Installed Building (IBP) Buys Pisgah, Expands in North Carolina

Installed Building Products, Inc. IBP continues its acquisition spree with the latest buyout of Pisgah Insulation and Fireplaces of NC, LLC.

The share price of this leading installer of insulation and complementary building products gained 3.7% during the trading session on Mar 1, 2022, following the news.

This acquisition will expand IBP’s reach in North Carolina. Based in Mills River, NC, Pisgah — with annual revenues of $8.5 million — mainly installs spray foam insulation, fiberglass insulation and fireplaces in new residential homes in the Asheville, NC market.

Jeff Edwards, the chairman and chief executive officer of IBP said, “Acquisitions remain a key component of our growth strategy and we continue to have a robust pipeline of opportunities across multiple geographies, products, and end markets.”

Acquisitions: a Major Growth Driver

IBP remains focused on profitable growth by acquiring well-run installers of insulation and complementary building products. In 2021, the company acquired 12 businesses. This represents $211 million of annual revenues, which is more than double of IBP’s $100-million acquired revenue target for 2021. In 2022, IBP expects to acquire at least $100 million of revenues.

Commercial end-market net revenues increased 7% for fourth-quarter 2021, largely driven by acquisitions, as same branch sales declined 7.3% owing to continued challenges associated with the COVID-19 pandemic.

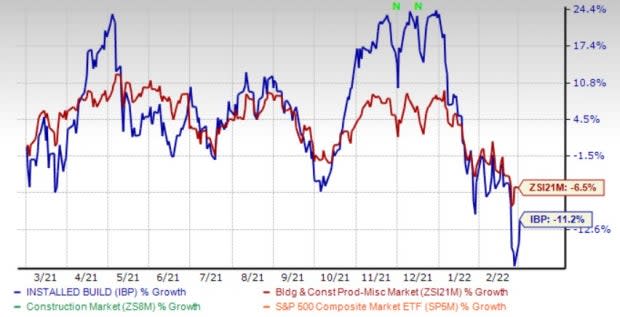

Image Source: Zacks Investment Research

Coming to price performance, shares of this Zacks Rank #3 (Hold) company have lost 11.2% over the past year compared with the Zacks Building Products – Miscellaneous industry’s 6.6% decline. That said, earnings for 2022 are expected to grow 25.2% year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks in the Same Space

James Hardie Industries plc JHX currently sports a Zacks Rank #1. JHX’s shares have gained 4.9% in the past year against the industry’s 6.6% decline.

James Hardie’s earnings are expected to rise 37.9% in fiscal 2022.

Simpson Manufacturing Co., Inc. SSD currently carries a Zacks Rank #1. The company’s shares have increased 19% in the past year.

Simpson Manufacturing’s earnings for 2022 are expected to rise 5.9%.

Owens Corning OC currently carries a Zacks Rank #2. The company’s shares have gained 7.6% in the past year.

Earnings for Owens Corning are expected to increase 11.7% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owens Corning Inc (OC) : Free Stock Analysis Report

James Hardie Industries PLC. (JHX) : Free Stock Analysis Report

Simpson Manufacturing Company, Inc. (SSD) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research