As Inflationary Pressures Remain, Gold Nears 5-Month High

This article was originally published on ETFTrends.com.

Gold could finally be on the precipice of breaking out of its sideways trend as inflationary pressures are pushing prices close to a five-month high.

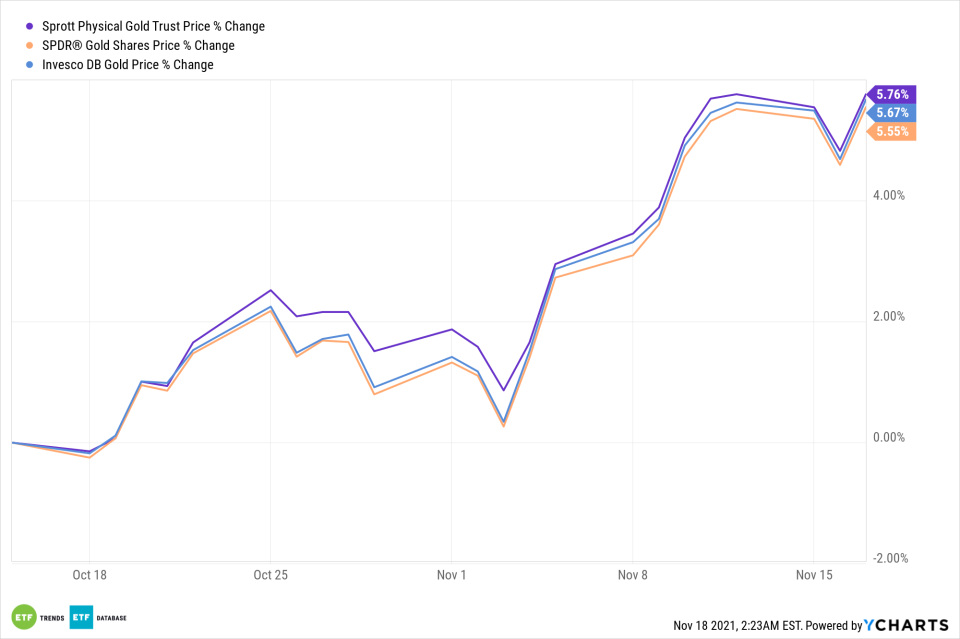

Exchange-traded fund (ETF) investors have been rejoicing the past month as prices start to tick higher amid rising consumer prices, as reflected in a decade-high consumer price index (CPI) during the month of October. Gold-based ETFs below have been rising close to 6% the last four weeks.

Getting exposure to gold can be had with ETFs like the Sprott Physical Gold Trust (PHYS). PHYS gives investors easy access to gold exposure with the option to convert their ownership shares to physical gold.

Gold was caught in a seemingly perpetual holding pattern that saw prices yo-yo up and down the $1,800 level. The recent rally could continue to fuel gold prices towards their previous year-high of over $1,900 as inflation fears persist in the capital markets.

Additionally, the U.S. Federal Reserve will be tapering its stimulus measures to shore up the economy amid the pandemic. This leads investors to believe that rates will also rise at some point, which should benefit the U.S. dollar.

"Rate hikes remain a potential risk for gold, and only a clear break above $1,875 may drive further gains," Carlo Alberto De Casa, external analyst at Kinesis Money said.

However, a recent uptick in Covid-19 cases could tamp down the economic recovery in addition to inflation. Speaking about inflation, stagflation (an economic condition marked by slow growth and rising rates) could also provide more headwinds for investors.

"The underlying support for gold and silver remains the inflationary pressures we continue to see in the market," said David Meger, director of metals trading at High Ridge Futures, in a Reuters report.

Gold Price in US Dollars data by YCharts

Gold Rising Amid a Crypto Pullback

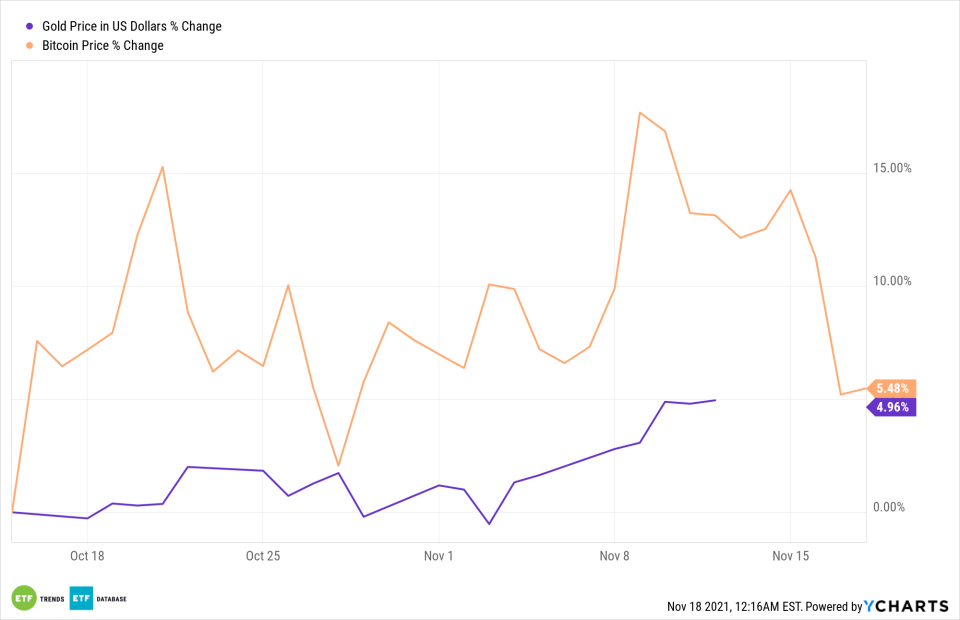

Leading cryptocurrency Bitcoin and other alternative coins have been pulling back as of late, while gold continues to rise. Bitcoin rocketed to a new high close to $70,000 before falling the past week, but gold has been steadily climbing.

The disparity in the past month between gold and Bitcoin (lately viewed as a supplemental hedge against inflation) has been narrowing. Nonetheless, Bitcoin is still up year-to-date over 100% versus gold's slight 1.5% drop in 2021.

Gold Price in US Dollars data by YCharts

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM