Do Institutions Own Elders Limited (ASX:ELD) Shares?

A look at the shareholders of Elders Limited (ASX:ELD) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

Elders is not a large company by global standards. It has a market capitalization of AU$796m, which means it wouldn’t have the attention of many institutional investors. In the chart below below, we can see that institutions are noticeable on the share registry. Let’s delve deeper into each type of owner, to discover more about ELD.

See our latest analysis for Elders

What Does The Institutional Ownership Tell Us About Elders?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

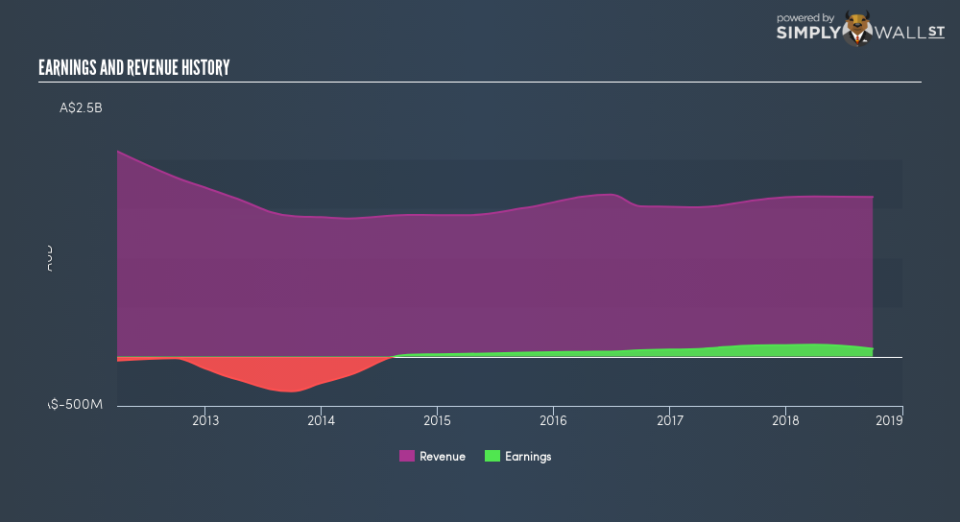

We can see that Elders does have institutional investors; and they hold 34% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Elders’s earnings history, below. Of course, the future is what really matters.

Elders is not owned by hedge funds. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Elders

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

I can report that insiders do own shares in Elders Limited. As individuals, the insiders collectively own AU$16m worth of the AU$796m company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 58% stake in ELD, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Public Company Ownership

Public companies currently own 5.0% of ELD stock. It’s hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it’s worth watching this space for changes in ownership.

Next Steps:

It’s always worth thinking about the different groups who own shares in a company. But to understand Elders better, we need to consider many other factors.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.