic online retailer. After losing the bid for Flipkart, Amazon committed to spend $5 billion in India, where it sees the fastest Prime membership growth rate.

Under regulatory uncertainties, analysts caution that expansion could cool down a bit. “There is clearly more uncertainty around India. Without clarity from the government, it will be hard to see AMZN pushing ahead aggressively,” Macquarie Research analysts wrote on Friday.

Krystal Hu covers technology and trade for Yahoo Finance. Follow her on Twitter.

Read more:

What Tim Cook left out about China in Apple's revenue guidance