Insiders Roundup: Kinder Morgan, The Hain Celestial

- By Tiziano Frateschi

The GuruFocus All-in-One Screener can be used to find insider trades from the past week. Under the Insiders tab, change the settings for All Insider Buying to "$200,000+," the duration to "March 2019" and All Insider Sales to "$5,000,000+."

According to these filters, the following are trades from company insiders this week.

Warning! GuruFocus has detected 3 Warning Signs with HAIN. Click here to check it out.

The intrinsic value of HAIN

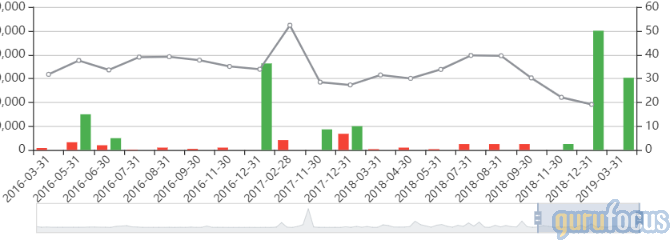

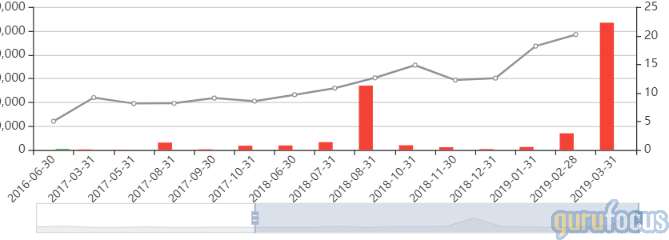

Engaged Capital Co-Invest VI-D and Glenn W. Welling, a director and 10% owner, bought a combined 7,949,822 shares of The Hain Celestial Group Inc. (HAIN) for an average price of $20.25 per share on March 7.

The consumer-packaged food company has a market cap of $2.24 billion and an enterprise value of $2.93 billion. It has insider ownership of 2.66% and institutional ownership of 130.54%.

Over the last 12 months, the stock has fallen 39.36% and is trading 40.36% below its 52-week high and 49.20% above its 52-week low.

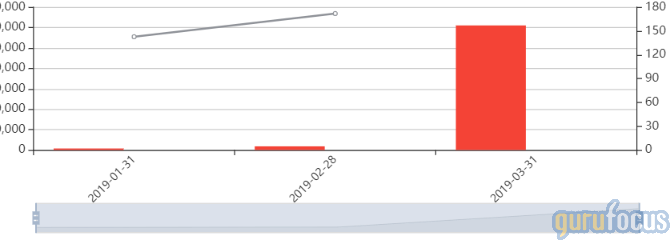

Flagship Ventures Fund V LP, 10% owner of Kaleido Biosciences Inc. (KLDO), bought 933,333 shares for an average price of $15 per share on March 4.

The company has a market cap of $376.63 million with just 29.39 million of shares outstanding.

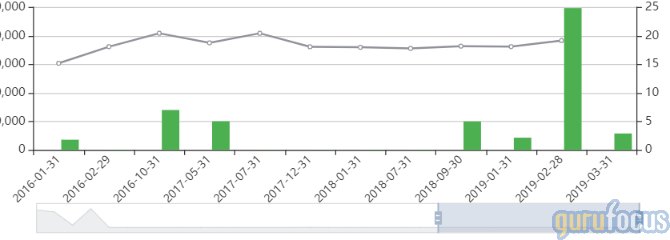

Richard D. Kinder, executive chairman and 10% owner of Kinder Morgan Inc. (KMI), bought 211,900 shares for an average price of $19.65 per share on March 4 and 5.

The energy infrastructure company has a market cap of $44.91 billion and an enterprise value of $79.81 billion. It has an insider ownership of 12.88% and institutional ownership of 89.98%.

Over the last 12 months, the stock has risen 23.61% and is trading 0.85% below its 52-week high and 35.70% above its 52-week low.

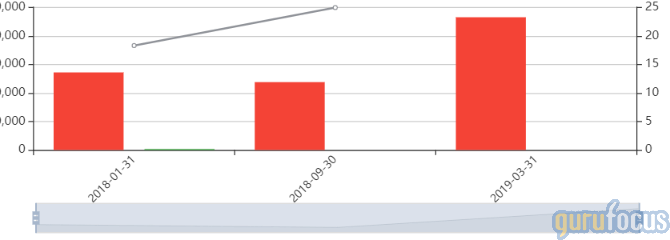

Alexander J. Denner, director of The Medicines Co. (MDCO), bought 606,900 shares for an average price of $25.59 per share on March 5.

The drug manufacturer has a market cap of $1.8 billion and an enterprise value of $2.35 billion. It has insider ownership of 3.57% and institutional ownership of 194.51%.

Over the last 12 months, the stock has fallen 25.26% and is trading 41.50% below its 52-week high and 45.72% above its 52-week low.

Most important insider sales

Joseph P. Disabato, director of Goldman Sachs Group Inc., 10% owner of Benefitfocus Inc. (BNFT), sold a combined 6,509,470 shares for an average price of $46.80 per share on March 5.

The cloud-based platform company has a market cap of $1.48 billion and an enterprise value of $1.52 billion. It has an institutional ownership of 137.90% and insider ownership of 12.17%.

Over the last 12 months, the stock has risen 84.65% and is currently trading 24.05% below its 52-week high and 111.82% above its 52-week low.

Ronald W. Burkle, director and 10% owner, and Bradley J. Gross, director of Americold Realty Trust (COLD), sold a combined 46,483,811 shares for an average price of $27.47 per share on March 5.

The real estate investment trust has a market cap of $4.37 billion and an enterprise value of $5.68 billion. It has institutional ownership of 104.84% and insider ownership of 0.3%.

Over the last 12 months, the stock has risen 65.67% and is trading 2.52% below its 52-week high and 65.58% above its 52-week low.

Geoffrey W. Guy, executive chairman of GW Pharmaceuticals PLC (GWPH), sold 1.2 million shares for an average price of $14.69 per share on March 4.

The drug manufacturer has a market cap of $4.94 billion and an enterprise value of $4.35 billion. It has institutional ownership of 117.87% and insider ownership of 34.03%.

Over the last 12 months, the stock has risen 39.23% and is trading 9.46% below its 52-week high and 83.05% above its 52-week low.

Director Jesse I. Treu and Giulia C. Kennedy, chief scientific and medical officer of Veracyte Inc. (VCYT), sold a combined 1,069,776 shares for an average price of $20.30 per share on March 4.

The biotechnology company has a market cap of $797 million and an enterprise value of $745 million. It has institutional ownership of 103.42% and insider ownership of 0.49%.

Over the last 12 months, the stock has risen 210.56% and is trading 12.96% below its 52-week high and 264.85% above its 52-week low.

Disclosure: I do not own any stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with HAIN. Click here to check it out.

The intrinsic value of HAIN