InMode's (NASDAQ:INMD) three-year total shareholder returns outpace the underlying earnings growth

InMode Ltd. (NASDAQ:INMD) shareholders have seen the share price descend 19% over the month. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 233% higher than it was. After a run like that some may not be surprised to see prices moderate. The thing to consider is whether the underlying business is doing well enough to support the current price.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for InMode

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

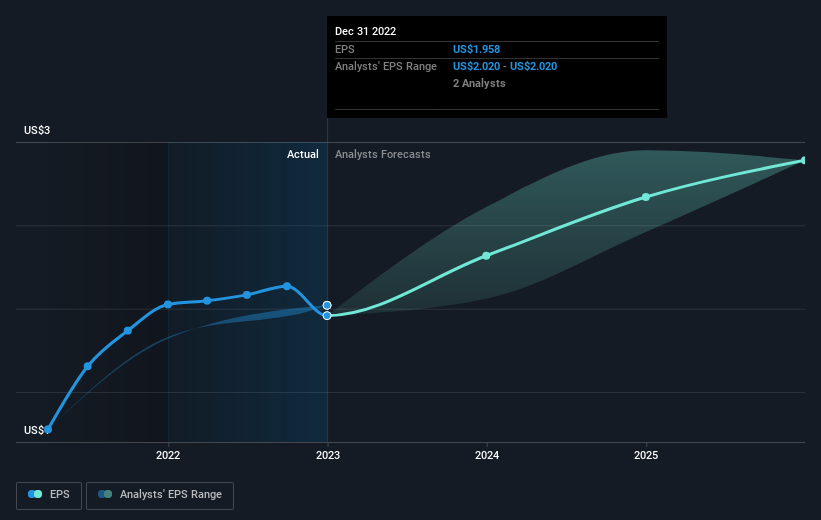

InMode was able to grow its EPS at 23% per year over three years, sending the share price higher. This EPS growth is lower than the 49% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on InMode's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for InMode shares, which performed worse than the market, costing holders 25%. The market shed around 12%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 49% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Is InMode cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here