Integra LifeSciences Global Prospects Solid, Competition Rife

On Jun 26, we issued an updated research report on Integra LifeSciences Holdings Corporation IART. The company has been seeing certain major developments overseas. However, a tough competitive landscape raises concern.

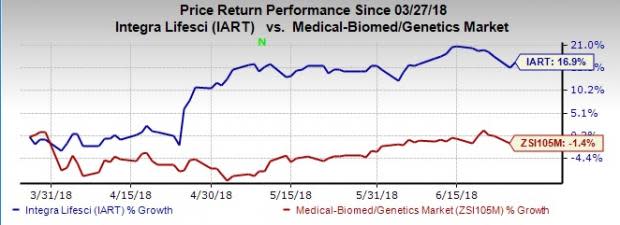

This New Jersey- based company is a leading developer, manufacturer and marketer of surgical implants and medical instruments for use in neurosurgery, extremity reconstruction, orthopedics, and general surgery. The stock has been outperforming its industry over the past three months. Per the latest stock movement, it has gained 16.9% against 1.4% decline of the industry.

In spite of facing foreign exchange fluctuations across its international business, Integra LifeSciences has been successfully growing overseas. The company is looking to invest in the Asian market in order to grow business much faster than the growth in the United States and also across certain parts of its international businesses.

In line with the growth strategy, the company is preparing to launch products in China and Japan. Turning to Europe, management feels encouraged about the growth potential in the region with Tissue Technologies business and CUSA Clarity product slated for launch soon.

We are also upbeat about the company’s Regenerative Technologies, which is the largest franchise under Orthopedics and Tissue Technologies. In the first quarter of 2018, the company registered mid-single-digit growth in this franchise, primarily backed by double-digit growth in PriMatrix product lines in both inpatient and outpatient settings.

At the end of the first quarter, Integra LifeSciences noted that the performance by the Codman Specialty Surgical segment had exceeded expectations. It has also successfully completed the transition of the Codman business in China.

Meanwhile, Integra LifeSciences faces intense competition in the surgical implants and medical instruments market. The company needs continuously innovate to fend off competition. Moreover, consolidation in the industry could lead to intense pricing pressure.

Also, significant margin contraction caused by escalating costs and expenses raise concerns.

Key Picks

Some better-ranked stocks in the broader medical space are Genomic Health GHDX, Abiomed ABMD and Stryker Corporation SYK.

Genomic Health has an expected earnings growth rate of 187.5% for the current quarter. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abiomed has a projected long-term earnings growth rate of 27% and a Zacks Rank of 1.

Stryker has a projected long-term earnings growth rate of 9.7%. The stock carries a Zacks Rank of 2 (Buy).

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Genomic Health, Inc. (GHDX) : Free Stock Analysis Report

Integra LifeSciences Holdings Corporation (IART) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research