Innophos (IPHS) Q4 Earnings Lag Estimates, Sales Up Y/Y

Innophos Holdings, Inc. IPHS posted a loss of $11.3 million or 58 cents per share in fourth-quarter 2017, compared with a profit of $9.4 million or 47 cents a year ago. The bottom line in the reported quarter was hit by tax reform charges of $17 million.

Barring one-time items, the company’s adjusted earnings were 52 cents per share in the quarter, which trailed the Zacks Consensus Estimate of 56 cents.

The company raked in net sales of $193.1 million in the reported quarter, up around 15% year over year. Sales were driven by strong gains in the Food, Health and Nutrition (FHN) segment on the back of Novel Ingredients and NutraGenesis acquisitions.

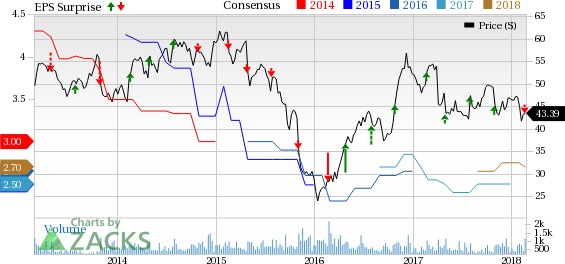

Innophos Holdings, Inc. Price, Consensus and EPS Surprise

Innophos Holdings, Inc. Price, Consensus and EPS Surprise | Innophos Holdings, Inc. Quote

FY17 Results

For 2017, profit was $22.4 million or $1.13 per share, down 53% from around $48 million or $2.44 per share recorded a year ago.

Net sales for the full year edged down roughly 1% year over year to $722 million.

Segment Highlights

Revenues from the FHN segment climbed 29% year over year to $116 million in the fourth quarter, driven by contribution from acquisitions.

The Industrial Specialties (IS) division recorded revenues of $64 million in the quarter, up 4% year over year. Sales were supported by higher volumes that more than offset pricing pressure in technical grade products.

Other sales fell 16% year over year to $13 million on lower volumes to low-value fertilizer markets.

Financials

Innophos ended 2017 with cash and cash equivalents of $28.8 million, down 46% year over year. Long-term debt was $310 million, up 68% year over year. Net cash provided by operating activities for 2017 was $80.6 million, a roughly 42% year over year decline.

Outlook

Moving ahead, Innophos expects revenues to grow 12-14% in 2018 on contributions from Novel Ingredients and NutraGenesis acquisitions, favorable growth in the nutrition end-markets and stabilization in the base business.

The company expects earnings per share (on a reported basis) to more than double in 2018. It also envisions adjusted earnings per share and adjusted EBITDA to grow 10-14% and 15-17%, respectively. The guidance includes an improvement in earnings per share of roughly 16 cents in full-year 2018 due to lower effective tax rate.

Moreover, the company is progressing with its proactive selling price increase program (implemented in fourth-quarter 2017) which is expected to offset the impact of anticipated increases in input cost in 2018. Innophos also remains on track to achieve $4 million of expected acquisition cost synergies this year, which is expected to enhance the adjusted EBITDA margin profile of its FHN unit.

Price Performance

Innophos’ shares are down 17.7% over a year, underperforming the gain of roughly 19.7% recorded by the industry over the same time frame.

Zacks Rank and Stocks to Consider

Innophos currently carries a Zacks Rank #4 (Sell).

Better-ranked companies in the basic materials space include Olympic Steel, Inc. ZEUS, Methanex Corporation MEOH and The Mosaic Company MOS, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel has an expected long-term earnings growth rate of 7.5%. Its shares rallied around 39% over the past six months.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have gained roughly 28% over the past six months.

Mosaic has an expected long-term earnings growth rate of 9.5%. Its shares have rallied around 43% over the past six months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Innophos Holdings, Inc. (IPHS) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research