Infosys (INFY) to Boost Ireland Footprint With 250 New Jobs

Infosys’ INFY business process management arm, Infosys BPM, recently announced that it will create 250 jobs in Ireland by opening a new delivery center in the Waterford area of the country. This testifies the India-based IT services company’s focus on increasing employment across various regions and expanding skills to expedite digital transformation.

Enhances Footprint in Ireland

Infosys started its Ireland operation by opening an office in Dublin in 2014. Since then, it has expanded operations in the country through its offices in Waterford, Wexford, Clonmel and Craigavon. The expansion of the operations in Waterford will enable the company to strengthen and expand business relationships with clients from the telecommunications, manufacturing, social media, healthcare, edu-tech and fin-tech sectors.

Infosys is gaining strong momentum worldwide with its quality efforts in digital transformation and boosting employment. The Top Employers Institute deemed INFY as the Global Top Employer among all of North America, APAC and Europe.

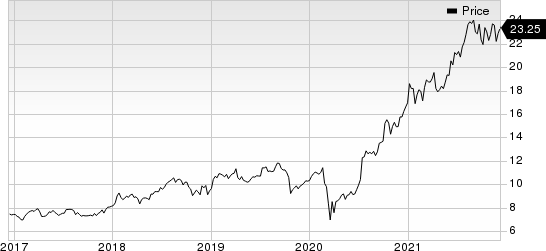

Infosys Limited Price

Infosys Limited price | Infosys Limited Quote

The news of workforce expansion in Ireland follows Infosys’ commitment to hire 1,000 workers in the U.K. by 2024, which was announced in May 2021.

Infosys is focused on expanding its footprint across major operational regions. The company opened several technology and innovation centers in Europe to develop leading-edge digital capabilities and provide training to IT talent to support the digital transformation of European businesses. INFY’s training infrastructure created skilled tech talent and prepared European workers to take on more digital and operational jobs.

Zacks Rank & Key Picks

Currently, Infosys carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector include Google-parent Alphabet GOOGL, Diodes DIOD and PTC Inc. PTC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alphabet’s fourth-quarter 2021 earnings has been revised downward by a penny to $26.71 per share over the past 30 days. For 2021, earnings estimates have moved upward by 43 cents to $108.29 per share in the last 30 days.

Alphabet’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 41.5%. The GOOGL stock has rallied 68.5% year to date (YTD).

The Zacks Consensus Estimate for Diodes’ fourth-quarter 2021 earnings has been revised upward by 23.9% to $1.45 per share over the past 60 days. For 2021, earnings estimates have moved upward by 6.3% to $5.06 per share over the past 60 days.

Diodes’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 10%. Shares of DIOD have rallied 52.4% YTD.

The consensus mark for PTC’s first-quarter fiscal 2022 earnings has been revised upward to $1.00 per share from 89 cents 60 days ago. For fiscal 2022, earnings estimates have been revised upward by 26 cents to $4.19 per share in the last 60 days.

PTC’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missed the same on one occasion, the average surprise being 47.8%. Shares of PTC have increased 0.3% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Infosys Limited (INFY) : Free Stock Analysis Report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.