Inflation is Cooling: 3 Stocks to Buy for Disinflation

Recent data released from the BLS has indicated that inflation is finally beginning to slow. This is some of the most bullish news the market has received in recent months and has even prompted the Federal Reserve to signal a slowdown in the pace of interest rate hikes. For many investors this is a green light to start deploying capital again.

Slowing inflation may mean a slowing economy though, so how should investors pick stocks going forward? A recent report from Jeffries, which I came across on Twitter, identified a list of stocks that are inversely correlated to inflation. These are stocks which have performed well in past periods of disinflation.

To further filter the search, I picked stocks which also have upward trending earnings revisions indicated by Zacks Rank. This has identified three stocks which have potential for strong returns going forward.

Disinflation

Disinflation is a decreasing rate of inflation. This means that the price increases experienced in goods are happening at a decreasing pace. This should not be confused with deflation, which is outright negative inflation, when the price of goods, services and wages reverse lower.

Following periods of high inflation, disinflation is the result of normalizing inflationary pressures. To be clear, the economy is in the early stages of disinflation.

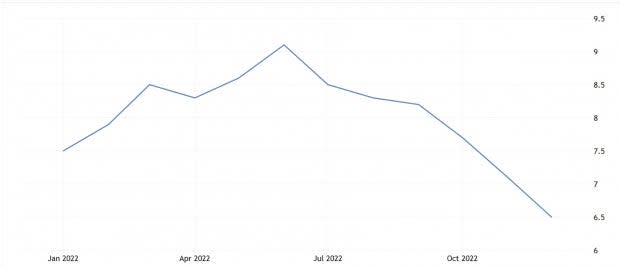

Inflation is generally terrible for the stock market. It erodes the value of dividends and earnings, increases the costs of goods and services, decreases margins, and leads to a generally uncertain economic environment. Although there is still uncertainty around inflation expectations, things are certainly moving in the right direction.

Image Source: US Bureau of Labor Statistics

McDonald’s Corporation

McDonald’s MCD, well known for its burgers and happy meals may be a stock that performs well during a period of disinflation. According to the Jefferies report, MCD stock has a -0.28 correlation to the ten-year inflation expectations. This means that as the expected rate of inflation decreases, these stocks have historically had a positive response to that change.

Additionally, McDonald’s currently sports a Zacks Rank #2 (Buy) reflecting the upward revisions analysts have been assigning to MCD’s earnings. Over the last 90 days Q4 earnings have been revised from $2.37 per share to $2.45 per share. Over the same period FY22 earnings have been upgraded from $9.79 to $9.93 per share.

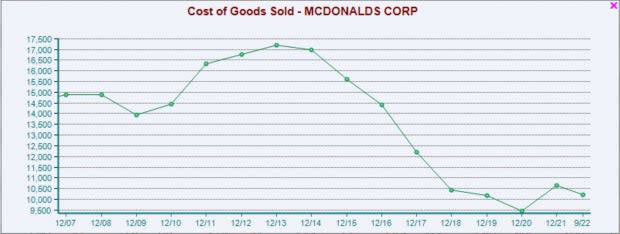

Q4 sales are currently expected to post a YoY decrease of -5% to $5.7 billion, but earnings are projected to grow 9.9%. It’s quite impressive to have your sales shrink and profits grow. Below we can see the continued decrease in the Cost of Goods Sold.

McDonald’s is also a member of the Dividend Aristocrats. A collection of stocks that have raised their dividend for over 25 years. MCD’s dividend currently yields 2.3%.

Image Source: Zacks Investment Research

The Hershey Company

The Hershey Company HSY, a brand we are all familiar with, has done exceptionally well during the period of high inflation, and may also perform well during disinflation. HSY has a historical correlation of -0.28 to ten-year inflation expectations.

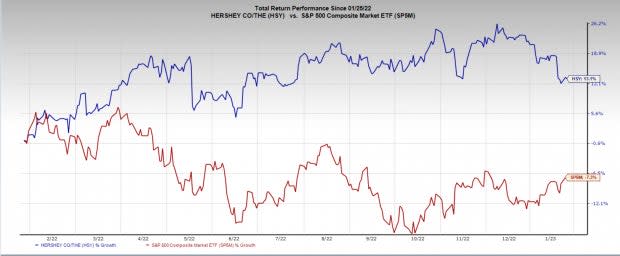

Over the last year HSY has outperformed the broad index by a 20% margin, which is extremely impressive considering how challenging the last year was. Hershey has been a strong performing stock for most of its history, outperforming the index over the past 5-, 10- and 20-year period.

Image Source: Zacks Investment Research

Hershey was likely able to succeed during the recent period of inflation because of the strong pricing power of its products. While the cost of ingredients and wages increased, Hershey was able to make up for those increases by increasing the price of its products more than the rate of inflation. This means its margins were able to continue to expand.

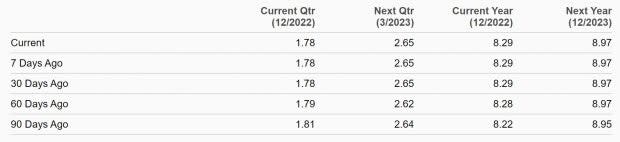

Hershey currently boasts a Zacks Rank #2 (Buy), indicating positive earnings revisions. Although the current quarter estimates have been revised lower over the last 90 days, all other timeframes have revisions trending higher.

HSY has strong sales and earnings growth expectations for Q4 projecting a 10.8% increase in sales, and 5.3% growth in earnings. The outlook for FY22 is also robust, with projections for a 15.3% increase in sales and a 15.5% rise in earnings.

Image Source: Zacks Investment Research

Although not a Dividend Aristocrat, HSY has a strong track record of increasing dividends. HSY currently yields 1.9% through its dividend payment.

Campbell Soup

It seems classic American brands have a history of strong performance during periods of disinflation. Campbell Soup CPB has a correlation of -0.28 to ten-year inflation expectations. Even more encouraging is that CPB currently has a Zacks Rank #1 (Strong Buy), and its Zacks Sector Rank is in the top 13%.

Earnings estimates for the current quarter have remained consistent over the last 90 days, while current year, and next year earnings have each had eight analysts revise earnings higher over the last 60 days. These revisions seem to align with the disinflation timeframe.

CPB Q2 FY23 sales are expected to come in 10.2% higher YoY to $2.4 billion. Earnings are projected to be strong too with 5.8% growth pushing earnings to $0.73 per share. CPB may not be a high-growth stock, but it is a reliable and steady investment, with a generous dividend yield of 2.87%.

Image Source: Zacks Investment Research

Conclusion

The shift from inflation to disinflation is a positive development for the stock market. A sustained decline in the rate of inflation provides greater certainty for investors. Additionally, a gradual decrease in inflation, as opposed to a sudden sharp decline, is less disruptive for the economy and markets, and more likely to be perceived positively by investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Hershey Company The (HSY) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report