Insiders Roundup: Salesforce, Mastercard

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$2,000,000+," the duration to "June 2020" and All Insider Sales to "$2,000,000+."

According to these filters, the following are this past week's most significant trades from company insiders.

Repare Therapeutics

BioVentures 2014 L.P., Ansbert Gadicke, Versant Vantage I L.P. and Versant Vantage V L.P., 10% owners, along with directors Todd Foley, Jerel Davis, Orbimed Advisors LLC, David P. Bonita, Ann D. Rhoads, Briggs Morrison, Carol Schafer, Executive Vice President and Chief Financial Officer Steve Forte and President and CEO Lloyd Mitchell Segal, bought a combined 3.3 million shares of Repare Therapeutics Inc. (NASDAQ:RPTX) for an average price of $20 per share on June 23.

The biotechnology company has a market cap of $1.2 billion and an enterprise value of $1.11 billion.

Progenity

The Athyrium Opportunities Fund and Athyrium Capital Management L.P., 10% owners of Progenity Inc. (NASDAQ:PROG), bought a combined 6.6 million shares for an average price of $15 per share on June 23.

The biotechnology company has a market cap of $474 million and an enterprise value of $535 million.

Continental Resources

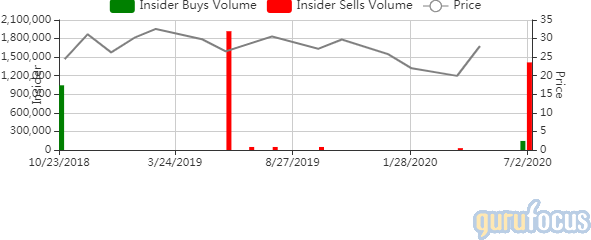

Harold Hamm, executive chairman and 10% owner of Continental Resources Inc. (NYSE:CLR) bought 3.4 million shares at an average price of $16.62 per share on June 24.

The oil and gas producer has a market cap of $5.94 billion and an enterprise value of $11.78 billion.

Over the past 12 months, the stock has lost 63.82%. As of Friday, it was trading 64.82% below its 52-week high and 122.17% above its 52-week low.

Forma Therapeutics

Wellington Biomedical Innovation and RA Capital Healthcare Fund LP, together with director and 10% owner Peter Kolchinsky, bought a combined 9 million shares of Forma Therapeutics Holdings Inc. (NASDAQ:FMTX) on June 23 for an average price of $20 per share.

The biotechnology company has a market cap of $1.79 billion and an enterprise value of $1.65 billion.

Allogene Therapeutics

TPG Group Holdings (SBS) Advisors sold 534,645 shares of Allogene Therapeutics Inc. (NASDAQ:ALLO) for an average price of $43.27 per share on June 22 and 25.

The clinical-stage immuno-oncology company has a market cap of $6.10 billion and an enterprise value of $5.66 billion. It has insider ownership of 3.53% and institutional ownership of 38.97%.

Over the past 12 months, the stock has gained 66.21%. As of Friday, shares were trading 21.13% below the 52-week high and 148.88% above the 52-week low.

Mastercard

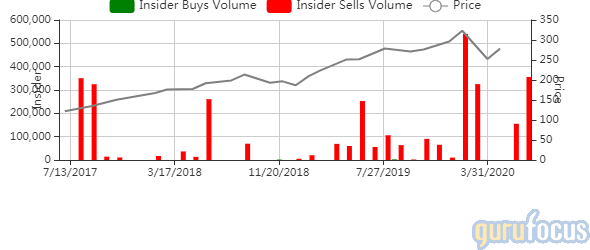

Vice Chairman Ann Caims and 10% owner Mastercard Foundation sold a combined 246,125 shares of Mastercard Inc. (NYSE:MA) for an average price of $302.60 per share on June 22 and 24.

The credit card manager has a market cap of $299 billion and an enterprise value of $300 billion. It has insider ownership of 0.15% and institutional ownership of 53.76%.

Over the past 12 months, the stock has climbed 12.18%. As of Friday, shares were trading 15.59% below the 52-week high and 46.57% above the 52-week low.

Salesforce.com

President and Chief Engineering Officer Srinivas Tallapragada, Chief Brand Officer and CEO Marc Benioff, Chief Administrative Officer Joe Allanson, Co-Founder and Chief Technology Officer Parker Harris, President and Chief Financial Officer Mark J. Hawkins, President and Chief Operating Officer Bret Steven Taylor, President and Chief Legal Officer Amy E. Weaver sold a combined 89,450 shares of Salesforce.com Inc. (NYSE:CRM) for an average price of $189 per share between June 22 and 25.

The provider of cloud computing solutions has a market cap of $169 billion and an enterprise value of $165 billion. It has insider ownership of 4.01% and institutional ownership of 63.21%.

Over the past 12 months, the stock has gained 24.48%. As of Friday, shares were trading 5.21% below the 52-week high and 60.92% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.