Insurance Stock Q1 Earnings List for May 4: MET, ALL, AFG, LNC

The first-quarter 2022 earnings season is likely to be mixed for the insurance stocks. Multiple factors like favorable renewals, strong retention, accelerated digitalization, reinsurance agreements, and organic business growth might have boosted the insurance players’ March-quarter results. Yet, a low interest rate environment, increased claims frequency and soft pricing might have been spoilsports. Some of the Insurance stocks like MetLife, Inc. MET, The Allstate Corporation ALL, American Financial Group, Inc. AFG and Lincoln National Corporation LNC are set to announce quarterly numbers on Wednesday May 4.

The insurance space belongs to the Finance sector (one of the 16 broad Zacks sectors within the Zacks Industry classification), overall earnings of which are projected to decline 13.9% year over year, while revenues are expected to inch up 2.6%, as indicated by our latest Earnings Preview. The year-over-year decrease in earnings might have been caused by a soft pricing environment and reduced investment yields on fixed-income securities. However, an increase in earned premiums is expected to have partially offset the negatives.

Let’s delve deeper and look at the key factors that are likely to have impacted the insurance stocks during the first quarter.

Major Impacting Factors

Business activities resuming normalcy throughout the first quarter might have boosted demand for the insurance products. Product diversification and redesigning might have aided the companies to address rising demand. This is likely to have boosted the insurers’ revenues in the said time period. Increased awareness following the COVID pandemic continued to support the businesses in the quarter.

Exposure management and enhanced reinsurance programs might have played a crucial role in the first-quarter results. Frequent occurrences of natural disasters at last year-end are likely to have accelerated policy renewals and somewhat helped the pricing momentum, which otherwise suffered the growing competition. Players in the life insurance business are expected to have gained from the policy renewals and increasing demand for the protection products. Per Deloitte Insights, the life insurance premium is expected to increase 4% in 2022.

Accelerated digitalization and higher adoption of technology are expected to have continued boosting the operating efficiency of the insurance companies in the first quarter. Technologies like blockchain, artificial intelligence, advanced analytics, cloud computing, telematics, and robotic process automation are aiding seamless operations and saving costs. This, in turn, might have benefited the bottom line of the insurance companies.

Owing to greater relaxation of COVID-related restrictions and the rising frequency of travel across the world, auto premiums are likely to have increased in the first quarter. Also, a low unemployment rate and ramped-up economic activities are likely to have boosted the commercial insurance and group insurance businesses in the quarter under review.

Although the Fed approved a rate hike in March 2022, it was too low to bear any significant impact on the investment yields in the quarter under review. Hence, reduced investment yields on fixed-income securities might have affected the insurance players in the March quarter.

The competitive environment in the insurance space is likely to have kept pricing under pressure. The industry players spending more on growth initiatives to gain a competitive edge might have negatively impacted their short-term profits. Also, the return of business activities to pre-pandemic levels is expected to have resulted in higher claims for the companies, which might affect their results.

Insurance Providers Reporting on May 4

Against such a backdrop, let us see how the following four companies are placed ahead of their first-quarter earnings release tomorrow.

Our proprietary model clearly indicates that a company needs to have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

MetLife: The Zacks Consensus Estimate for MetLife’s premiums is currently pegged at $10.5 billion, which suggests growth of 2.1% from the prior-year quarter’s reported figure. The consensus mark for adjusted earnings in Latin America indicates a 125% rise from the year-ago period’s actuals.

However, MetLife’s U.S. business is likely to have been affected by unfavorable underwriting margins in Group Life, partly offset by volume growth. The Zacks Consensus Estimate for adjusted earnings of this segment is pegged at $571 million, which suggests a decline of 27.2% from the prior-year quarter’s reading. (Read more: MetLife Gears Up for Q1 Earnings: What to Expect)

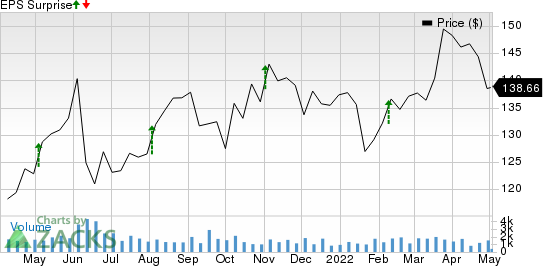

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines stands at $1.63 per share and $17.1 billion, respectively. This indicates an earnings decline of 25.9% and a revenue increase of 2.5% from the corresponding year-ago quarter’s actuals. As far as earnings surprises are concerned, MetLife’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average being 48.2%.

MetLife, Inc. Price and EPS Surprise

MetLife, Inc. price-eps-surprise | MetLife, Inc. Quote

Our proven model doesn’t predict an earnings beat for MET this time around. This is because the stock has an Earnings ESP of 0.00% and a Zacks Rank #3.

The Allstate Corporation: The leading property-casualty insurer’s first-quarter revenues might have been supported by better premiums. The consensus mark for insurance premiums from the Property-Liability business segment indicates an upside of 4.8% from the year-ago comparable period’s reported level. Nevertheless, Allstate’s first-quarter results are likely to reflect pre-tax catastrophe losses worth $462 million. Catastrophe losses for March primarily stemmed from events bearing an estimated cost of $227 million.

The consensus mark for net investment income from the Property-Liability unit is currently pegged at $570 million, indicating a decline from $673 million in the year-ago period. Also, the consensus mark for overall net investment income indicates a 20.3% decrease from the prior-year quarter’s reported figure. (Read more: Allstate to Post Q1 Earnings: Here's What You Should Know)

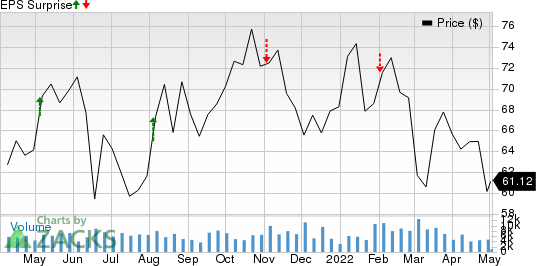

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is pegged at $2.79 per share and $11.6 billion, respectively. This indicates an earnings and a revenue decline of 54.3% and 3.3%, respectively, from the corresponding year-ago quarter’s readings. As far as earnings surprises are concerned, Allstate’s bottom line beat the Zacks Consensus Estimate in three of the last four quarters and missed the mark once, the average surprise being 7.7%.

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

Our proven model doesn’t predict an earnings beat for ALL this time around. This is because the stock has an Earnings ESP of -1.90% and a Zacks Rank of 3.

American Financial Group: The Zacks Consensus Estimate for American Financial Group’s net premiums earned from Property and Casualty for the first quarter indicates a 39.6% increase from the year-ago quarter’s finals. The consensus mark for the same metric from Specialty Casualty implies a 13.5% rise from the year-ago comparable period’s level.

However, the Zacks Consensus Estimate for the combined ratio in Property and Transportation is pegged at 87%, indicating a deterioration from the year-ago period’s 85.6%. Also, the consensus mark for the same metric in Specialty Financial is pegged at 86%, predicting a rise from 84.1% in the year-ago quarter. This could have induced lower profits for AFG in the first quarter.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is $2.45 per share and $1.6 billion, respectively. This indicates earnings and revenue growth of 2.9% and 12.4%, respectively, from the corresponding year-ago quarter’s reported numbers. As far as earnings surprises are concerned, American Financial Group’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average being 39.6%.

American Financial Group, Inc. Price and EPS Surprise

American Financial Group, Inc. price-eps-surprise | American Financial Group, Inc. Quote

Our proven model doesn’t predict an earnings beat for AFG this time around. This is because the stock has an Earnings ESP of 0.00% and a Zacks Rank #3.

Lincoln National Corporation: Lincoln National’s Annuity business is likely to have witnessed growth in variable annuity sales without guaranteed living benefits. The consensus mark for revenues from Annuities indicates an upside of 5.9% from the year-ago level on product innovation and growing digital capabilities. The Retirement business is expected to have gained from an improved economy and increased account values. Yet, the consensus mark for net investment income indicates a 3.5% year-over-year decline in the first quarter.

The Zacks Consensus Estimate for the to-be-reported quarter’s bottom and top lines is $1.97 per share and $4.8 billion, respectively. This indicates earnings and revenue growth of 8.2% and 0.1% each from the respective year-earlier quarter’s readings. As far as earnings surprises are concerned, Lincoln National’s bottom line beat the Zacks Consensus Estimate twice in the last four quarters and missed the mark on other two occasions, the average negative surprise being 0.7%.

Lincoln National Corporation Price and EPS Surprise

Lincoln National Corporation price-eps-surprise | Lincoln National Corporation Quote

Our proven model doesn’t conclusively predict an earnings beat for LNC this time around. This is because the stock has an Earnings ESP of 0.00% and a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research