Insiders Roundup: National CineMedia, Cloudera

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$2,000,000+," the duration to "April 2020" and All Insider Sales to "$2,000,000+."

According to these filters, the following are this past week's most significant trades from company insiders.

National CineMedia

Standard General L.P., 10% owner of National CineMedia Inc. (NCMI), bought 294,692 shares for an average price of $2.61 on April 15.

The company, which operates a digital in-theatre media network, has a market cap of $200 million and an enterprise value of $1.31 billion. It has institutional ownership of 47.17% and insider ownership of 4.73%.

Over the past 12 months, the stock has lost 65.44%. As of Friday, it was trading 73.40% below its 52-week high and 61.73% above its 52-week low.

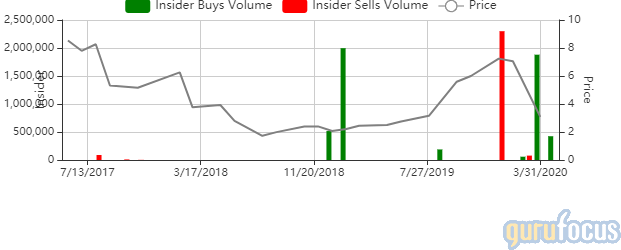

Quantum

10% owner BRC Partners Opportunity Fund bought 231,598 shares of Quantum Corp. (QMCO) for an average price of $3.68 per share on April 14.

The provider of archive and data protection systems has a market cap of $152.26 million and an enterprise value of $308.83 million. It has institutional ownership of 1.6% and insider ownership of 29.59%.

Over the past 12 months, the stock has gained 51.43%. As of Friday, it was trading 56,34% below its 52-week high and 195.24% above its 52-week low.

Pioneer Floating Rate Trust

Saba Capital Management, L.P. 10% owner of Pioneer Floating Rate Trust (PHD), bought 117,834 shares of the company at the average price of $8.45 per share on April 13.

The company, which operates in the asset management industry, has a market cap and enterprise value of $206.56 million. It has institutional ownership of 24.53%.

Over the past 12 months, the shares have decreased 21.21%. As of Friday, the stock was trading 43.96% below its 52-week high and 25.51% above its 52-week low.

Take-Two Interactive

Zelnick Strauss, chairman and CEO, together with company president Karl Slatoff, sold 439,712 shares of Take-Two Interactive Software Inc. (TTWO) for an average price of $119.05 per share on April 14.

The independent video game publisher has a market cap of $14.08 billion and an enterprise value of $12.27 billion. It has insider ownership of 63.16% and institutional ownership of 1.6%.

Over the past 12 months, the stock has gained 39.53%. As of Friday, shares were trading 7.88% below the 52-week high and 42.11% above the 52-week low.

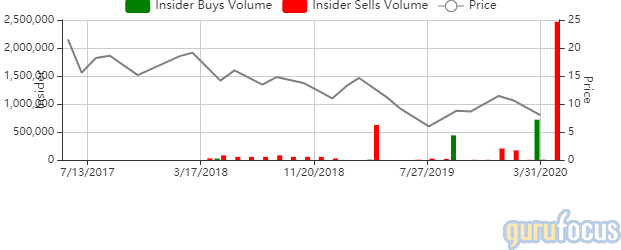

Cloudera

Cloudera Inc. (CLDR) 10% owner Carl C. Icahn sold 1.44 million shares for an average price of $8.05 per share on April 14.

The United States-based software company has a market cap of $2.18 billion and enterprise value of $2.03 billion. It has insider ownership of 1.72% and institutional ownership of 26.76%.

Over the past 12 months, the stock has declined 32.18%. As of Friday, shares were trading 38.79% below the 52-week high and 57.14% above the 52-week low.

Copart

Willis J. Johnson, chairman of the board of Copart Inc. (CPRT), sold 462,722 shares for an average price of $71.44 per share on April 14.

The company, which provides online auctions and vehicle remarketing services, has a market cap of $16.42 billion. It has insider ownership of 4.16% and institutional ownership of 52.05%.

Over the past 12 months, the stock has gained 8.86%. As of Friday, shares were trading 32.70% below the 52-week high and 26.74% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here

This article first appeared on GuruFocus.