Integer Holdings (ITGR) Q3 Earnings Beat, 2022 View Lowered

Integer Holdings Corporation ITGR delivered adjusted earnings per share (EPS) of 95 cents in the third quarter of 2022, which declined 9.5% year over year. The figure, however, topped the Zacks Consensus Estimate by 6.7%.

The adjustments include expenses related to the amortization of intangible assets, and restructuring and restructuring-related charges, among others.

Our projection of adjusted EPS was 90 cents.

GAAP EPS for the quarter was 48 cents, reflecting a plunge of 27.3% year over year.

Revenues in Detail

Integer Holdings registered revenues of $342.7 million in the third quarter, up 12.1% year over year. The figure missed the Zacks Consensus Estimate by 0.1%.

Organically, revenues increased 5.6%.

Our estimate for third-quarter revenues was $343.4 million.

Robust segmental performances drove the company’s top line in the reported period.

Segmental Analysis

Integer Holdings operates through two segments — Medical Sales and Non-Medical Sales.

Medical Sales reported revenues of $330.9 million, up 11.7% year over year on a reported and 5% on an organic basis.

This figure compares to our Medical Sales Q3 projection of $316.1 million.

Medical Sales has three product lines — Advanced Surgical, Orthopedics & Portable Medical (AS&O); Cardio & Vascular; and Cardiac Rhythm Management & Neuromodulation.

Integer Holdings’ AS&O revenues amounted to $26.2 million, up 16.6% year over year on a reported and 16.7% on an organic basis. Per management, this resulted from higher demand to support the start of the multi-year Portable Medical exit announced earlier this year and low-double-digit growth in Advanced Surgical and Orthopedics.

Revenues at the Cardio & Vascular business totaled $174.1 million, up 14.4% from the prior-year quarter on a reported basis and up 7.6% organically. The strong year-over-year performance was driven by solid demand in the electrophysiology and structural heart markets as well as sales from the Oscor and Aran buyouts, despite the complex catheter supplier delay.

Revenues at the Cardiac Rhythm Management & Neuromodulation business were $130.6 million, up 7.6% year over year on a reported but down 0.4% on an organic basis. The business recorded strong year-over-year sales growth from the Oscor, Inc. buyout.

Revenues in the Non-Medical segment totaled $11.8 million, up 24.5% year over year, both on a reported and an organic basis. This was driven by strong sales at the Electrochem product line, part of the Non-Medical segment, across all market segments. However, this growth was softened due to battery-supplier constraints.

This figure compares to our segmental projection of $27.3 million for the third quarter.

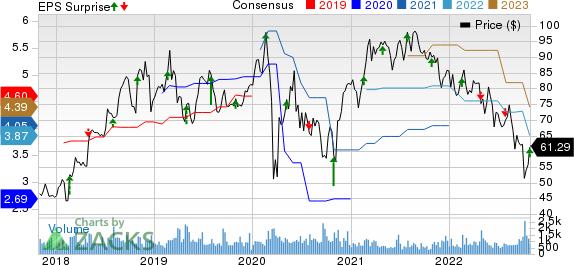

Integer Holdings Corporation Price, Consensus and EPS Surprise

Integer Holdings Corporation price-consensus-eps-surprise-chart | Integer Holdings Corporation Quote

Margin Analysis

Integer Holdings generated a gross profit of $86.7 million in the third quarter, up 5.9% year over year. The gross margin in the reported quarter contracted 149 basis points (bps) to 25.3%.

We had projected 28.3% gross margin for Q3.

Selling, general and administrative expenses were $38.2 million, up 11.5% year over year. Research, development and engineering costs were $16.1 million in the quarter, up 33.8% year over year. Adjusted operating expenses of $54.3 million increased 17.3% year over year.

Adjusted operating profit totaled $32.4 million, reflecting an 8.9% plunge from the prior-year quarter. Adjusted operating margin in the third quarter contracted 218 bps to 9.5%.

The adjusted operating margin, according to our model, was 13.7% for Q3.

Financial Position

Integer Holdings exited third-quarter 2022 with cash and cash equivalents of $20.2 million compared with $15.6 million at the end of the second quarter. Total debt (including the current portion) at the end of third-quarter 2022 was $938.6 million compared with $947.1 million at the end of the second quarter.

Cumulative net cash flow from operating activities at the end of third-quarter 2022 was $64.8 million compared with $117.4 million a year ago.

2022 Guidance

Integer Holdings has lowered its financial outlook for the full-year 2022.

For 2022, the company now expects revenues in the range of $1,350 million-$1,380 million (suggesting an improvement of 11-13% from the 2021 reported figure), lowered from the previously-provided outlook of $1,370 million - $1,395 million (suggesting an improvement of 12- 14% from the 2021 reported figure). The Zacks Consensus Estimate for the same is pegged at $1.37 billion.

Organic sales growth expectations have been lowered to 4-6% from 6-8%.

The company has lowered its expectations for full-year adjusted EPS to the band of $3.57-$3.97 (suggesting a decline of 13-3% from the 2021 reported figure), lowered from the earlier-provided projection of $4.20 to $4.50 (suggesting an improvement of 3-10% from the 2021 reported figure). The Zacks Consensus Estimate for the same is pegged at $3.87.

Our Take

Integer Holdings exited the third quarter of 2022 with lower-than-expected revenues. The year-over-year fall in the bottom line and lower organic sales in the Cardiac Rhythm Management & Neuromodulation product line in the quarter were disappointing. The contraction of both margins also does not bode well. Integer Holdings also lowered its full-year financial outlook, which is discouraging. The company’s business was widely hampered by supply-chain constraints, which raised our apprehension.

On a positive note, Integer Holdings exited the quarter with better-than-expected earnings. The strong year-over-year top-line performance was impressive. Robust performances by both segments and strength in all three product lines of the Medical Sales segment were encouraging. Continued benefits from the Oscor and Aran acquisitions hold promise.

Zacks Rank and Stocks to Consider

Integer Holdings currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Elevance Health Inc. ELV, Medpace Holdings, Inc. MEDP and Merit Medical Systems, Inc. MMSI.

Elevance Health, carrying a Zacks Rank #2 (Buy), reported third-quarter 2022 adjusted EPS of $7.53, which beat the Zacks Consensus Estimate by 6.1%. Revenues of $39.63 billion outpaced the consensus mark by 1.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Elevance Health has an estimated long-term growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average being 4.1%.

Medpace Holdings, sporting a Zacks Rank #1, reported third-quarter 2022 EPS of $2.05, which beat the Zacks Consensus Estimate by 39.5%. Revenues of $383.7 million outpaced the consensus mark by 8.1%.

Medpace Holdings has an estimated growth rate of 37.6% for the full-year 2022. MEDP’s earnings surpassed estimates in all the trailing four quarters, the average being 22%.

Merit Medical, carrying a Zacks Rank #2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

Merit Medical has an estimated long-term growth rate of 10.5%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research