Ingevity Provides Update in Response to Coronavirus Outbreak

Ingevity Corporation NGVT has announced some of the measures that it is taking at different levels to mitigate the impacts of the coronavirus outbreak.

The company’s management emphasized on workers’ health and safety in the wake of the outbreak.

Per management, Ingevity’s first quarter is going better than anticipated despite modest headwinds from the virus outbreak.

The company stated that manufacturing operations at its production sites in China resumed in full force on Feb 10. Notably, the plants continued to operate at a pace sufficient to fulfill steady customer orders. Also, Ingevity’s manufacturing locations in the United States and the U.K. continued to function normally, with no production declines. Reportedly, plans are being developed to adjust productions per market needs if necessary.

Manufacturing plants of the company are not facing any difficulties in sourcing raw materials. All of its manufacturing plants have pandemic response and business continuity measures in place. If and when required, plant leaders must evaluate and prepare to execute the plans.

Originally scheduled for April, the kiln repair shutdown at the Covington, VA-based activated carbon facility is being deferred until the fall to ensure that it runs uninterruptedly.

As far as financial status and liquidity are concerned, the company stated that to date, net debt to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) has been stable at 2.8x since the end of 2019. Ingevity has retained the moderate leverage in preparation for the paving season, given its usual first-quarter cash consumption. The leverage also represents the heavy emphasis that the company puts on cash collections.

Ingevity has substantial $750 million revolver of which $620 million was available at year end. Recently, the company withdrew $250 million from the revolver out of caution.

Excluding commitments to letters of credit, it has around $350 million of additional funds. After Ingevity acquired the Capa caprolactones business, Moody's upgraded Ingevity's outlook from negative to stable as a consequence of its deleveraging.

Shares of the company have lost 70.9% in the past year compared with the industry’s decline of 36.7%.

On the fourth-quarter earnings call, Ingevity expected sales of $1.3-$1.35 billion for 2020. It also anticipated adjusted EBITDA of $400-$420 million for the year.

Free cash flow for 2020 has been forecast to be $200-$220 million.

The company expects revenues to be flat to down modestly for the Performance Chemicals segment. Engineered polymers and pavement technologies are expected to witness solid growth, which is likely to be offset by ongoing pressure in industrial specialties and oilfield applications.

Ingevity also expects to generate double-digit revenue growth and accretion in adjusted EBITDA margins for the Performance Materials unit.

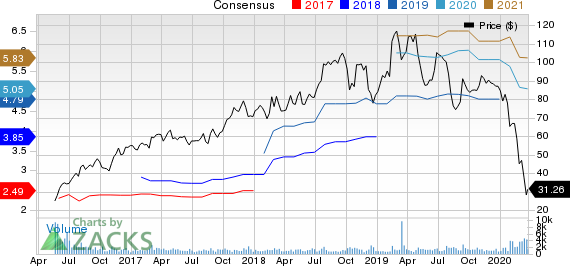

Ingevity Corporation Price and Consensus

Ingevity Corporation price-consensus-chart | Ingevity Corporation Quote

Zacks Rank & Stocks to Consider

Ingevity currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Franco-Nevada Corporation FNV, NovaGold Resources Inc. NG and Barrick Gold Corporation GOLD.

Franco-Nevada has a projected earnings growth rate of 24.2% for 2020. The company’s shares have rallied 43.8% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NovaGold has a projected earnings growth rate of 11.1% for 2020. It currently flaunts a Zacks Rank #1. The company’s shares have surged 83.9% in a year.

Barrick Gold currently has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 34.5% for 2020. The company’s shares have gained 18.7% in a year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Novagold Resources Inc. (NG) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.