Initial claims, Dollar General — What you need to know in markets on Thursday

After a headline-heavy Wednesday, investors will face a lighter schedule Thursday with the economic highlight coming from initial jobless claims in the morning and Dollar General’s (DG) earnings serving as a focus for retail names.

Also on the calendar are earnings from retailer Conn’s (CONN) and Smith & Wesson parent company American Outdoor Brands (AOBC). On the economics side, we’ll also get the October reading on consumer credit balances, and don’t forget that Friday is the all-important December jobs report with the next Fed meeting just a week away.

Markets will also keep an eye on shares of lululemon (LULU), which were surging in after-hours trade on Wednesday after the athletic apparel retailer reported earnings that beat on the top and bottom lines.

Bitcoin (BTC-USD), of course, should also be a fascination for markets as the digital currency broke through $12,000 overnight on Wednesday and then by the afternoon had topped $13,000 for the first time. Near 5:15 p.m. ET, bitcoin was trading near $13,350.

We’ll also be keeping an eye on the media space, as reports late Wednesday suggested Disney (DIS) CEO Bob Iger would likely extend his contract for a sixth time, this time keeping him at the company until the beginning of next decade, to lead a combined Disney-Fox entity.

Bitcoin and the stock market

Bitcoin hit new records on Wednesday to surge well past $13,000 for the first time.

In the time it took to draft this post, the price of the digital currency rose about $250.

So when it comes to bitcoin and the investment opportunities there, it is plain to see that there is enthusiasm, exuberance, perhaps even a mania around the price. And why wouldn’t there be — every night you go to bed and in the morning the price is 5% higher. Easy money.

But what bitcoin increasingly appears to be channeling is a kind of pent-up energy to be excited about financial assets that we haven’t seen in the U.S. population since house-flipping was hot in the mid-00s or since the tech bubble of the ’90s.

“As this year has progressed, the acceptance of the bull market has become more widespread,” Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch, said on Tuesday. And with a positive economic backdrop, strong earnings growth, and tax cuts coming to the U.S., there is certainly a lot to like.

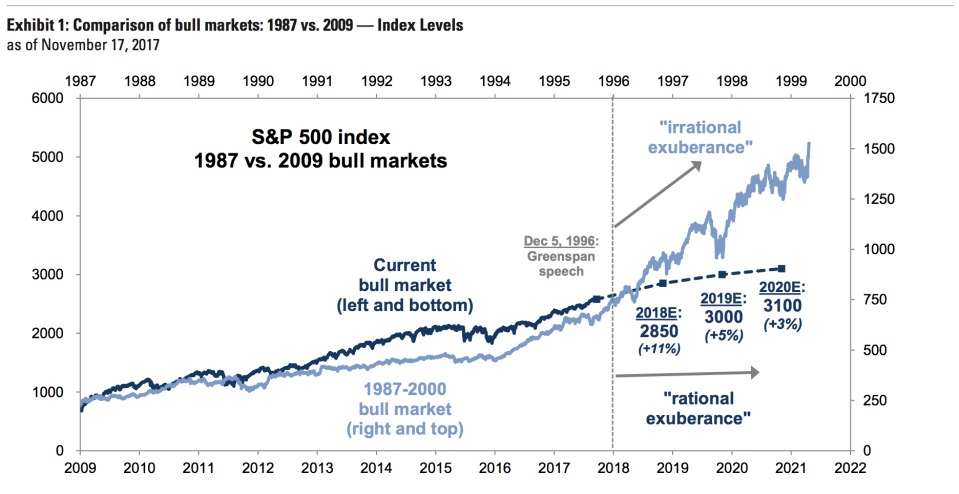

The rise in the price of stocks this year, has paled in comparison to bitcoin and doesn’t look like a whole lot when compared to the final days of the tech bubble of the ’90s. This chart from Goldman Sachs, which we highlighted in November, shows the acceleration in stocks we saw as that rally reached its final days. By comparison, the numbers might be bigger now but the percentage gains look downright meager.

But that this enthusiasm for investing appears not to be moving, on a large scale, into the public markets shows two things about the current state of investor psychology.

For one thing, folks have not gotten over the awful returns seen from 2000-2009, which Jim O’Shaugnessy notes was the worst decade for stocks in 109 year with an average annual return of -3.3%.

And while a review of stock returns through time show that great decades (the ’90s, for example) are often followed or preceded by terrible ones, the post-crisis rally shows that investors have long memories and the financial crisis has not been forgotten. At least not by many in the investing public.

The second is that while many strategists have been looking for a “blow off top” — or a sudden, sharp move higher in stocks — to mark the end of the bull run, this event might not be coming. As TD Ameritrade’s Oliver Renick noted on Tuesday, stocks like Nvidia (NVDA), AMD (AMD), and Square (SQ) have rallied this year on enthusiasm related to cryptocurrencies.

The bitcoin craze isn’t waiting to come to the stock market — it’s already here.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: