Integer Holdings (ITGR) Q1 Earnings, Revenues Lag Estimates

Integer Holdings Corporation ITGR delivered adjusted earnings per share (EPS) of 78 cents in the first quarter of 2022, which declined 19.6% year over year. The figure lagged the Zacks Consensus Estimate by 12.4%.

The adjustments include expenses related to the amortization of intangible assets, among others.

GAAP EPS for the quarter was 34 cents a share, reflecting a plunge of 47.7% year over year.

Revenues in Detail

Integer Holdings registered revenues of $310.9 million in the first quarter, up 7% year over year. The figure missed the Zacks Consensus Estimate by 1.3%.

Organically, revenues increased 1%.

Robust performances by both segments of the company drove the top line.

Segmental Analysis

Integer Holdings operates through two segments — Medical Sales and Non-Medical Sales.

Medical Sales reported revenues of $302 million, up 6.7% year over year on a reported and 0.5% on an organic basis.

Medical Sales has three product lines — Advanced Surgical, Orthopedics and Portable Medical (AS&O); Cardio & Vascular; and Cardiac & Neuromodulation.

Integer Holdings’ AS&O business includes sales under a supply agreement with the acquirer of the divested AS&O product line. Revenues amounted to $19.7 million, down 1.9% year over year on a reported and 1.8% on an organic basis. Per management, the downside was due to a decline in demand for COVID-related ventilators and patient monitoring components.

Revenues at the Cardio & Vascular business totaled $159 million, up 12.6% from the prior-year quarter on a reported basis and up 8.2% organically. The strong year-over-year performance was driven by solid demand in the neurovascular market and structural heart product development revenues despite higher direct labor absenteeism in January 2022 from the COVID-19 surge and supply-chain constraints.

Revenues at the Cardiac & Neuromodulation business were $123.3 million, up 1.3% year over year on a reported and down 7.8% on an organic basis. The business recorded strong year-over-year sales growth resulting from the Oscor, Inc. buyout. However, this was offset by higher direct labor absenteeism in January 2022 owing to the COVID-19 surge and supply-chain constraints.

Revenues in the Non-Medical Sales segment totaled $8.9 million, up 18.4% year over year, both on a reported and an organic basis. Sales at the Electrochem product line, part of the Non-Medical segment, improved 18% on the back of the continued recovery of the energy market despite adverse impacts from supply-chain constraints.

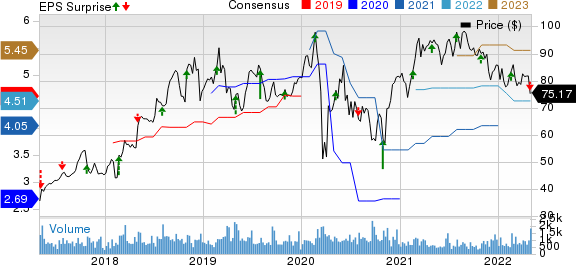

Integer Holdings Corporation Price, Consensus and EPS Surprise

Integer Holdings Corporation price-consensus-eps-surprise-chart | Integer Holdings Corporation Quote

Margin Analysis

Integer Holdings generated gross profit of $81.5 million in the first quarter, down 3.6% year over year. Gross margin in the reported quarter contracted 288 basis points (bps) to 26.2%.

Selling, general and administrative expenses were $39.6 million, up 11.4% year over year. Research, development and engineering costs were $16.1 million in the quarter, up 19.5% year over year. Adjusted operating expenses of $55.6 million increased 13.6% year over year.

Adjusted operating profit totaled $25.8 million, reflecting a 27.3% plunge from the prior-year quarter. Adjusted operating margin in the first quarter contracted 392 bps to 8.3%.

Financial Position

Integer Holdings exited first-quarter 2022 with cash and cash equivalents of $25.7 million compared with $17.9 million at the end of 2021. Total debt (including the current portion) at the end of first-quarter 2022 was $829.6 million compared with $828.1 million at the end of 2021.

Net cash flow from operating activities at the end of first-quarter 2022 was $18.2 million compared with $36.4 million a year ago.

2022 Guidance

Integer Holdings’ first-quarter results were adversely impacted by pandemic-led high January absenteeism and supply-chain constraints.

Despite that, the company has revised its financial outlook for 2022, which includes the impact of the Aran Biomedical acquisition.

For 2022, the company now expects revenues in the range of $1,356 to $1,381 million (suggesting an improvement of 11- 13%) from the 2021 reported figure, up from the previously-provided outlook of $1,340-$1,365 million (indicating an improvement of 10-12%). The Zacks Consensus Estimate for the same is pegged at $1.35 billion.

Organically, sales growth expectations are maintained at 5-7%.

The company has lowered its expectations for full-year adjusted EPS to the band of $4.32 to $4.62 (suggesting an improvement of 6-13%) from the 2021 reported figure, compared to the earlier-provided projection of $4.35-$4.65 (indicating an uptick of 7-14%). The Zacks Consensus Estimate for the same is pegged at $4.51.

Our Take

Integer Holdings exited the first quarter with lower-than-expected results. The company’s business was widely hampered by higher direct labor absenteeism in January 2022 owing to the COVID-19 surge and supply-chain constraints. Integer Holdings’ year-over-year fall in the bottom line is disappointing. The company continued to witness weak performance by its AS&O product line in the quarter under review. Contraction of both margins also does not bode well.

On the positive side, the strong year-over-year top-line performance is impressive. Robust segmental performances along with strength in the majority of the product lines are encouraging. Continued business recovery despite the U.S. labor constraints and global supply-chain disruptions is encouraging. Integer Holdings’ Aran Biomedical’s buyout in April raises optimism about the stock.

Zacks Rank and Key Picks

Integer Holdings currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Molina Healthcare, Inc. MOH, UnitedHealth Group Incorporated UNH and Alkermes plc ALKS.

Molina Healthcare, carrying a Zacks Rank #2 (Buy), reported first-quarter 2022 adjusted EPS of $4.90, which beat the Zacks Consensus Estimate by 3.4%. Revenues of $7.77 billion outpaced the consensus mark by 3.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Molina Healthcare has an estimated long-term growth rate of 16.4%. MOH’s earnings surpassed estimates in three of the trailing four quarters, the average surprise being 1.5%.

UnitedHealth, having a Zacks Rank #2, reported first-quarter 2022 adjusted EPS of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 1.9%.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research